USD/CAD Price Analysis: All eyes on the US Dollar as price corrects in bear trend

- USD/CAD bears are lurking but bulls are moving in.

- The US Dollar has perked up but resistances are eyed.

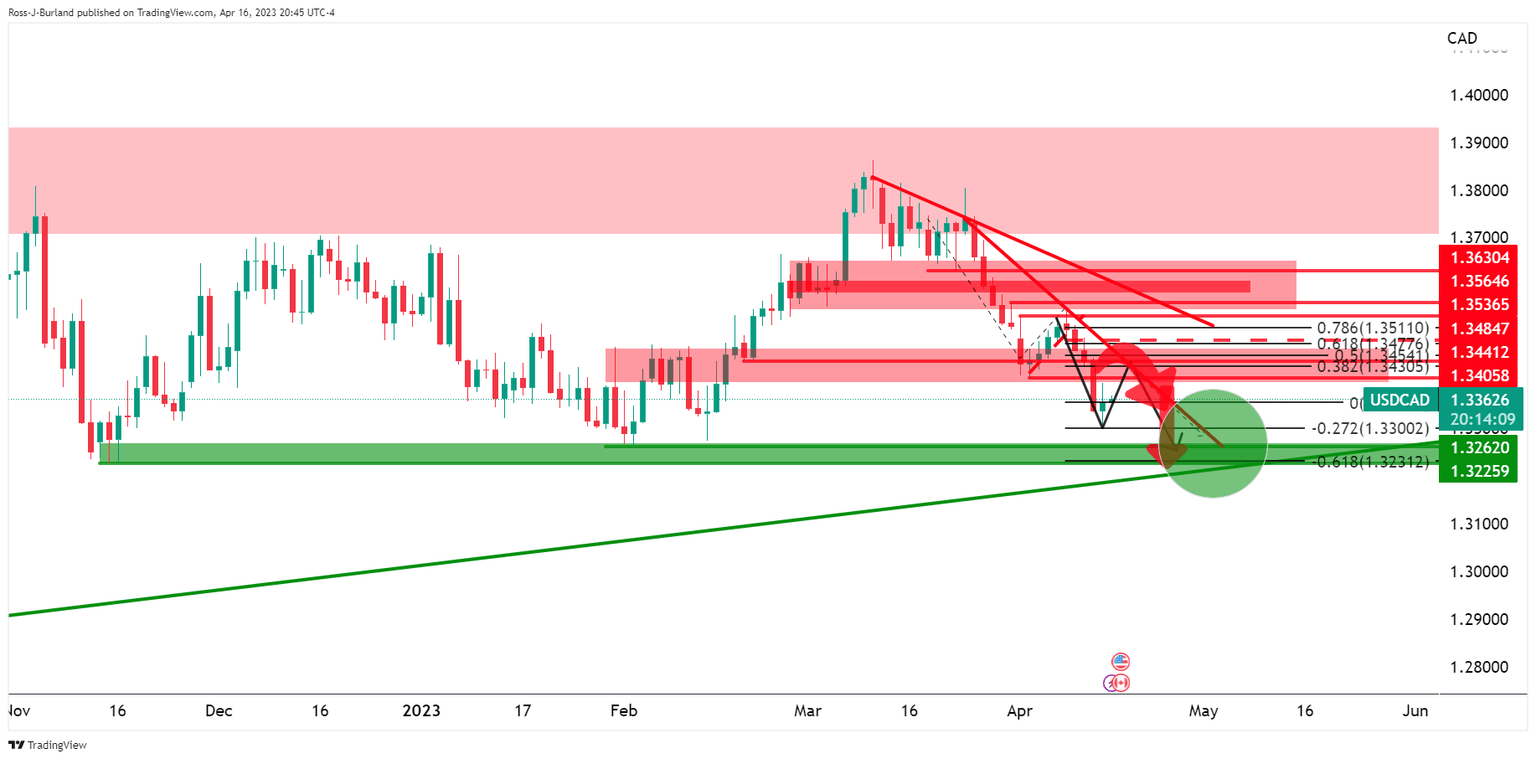

As per the prior analysis, USD/CAD Price Analysis: Bears in control and eye lower to 1.3320, USD/CAD has remained in the hands of the bears although we are starting to see some US Dollar strength come in which is holding up the downside as the following will illustrate.

