USD/CAD even after release of Canadian GDP and US PCE data

- USD/CAD trades flat at around 1.3700 after a big data day for the pair.

- Canadian GDP showed a 0.3% rise in April suggesting a strong economy.

- US PCE inflation data, the Fed’s preferred gauge, meanwhile, showed progress towards the Fed’s 2.0% target.

USD/CAD trades flat at around 1.3700 on Friday after the release of Canadian economic growth data and US inflation data updated investors' evaluations of the currency pair.

After starting the Asian session in the 1.3730s the pair declined during the day as the Canadian Dollar (CAD) steadily appreciated against its south-of-the-border counterpart. A late-stage rally by the US Dollar (USD), however, brought the pair even as the west coast began to rise.

USD/CAD pulls back following Canadian GDP

The release of Canadian Gross Domestic Product (GDP) data for April at 12:30 GMT strengthened the CAD, speeding up USD/CAD’s descent.

GDP rose 0.3% in April in line with analysts expectations after showing a 0.0% rise in March, according to Statistics Canada. The preliminary estimate for May GDP was also released and showed a 0.1% rise.

Markets took the 0.3% growth rate in April as a positive sign for the economy, however, it is not likely to change the widely held expectation that the Bank Of Canada (BoC) will lower interest rates in July. This is likely to put a floor under downside for USD/CAD. Currencies tend to depreciate when central banks lower interest rates because they reduce foreign capital inflows.

“The solid rise in GDP in April and preliminary estimate of a small increase in May leave the economy on track to perform better than the Bank of Canada expected this quarter, but not by enough to have any real impact on the probability of another interest rate cut in July,” said Stephen Brown, Deputy Chief North America Economist for Capital Economics.

His views were echoed by Robert Both, Senior Macro Strategist at TD Securities, who said, “The April (GDP) strength was widely expected following the flash estimate last month, but we believe new projections for softer growth in May should give the Bank of Canada some added conviction that this strength will not be sustained. A 0.1% print in May would leave Q2 GDP tracking slightly above projections from the April MPR, but we do not think that's enough to derail another cut in July.”

US Inflation steadily declines towards Fed’s target

US inflation data, in the form of the Fed’s preferred inflation gauge, the Personal Consumption Expenditures Price Index, meanwhile, showed price rises cooling in May, as analysts had estimated. The data weighed on the US Dollar (USD) adding further downside to USD/CAD.

PCE fell to 2.6% from 2.7% in April, on a year-on-year basis, whilst Core PCE fell to 2.6% from 2.8% respectively.

The steady decline in PCE inflation towards the Fed’s 2.0% target slightly increased the probability of the Fed making a September interest-rate cut to 66%, from 64% before the release, according to the CME FedWatch Tool, which uses the price of Fed Fund Futures for its estimates.

Speaking after the release, Fed Bank of San Francisco President Mary Daly told CNBC that the cooling inflation data was “good news” but that the “Fed is not done yet”. It suggested the Fed's monetary policy was working.

The US Dollar also gained a small election-related bump from the overall perception that Donald Trump came out of the Presidential debate on Thursday night looking better than President Joe Biden.

Technical Analysis: USD/CAD stuck in a range

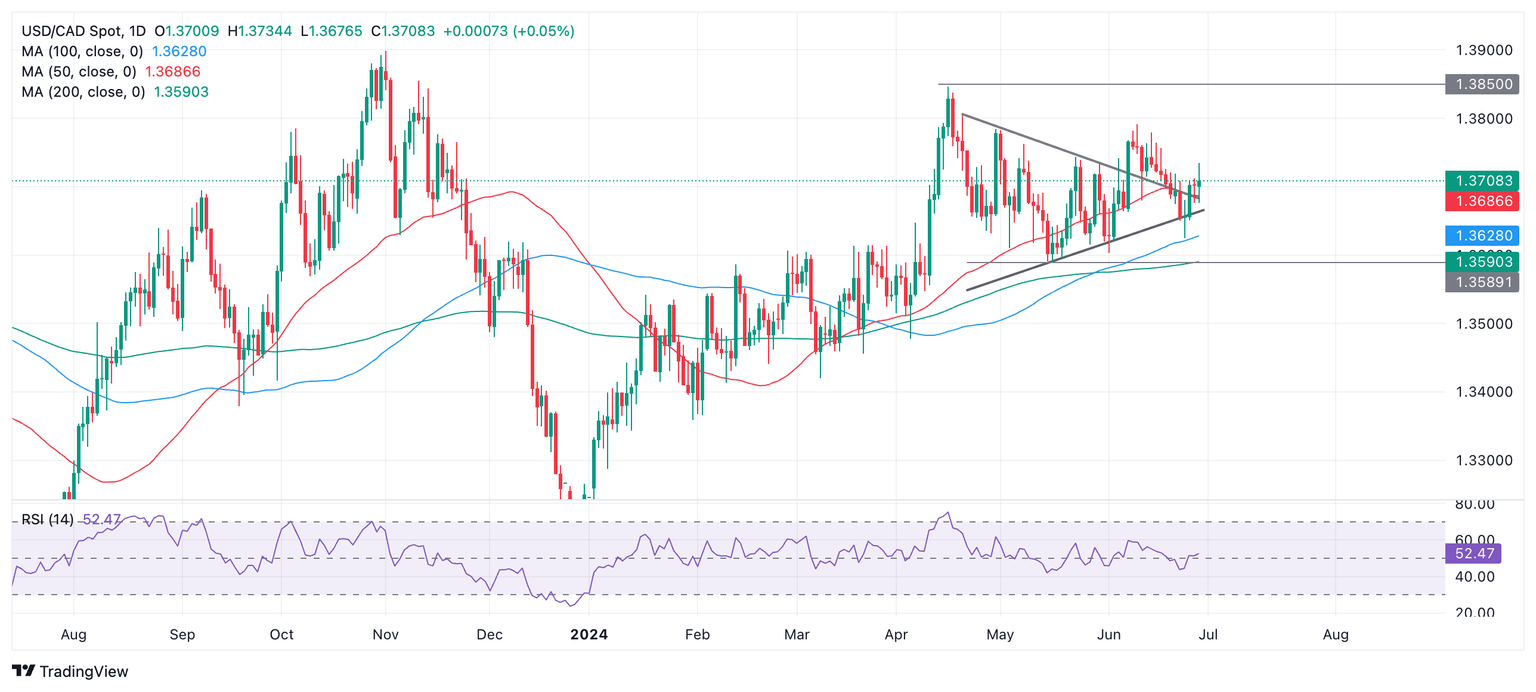

From a technical perspective USD/CAD remains trapped in a range after a failed attempt to break out of a Symmetrical Triangle (ST) price pattern back on June 7.

USD/CAD Daily Chart

Price action has been bearish since the breakout but the odds continue to favor a resumption of the initial move higher. A break above 1.3791 (June 11 high) would provide bullish confirmation, and lead to a move up to a potential target at 1.3850.

Alternatively a break below 1.3624 would indicate a downside breakout instead with an initial target at 1.3590.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.