USD/CAD pierces 1.33 in broad-market Greenback selloff

- USD/CAD sets another 19-week low as the Loonie climbs into 1.3300 against the Greenback.

- Broader markets are pushing down the USD as risk appetite recovers from Wednesday's late-day plunge.

- US PCE inflation undercuts market forecasts, markets race to peg 2024 rate cut bets even higher.

The USD/CAD eased into 1.3300 as the Canadian Dollar (CAD) gets one last crack at the handle as markets gear up for the holiday shutdown with a broad-base selloff of the US Dollar (USD).

US inflation figures came in below expectations as price growth decelerated quicker than most expected, giving markets the excuse they needed to ramp up bets of even further rate cuts from the Federal Reserve (Fed) next year, and the gap between the Fed and money markets continues to widen.

The Fed’s own dot plot of interest rate expectations sees around 75 basis points in rate cuts through 2024, and Thursday’s US data prints see markets pushing their 2024 median rate cut expectations to an eye-watering 160 basis points by the end of next December.

CAD Retail Sales barely register on the needle as markets chew on US PCE preview

Canadian Retail Sales mixed on Thursday, with October’s Retail Sales slipping back from 0.8% to 0.78% versus September’s 0.5% (revised down from 0.6%). However, Retail Sales excluding motor vehicles and vehicle parts from the same period beat expectations, ticking up from 0.5% to 0.6% versus the previous 0.1% (also revised down from 0.2%).

US Initial Jobless Claims ticked up slightly for the week into December 15, but much less than markets were expecting, printing at 205K versus the previous week’s 203K (revised up from 202K).

The market’s key focal point on Thursday was US Core Personal Consumption Expenditures for the third quarter, which slipped to 2.0% versus the forecast steady print of 2.3%, bringing inflation measures down to a key target level for the Fed.

US Annualized third quarter Gross Domestic Product (GDP) also softened on Thursday to round out the US data dump, coming in at 4.9% versus the forecast steady reading of 5.2%.

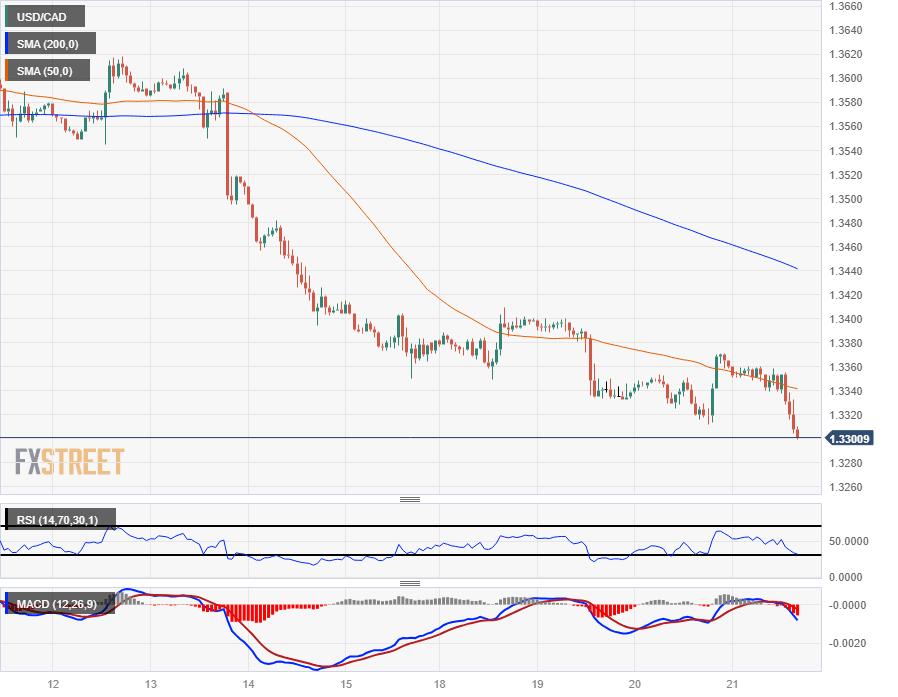

USD/CAD Technical Outlook

With the USD/CAD setting a fresh 19-week low into the 1.33 handle, further declines could easily be on the cards for the pair as the Canadian Dollar bids into chart territory with limited technical barriers against the US Dollar.

The USD/CAD is set for another week of declines, having closed in the red for five of the last seven consecutive trading weeks.

Intraday price action has run well ahead of the median bids, with the 200-day Simple Moving Average (SMA) falling behind at 1.3440 as price accelerates declines.

Daily candlesticks reveal much of the same as price drops away from the 200-day SMA at the 1.3500 handle, and the USD/CAD is down around four and one-third of a percent from November’s peak bids just shy of the 1.3900 handle.

USD/CAD Hourly Chart

USD/CAD Daily Chart

USD/CAD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.