- USD/CAD is currently consolidating around the lowest levels since 2017.

- Bulls are looking for an upside correction on a monthly basis as accumulation kicks in.

Funds travelled between a high of 1.2078 and 1.2029 on the day with some upside pressure, rising 0.12% at the time of writing.

The loonie edged lower against its broadly weaker greenback on Tuesday.

The US dollar has edged lower on Tuesday to print 89.5350 for a fresh 4-1/2 month lows against a basket of peers in the DXY.

Officials from the US Federal Reserve reiterated that policy would stay pat and this has calmed fears about inflation forcing rates higher.

Earlier this week, we heard from both Fed Board Governor Lael Brainard and James Bullard, president of the St. Louis Federal Reserve.

Brainard assuaged inflation concerns, saying she expects that price spikes associated with supply bottlenecks and the reopening of the economy to "subside over time."

Bullard said that while still in the pandemic, it was not the time to talk more about changing the parameters of monetary policy.

The tones were backed by today's comments from Fed's Richard Clarida who said the threats to financial stability are manageable and that data continue to support inflation forecasts that are well anchored.

Meanwhile, however, the Canadian dollar was pressured by domestic data that has otherwise enjoyed consistent better than expected data of late.

On Tuesday, the numbers showed a likely drop for manufacturing sales in April.

Canadian factory sales likely fell 1.1% in April from March, giving back some of the previous month's increase, a flash estimate from Statistics Canada showed.

The decrease was mostly attributed to lower sales in the transportation equipment industry.

Canadian government bond yields were lower across a flatter curve as well.

The 10-year marked its lowest since May 10 at 1.505% before edging up to 1.508%, down 3.5 basis points on the day.

Taking a deeper look at the outlook

Winding the charts back, the loonie has climbed 5.7% since the start of the year, the biggest gain among G10 currencies.

The currency has been bolstered by higher commodity prices and a hawkish shift last month from the Bank of Canada.

The monthly and weekly charts are compelling and are due for a correction, (more on this below).

Fundamentally, however, strategists at Scotiabank, including Shaun Osborne, said "there appears to be little concern at the central bank about the CAD and the message is clear that the central bank will keep policy settings aligned with the economy as it works towards its goals."

"We continue to target a deeper push below 1.20 in the coming months," the strategists said.

Moreover, speculators have raised their bullish bets on the Canadian dollar to the highest since November 2019, data from the US Commodity Futures Trading Commission (CFTC) showed on Friday as the market prices in a reasonably hawkish road map for the BoC.

All eyes on the oil price

This week will be very quiet otherwise on the data front and there are no BoC speakers scheduled which leaves the loonie more vulnerable to potential unwelcome swings in commodity prices.

While there is the case for a technical upside correction, the linchpin for the loonie could be in the price of oil in particular.

The price of oil, one of Canada's major exports, has been supported by tempered expectations of an early return of oil exporter Iran to international crude markets as well as prospects of unprecedented demand from the global economic recovery during these forthcoming summer vacation and travelling months.

Concerns that Iran was soon going to start selling oil if an agreement resulted in the lifting of UN and other sanctions on crude exports had pulled down prices earlier but talks have not been conclusive.

Indirect negotiations between the United States and Iran are due to resume in Vienna this week. Talks were given another life after Tehran and the UN nuclear agency extended a monitoring agreement on the Middle Eastern country's atomic programme.

However, the apparent differences suggest an end to sanctions is still some way off,'' analysts at ANZ Bank said.

''With economic growth continuing to recover, and the market approaching the seasonal peak in demand, it will be in a much stronger position to handle any additional oil.''

USD/CAD technical analysis

The price would be expected to correct following such a fast move to the downside within three months of consecutive lower lows.

Accumilation is kicking in.

A 38.2% Fibonacci retracement aligns perfectly with the prior lows of 2018 as a meanwhile upside target.

