USD/CAD climbs toward 1.3560s and tests a major resistance trendline, post-US economic data

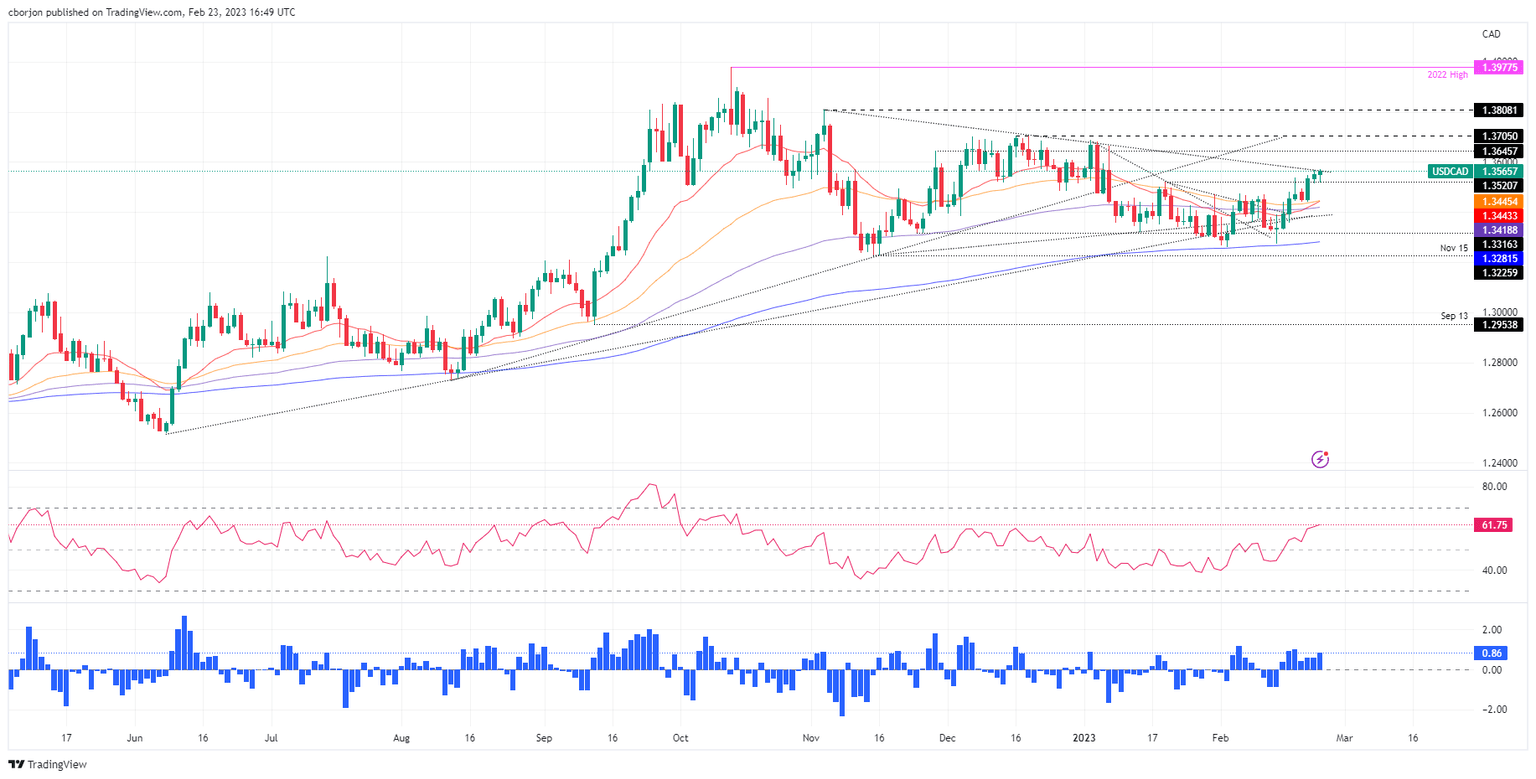

- USD/CAD aims higher and tests a significant resistance trendline in the daily chart.

- The latest FOMC minutes suggested that the Fed will continue to hike rates.

- Upbeat US economic data underpinned the US Dollar and bolstered the USD/CAD.

- Rising oil prices capped the USD/CAD rally on Thursday.

The USD/CAD clash with a four-month-old downslope resistance trendline, gaining 0.15% daily. At the time of writing, the USD/CAD exchanges hands at around 1.3565.

USD/CAD to continue upwards on Fed and BoC policy divergence

Wall Street continues to pare some of its losses. The US Dollar (USD) is gaining some traction as the Federal Reserve is ready to continue tightening monetary conditions, as revealed by the Federal Reserve’s (Fed) last meeting minutes. The minutes showed a slightly hawkish tone as a few officials advocated for a 50 basis point increase in interest rates, but ultimately, they all agreed on a 25 basis point hike. Officials commented that the labor market remains tight and added that growth risks are tilted to the downside.

In the meantime, the US Bureau of Labor Statistics (BLS) revealed that unemployment claims for the week ending on February 18 came at 192K, below last week’s 194K and lower than the 200K expected. Gross Domestic Product (GDP) in the US expanded in the fourth quarter by 2.7%, shy of the first estimate of 2.9%.

The strong growth in the 2022 second half compensated for the 1.1% economic decline during the first six months. Although there was a slowdown in economic activity during the last two months of 2022, it seems the economy has picked up the pace again at the beginning of 2023.

The US Dollar Index (DXY), which tracks the buck’s value vs. six currencies, advances 0.14% at 104.635, the reason for the latest uptick in the USD/CAD pair. Nevertheless, the rally was capped by the jump in oil prices, with WTI’s advancing 2%, trading at $75.32 PB.

On the Canadian front, Average Weekly Earnings eased from 4% to December’s 3.4% YoY. It was the 19th month of growth, with 17 of the 20 sectors reporting gains.

Given the backdrop, the USD/CAD might continue to edge higher. Divergence in monetary policy between the Fed and the Bank of Canada (BoC) warrants further upside in the pair. The BoC announced that it would pause, while Fed officials had stated the need for higher for longer. Therefore, USD/CAD upside is expected.

USD/CAD Technical analysis

The USD/CAD pair is testing a four-month-old resistance trendline, drawn from November highs of 1.3808, which passes at around the 1.3560/80 area. Also, the Relative Strength Index (RSI) is still bullish and aiming north, putting at risk the previously-mentioned trendline. Once cleared, the USD/CAD could test 1.3600, followed by the next resistance at 1.3664, the January 6 high.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.