USD/CAD bulls move back in as Fed´s Powell balances-out the Fed meeting

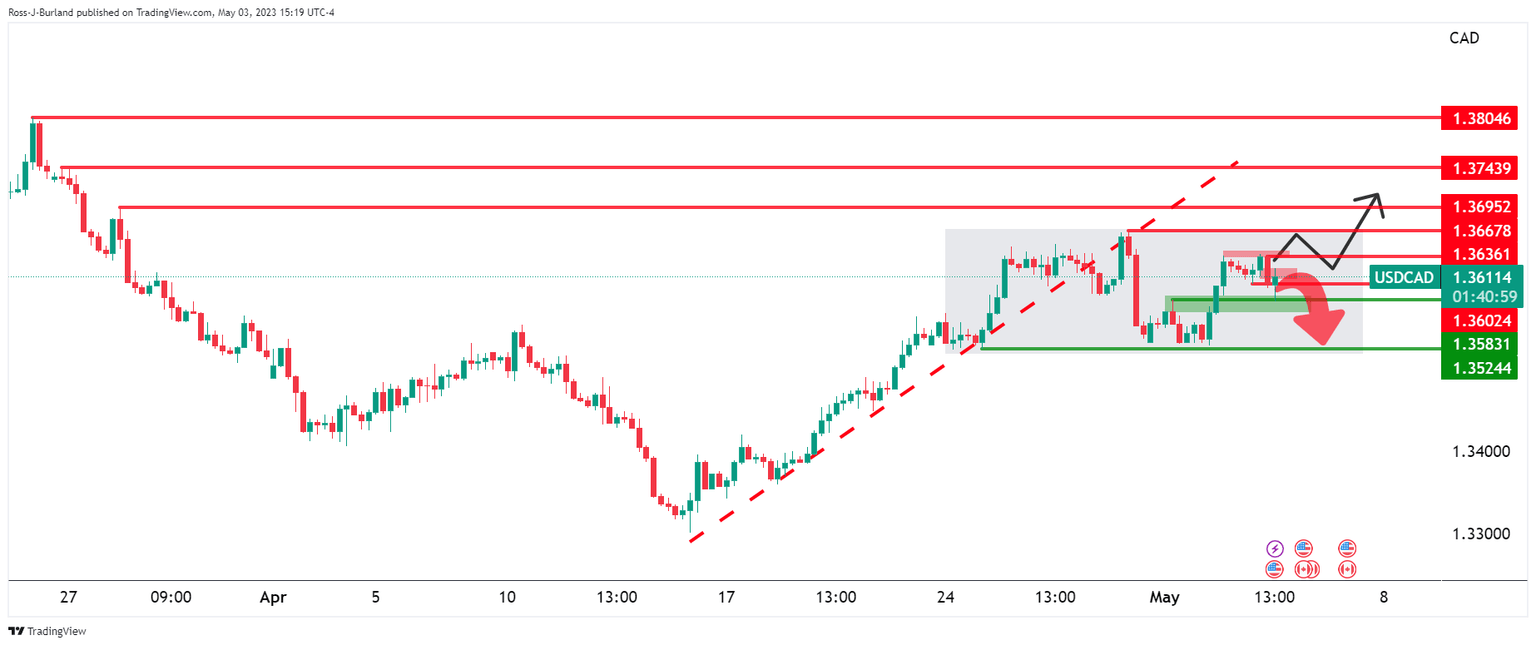

- USD/CAD is mixed during the Fed event on Wednesday.

- USD/CAD is trapped in a box 1.3600 is key.

- A break below 1.3580 tips the bias in favor of the bears.

USD/CAD is down on the day by some 0.2% as the US Dollar plummets on the back of what has been perceived to be a dovish outcome of the Federal Reserve meeting on Wednesday. A dovish hike is being priced into the markets following the Federal Reserve´s rate hike of 25 basis points and accompanying announcements within its statement.

The US Dollar has dropped as the central bank removed the prior language that signaled more hikes were coming. Instead, the statements say the extent to which more firming is needed hinges on the economy. Subsequently, Fed futures are pricing in a pause in June and July and rate cuts in September.

Currently, Federal Reserve´s Chairman, Jerome Powell is being quizzed by the press that are scrutinizing the language in the statement.

Feds statement, key takeaways

- Fed drops language that it anticipates more policy firming may be appropriate to attain a sufficiently restrictive stance.