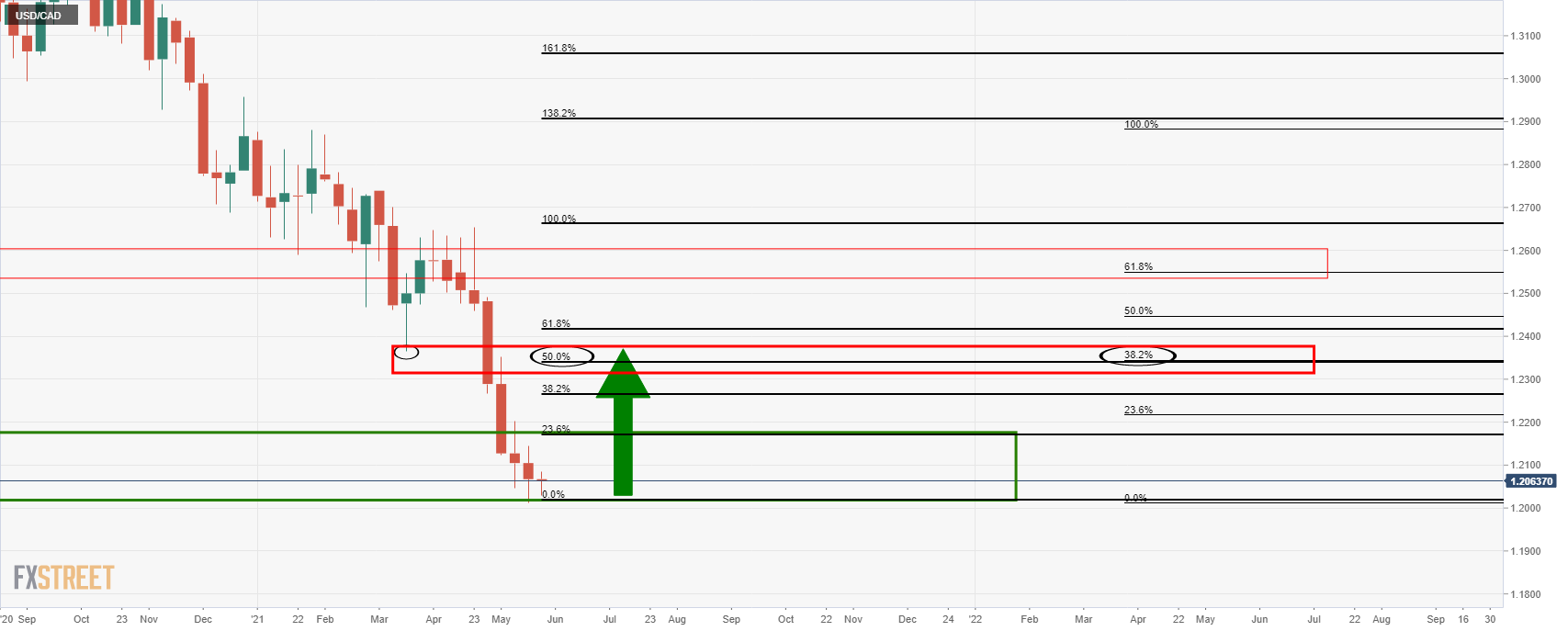

From a weekly impulse perspective, there is a confluence of the 50% mean reversion and 38.2% Fibonacci on the monthly impulse reinforcing the monthly resistance target:

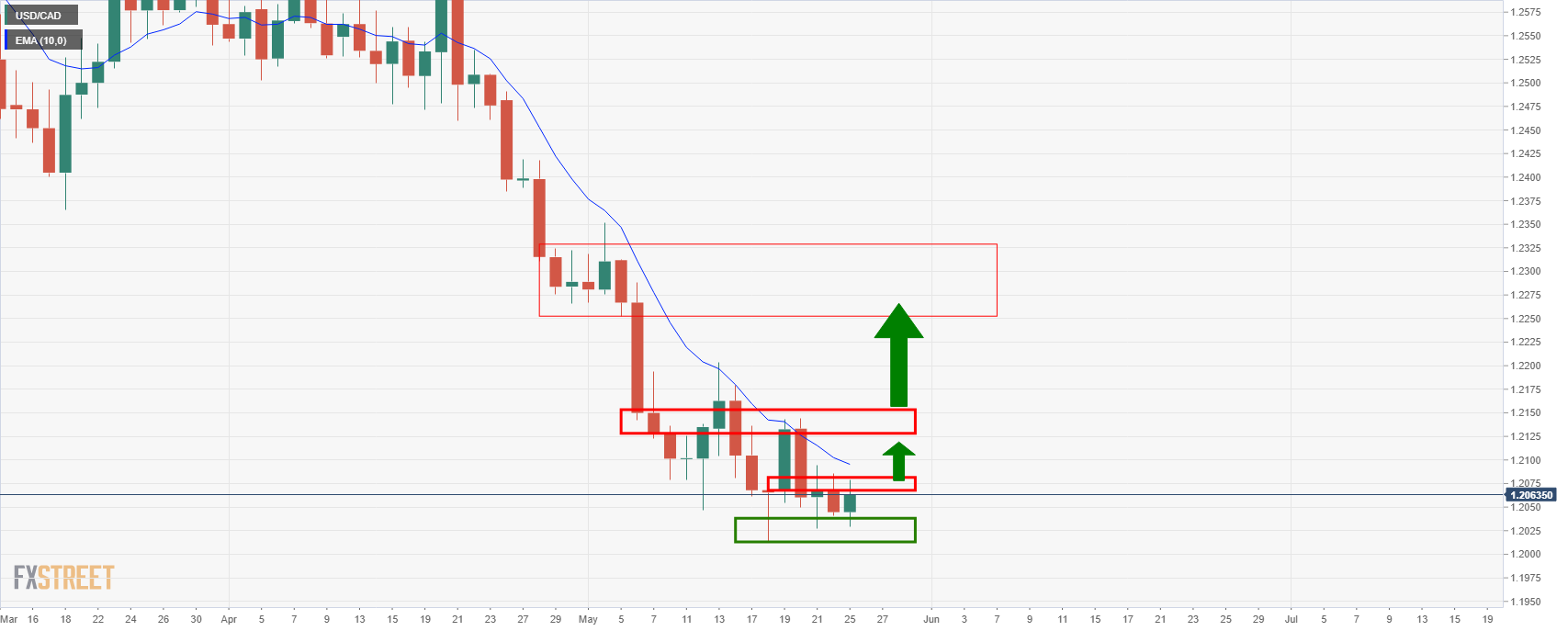

From a daily perspective, bulls will want to see the near term resistances broken for a high probability run between there and the monthly/weekly resistance target area:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.