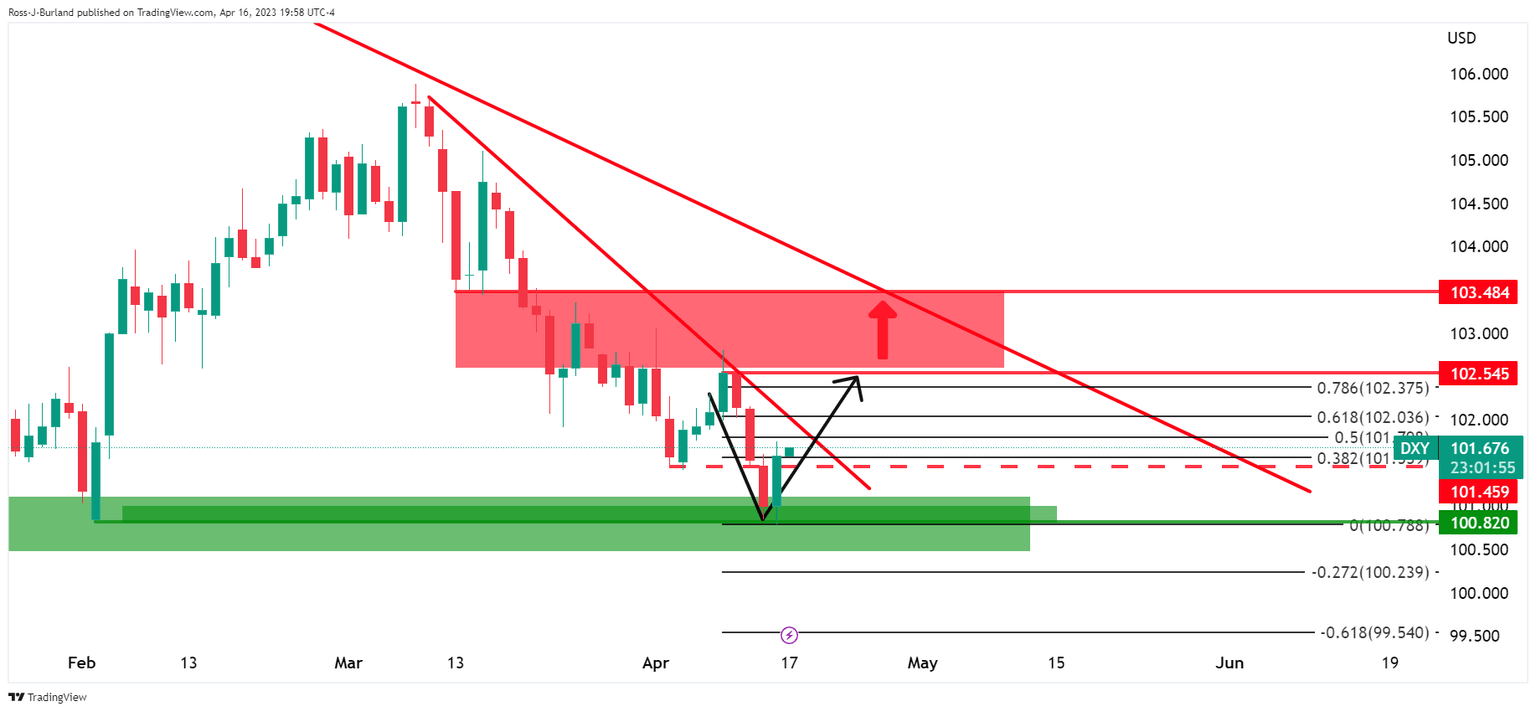

US dollar technical analysis

102.50 comes as a critical resistance that guards 103.50 to the upside meeting the aforementioned major trend line resistance.

However, should the bears commit at the micro trendline resistance and somewhere within the Fibonacci scale, then the downside bias for USD/CAD will remain in place.

USD/CAD daily chart update

USD/CAD is correcting with the prior support in focus near 1.3406 meeting the micro trendline resistance and coming in close to the 38.2% Fibonacci retracement area near 1.3430. Should this area of potential resistance hold, then the low 1.32s will be a target that meets the broader trendline support and horizontal supporting area:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.