USD/CAD bulls move in on dovish BoC and hawkish Fed sentiment

- USD/CAD bulls are moving in despite the prior day's bearish close.

- The US Dollar has firmed on hawkish sentiment brewing around the Fed again and a dovish BoC.

In this scenario, we have a 61.8% Fibonacci retracement level near 1.3350 below the neckline near 1.3380. However, given that the price is attempting to close higher for the day, that will leave an emphasis on the upside where eyes look to 1.3475.

The Canadian Dollar is trapped between 1.3440 and 1.3420s, below a 2-½-month high of 1.326 that was scored at the start of the month.

The US Dollar continues with its relentless comeback as the markets fear that the Federal Reserve is not as close to a pivot as first presumed on the back of what was regarded as a dovish outcome from the Federal Reserve interest rate decision last week. At the same time, the Bank of Canada is expected to be the first major central bank to pause rate increases after delivering eight rate hikes in the past 11 months.

At the time of writing, USD/CAD is trading towards the highs of the day but the bears are present, chipping away as a key support structure of the consolidation of the day's highs. USD/CAD has travelled between a low of 1.3359 and 1.3444 so far and has been forced higher on a dovish sentiment at the Bank of Canada that has hiked its key interest rate to 4.5% in January, the highest level in 15 years.

Meanwhile, however, Governor Tiff Macklem said no further rate hikes would be needed if, as expected, the economy stalled and inflation fell. The summary of Governing Council deliberations were released today and they showed that policymakers decided to hike rates in January because of labour-market tightness and stronger-than-expected growth.

As for the US Dollar, it too is trapped up high following today's rally, testing the boundaries of 104 the figure and 103.00 on the downside as per the DXY index as investors paused selling the greenback, a day after Federal Reserve Chair Jerome Powell did not significantly change his US interest rate outlook. There is an air of nervousness considering a very strong US jobs report last week although the outlook remained tilted to the downside as the Fed nears the end of its tightening cycle.

The markets are trying to price in rate cuts by the end of the year, although Fed officials keep sounding the alarm over the prospects of higher for longer inflation, dependent on data which is fuelling a recovery in the greenback:

The bulls are in charge while above 103.00 but the price is testing the dynamic trendline support. If this were to give way, a bearish thesis can be drawn for a continuation lower below 103.00.

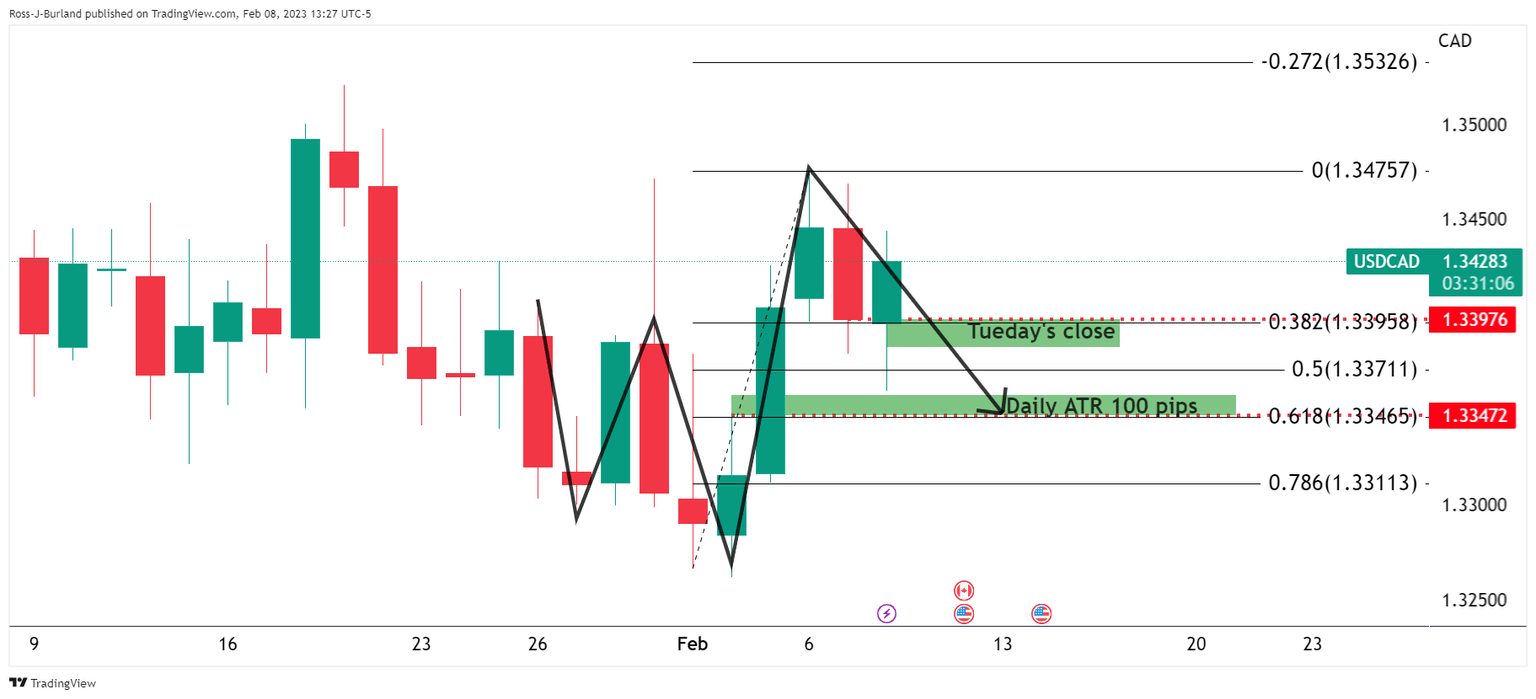

USD/CAD technical analysis

Meanwhile, USD/CAD is up high in the day's range but the bias is to the downside given the draw of the W-formation's neckline:

The pattern is a reversion pattern and tends to pull the price toward the neckline for the restest of the support in that area. In this scenario, we have a 61.8% Fibonacci retracement level near 1.3350 below the neckline near 1.3380. However, given that the price is attempting to close higher for the day, that will leave an emphasis on the upside where eyes look to 1.3475.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.