Most recent article: USD/CAD unable to pull itself off of 1.3500 in quiet Friday trading

- Markets churned on Thursday after mixed US PMI figures.

- Canada’s Retail Sales also spread.

- Friday to wrap up the week with Fed’s Monetary Policy Report.

USD/CAD drifted into the low end early Thursday as markets geared up for the day’s US Purchasing Managers Index (PMI) print. Mixed results left markets a little less confident, and the pair traveled notable ground to wind up close to flat on the day.

Canada saw a similar mixed result in its Retail Sales figures, with sales volumes excluding automobiles coming in below expectations. Next up on the economic calendar will be Friday’s Monetary Policy Report from the Federal Reserve (Fed), but little of note is expected within the report itself following the Fed’s latest meeting Minutes released on Wednesday.

Daily digest market movers: USD/CAD churns and burns as data prints spread

- Canadian Retail Sales rose 0.9% in December compared to the forecast of 0.8%, rebounding from the previous month’s 0.0%.

- Canadian Retail Sales excluding Autos also rose but by a more sedate 0.6%, missing the 0.7% forecast but recovering from the previous -0.4%.

- US Initial Jobless Claims for the week ended February 16 declined to 201K, coming in well below the 4-week average of 215.25K and even further away from the forecast of 218K. The previous week saw 213K (revised from 212K) new jobless benefits applicants.

- The S&P Global PMIs for February in the US were mixed with Services underperforming but the Manufacturing sector gaining further ground as producers look hopeful they will avoid a recession.

- The Services component printed at 51.3 MoM versus the forecast 52.0, falling back from the previous month’s 52.5, while the Manufacturing component rose to 51.5 compared to the forecast 50.5 and January’s 50.7.

- US Existing Home Sales also rose in January with Existing Home Sales Change climbing 3.1% MoM, recovering from the previous -0.8% (revised up from -1.0%).

- Read More: US S&P Global Manufacturing PMI improves to 51.5

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.00% | -0.16% | -0.11% | -0.02% | 0.14% | -0.30% | 0.15% | |

| EUR | 0.00% | -0.17% | -0.13% | -0.02% | 0.14% | -0.29% | 0.14% | |

| GBP | 0.16% | 0.17% | 0.05% | 0.14% | 0.31% | -0.12% | 0.31% | |

| CAD | 0.09% | 0.12% | -0.04% | 0.10% | 0.26% | -0.16% | 0.24% | |

| AUD | 0.01% | 0.02% | -0.15% | -0.10% | 0.16% | -0.27% | 0.16% | |

| JPY | -0.14% | -0.13% | -0.30% | -0.26% | -0.21% | -0.43% | 0.02% | |

| NZD | 0.30% | 0.29% | 0.12% | 0.16% | 0.26% | 0.42% | 0.42% | |

| CHF | -0.15% | -0.14% | -0.31% | -0.27% | -0.16% | -0.01% | -0.44% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

