- USD/CAD extends decline in tandem with the US dollar.

- The bulls defending the critical support near 1.2715, for now.

- Focus shifts to the Canadian data and Treasury Sec. nominee Yellen.

USD/CAD extends the pullback from five-day tops into Tuesday, although the bears appear to take a breather following a steady decline from 1.2760.

The spot fell in tandem with the US dollar, as the return of risk-on flows weighed on the safe-haven demand for the greenback. Markets cheer calls for higher fiscal stimulus under Biden’s presidency after Treasury Secretary Nominee Janet Yellen urged Congress to do more to fight the pandemic recession.

On Monday, USD/CAD rallied hard and tested the 1.2800 level after the Canadian dollar was hit by the reports that Biden is expected to cancel the controversial Keystone XL Pipeline on his first day in office.

The pipeline is projected to carry oil nearly 1,200 miles (1,900km) from the Canadian province of Alberta down to Nebraska, to join an existing pipeline.

Markets now await the Canadian Manufacturing Sales data and Yellen’s inaugural speech as the Treasury Secretary due later in the NA session today for fresh trading directives.

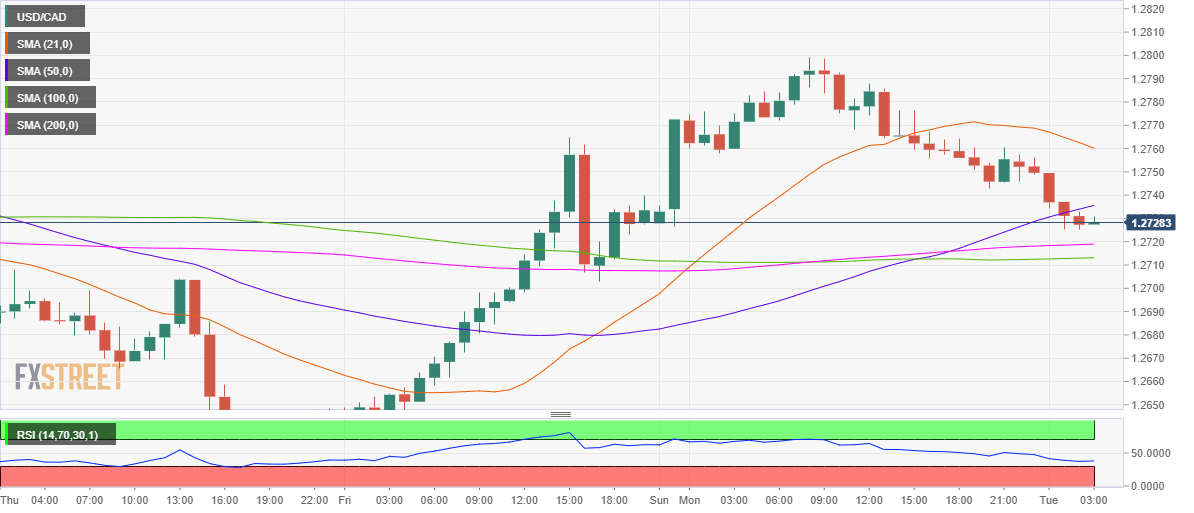

From a near-term technical perspective, the price has stalled its decline above the critical support near 1.2715, which is the confluence of the 200-hourly moving average (HMA) and 100-HMA.

The Relative Strength Index (RSI) has also taken a U-turn from lower levels, suggesting a brief bounce.

The bullish 50-HMA support now resistance at 1.2736 will be tested on the road to recovery. A break above the latter could expose the bearish 21-HMA barrier at 1.2760.

To the downside, a breach of the 1.2715 support could call for a test of the 1.2700 psychological level. The next relevant support is aligned at the January 13 low of 1.2680.

USD/CAD: Hourly chart

USD/CAD: Additional levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.