USD/CAD challenges the 20-day SMA following PCE data from the US

- US February’s PCE figures largely met expectations.

- Next week, the focus will be on Nonfarm payrolls for markets to continue placing their bets on the next Fed decisions.

- Hot data may justify a delay in policy rate cuts beyond June.

The USD/CAD pair is currently trading around the 1.3543 level on Friday, reflecting minor losses after hitting a high of 1.3560 earlier in the session. While investors digest Personal Consumption Expenditures (PCE) figures, the market will turn its attention toward forthcoming employment-related figures that may add further nuance to the Federal Reserve's (Fed) posture on a probable policy rate delay.

The PCE Price Index, preferred by the Federal Reserve for gauging inflation in the US, saw a slight uptick to 2.5% annually in February, up from January's 2.4%, meeting expectations. The monthly increase of 0.3% was slightly below the forecasted 0.4%. Core PCE, which excludes food and energy, also rose by 2.8% annually, aligning with predictions, with a 0.3% monthly increase. The upward revision of January's core PCE figures suggests a continued trend of inflation, potentially prompting the Federal Reserve to maintain higher interest rates.

Future policy decisions will be influenced by incoming data, and the health of the labor market may potentially lead to adjustments in the timing and scale of rate cuts. Strong employment figures could prompt Fed policymakers to delay rate cuts beyond June and possibly reduce the number of cuts projected for 2024 from three to two, potentially bolstering the US Dollar. As for now, the strongest case scenario continues to be three rate cuts in 2024, starting in June.

USD/CAD technical analysis

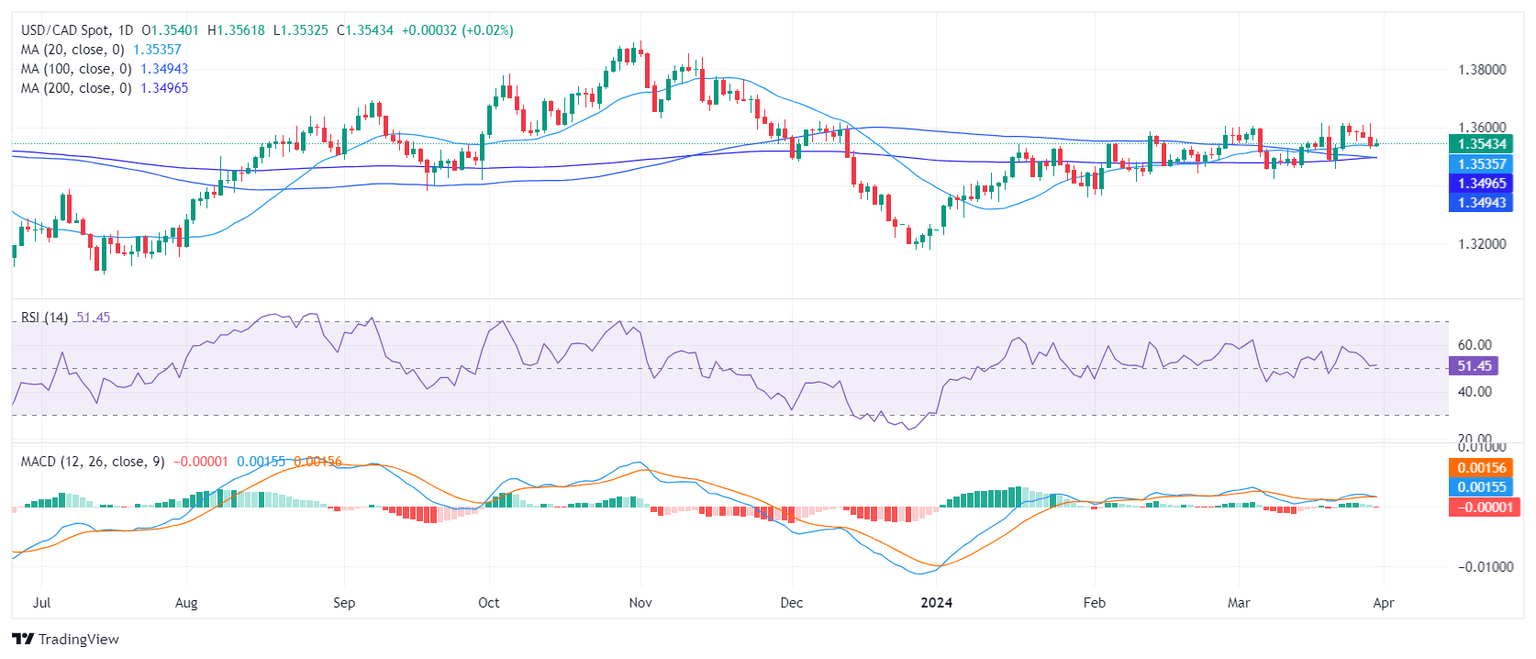

On the daily chart, USD/CAD shows a somewhat stable trend. The Relative Strength Index (RSI) primarily maintains itself in positive territory, indicating that buying pressure slightly dominates the market. However, the Moving Average Convergence Divergence (MACD) histogram printed a new red bar which may imply a weak bullish momentum.

Analyzing the Simple Moving Average (SMA), it is seen that on a broader scale, despite showing a neutral outlook in the short term, the pair is above the 20,100,200-day SMAs. This suggests that the bulls command the overall trend, as long as the bulls defend the challenged 20-day average around the 1.3530 area.

USD/CAD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.