- Will continue reducing the balance sheet as planned.

- Job gains have been robust and inflation remains elevated.

- Tighter credit conditions are likely to weigh on the economy, hiring, and inflation.

- Fed says the vote in favor of the policy was unanimous.

- Fed repeats us banking system is sound and resilient.

- In determining the extent to which additional policy firming may be appropriate, it will take into account tightening.

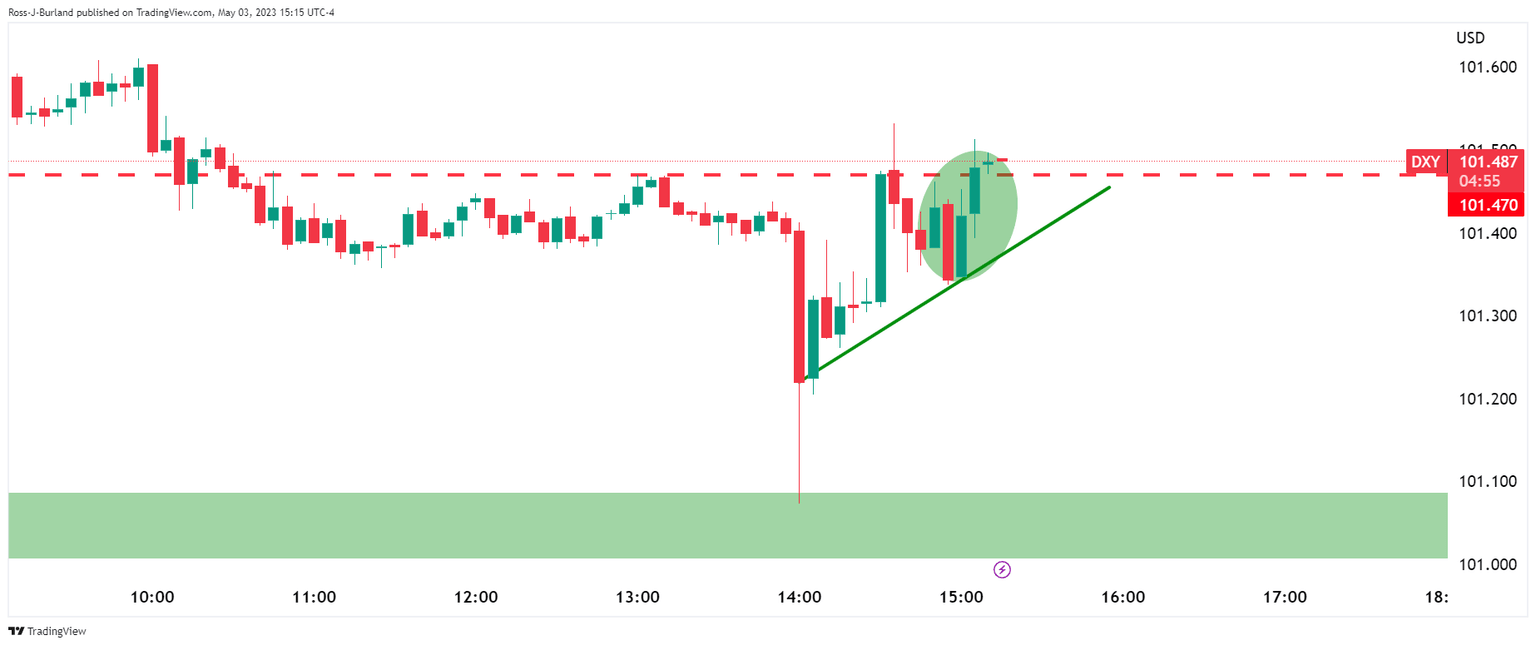

´The press are asking whether rate cuts are on the way and Fed´s Powell has dodged to comment anything in concrete. To the contrary, ´´it would not be appropriate for us to cut rates,´´ when he outlined the conditions of high inflation whereby the Fed would need to stay on its rate hiking course. ´´Rate cuts would be inappropriate given our belief that inflation will take some time to subside,´´ Fed Chairman said. Consequently, the US Dollar is finding some support:

DXY chart

USD/CAD technical analysis

The price is trapped in a box 1.3600 is key. If 1.3600 can hold, then the bulls will be in play still. A break below 1.3580 tips the bias in favor of the bears.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.