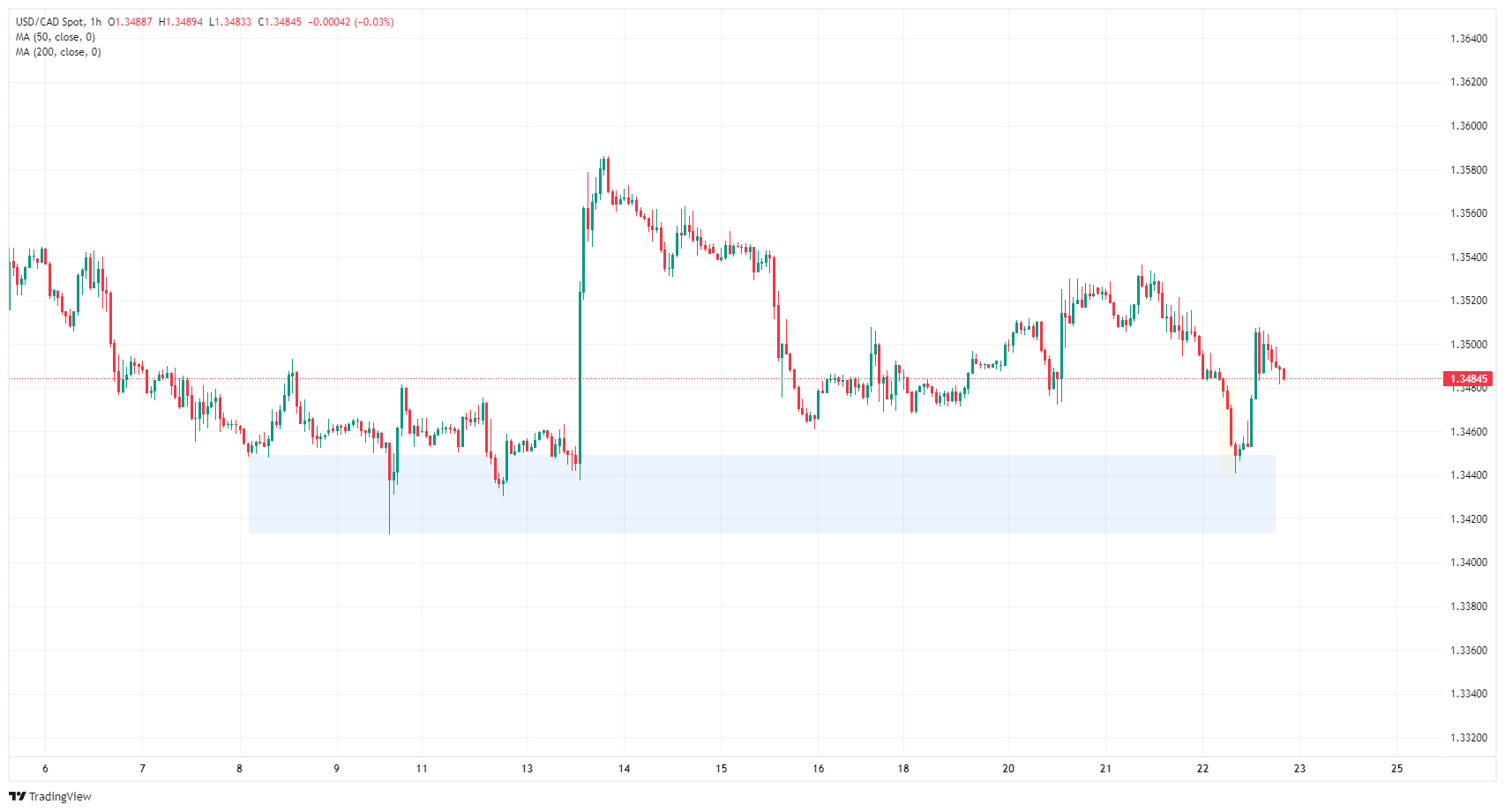

Technical analysis: USD/CAD falls back into near-term lows but then recovers to 1.3500

USD/CAD backslid into a prime buying area early Thursday, settling into 1.3440 before staging a recovery. The pair knocked back into 1.3510 as it remains lashed firmly to the 1.3500 handle in the near term. The day’s dip into a heavy supply zone also saw an intraday Fair Value Gap (FFVG) form between 1.3480 and 1.3455, which got filled almost immediately and set the stage for further gains provided the market’s change of character holds through the end of the week.

With Thursday’s down-and-up action on the USD/CAD, the pair is catching firm technical support from the 200-day Simple Moving Average (SMA) at 1.3478. A pattern of higher highs is dragging the pair further into bull country as the USD/CAD recovers from December’s lows at 1.3177.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds steady above 1.0500 ahead of FOMC Minutes

EUR/USD trades marginally higher on the day above 1.0500. The US Dollar struggles to preserve its strength amid a modest improvement seen in risk sentiment, helping EUR/USD hold its ground before the Fed publishes the minutes of the November policy meeting.

GBP/USD extends recovery, trades near 1.2600

GBP/USD extends its daily recovery toward 1.2600 in the European session on Tuesday, following a slump to the 1.2500 area in Asian trading. The pair finds footing as the US Dollar retreats with markets looking past Trump tariff threats, bracing for FOMC Minutes.

Gold stabilizes after sell-off on hope of ceasefire in Lebanon

Gold stabilizes in the $2,630s on Tuesday after sliding almost three percent – a whopping $90 plus – on Monday due to rumors Israel and Hezbollah were on the verge of agreeing on a ceasefire. Whilst good news for Lebanon, this was not good news for Gold as it improved the outlook for geopolitical risk.

Trump shakes up markets again with “day one” tariff threats against CA, MX, CN

Pres-elect Trump reprised the ability from his first term to change the course of markets with a single post – this time from his Truth Social network; Threatening 25% tariffs "on Day One" against Mexico and Canada, and an additional 10% against China.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.