USD/CAD bulls denied a free lunch despite hawkish Fed

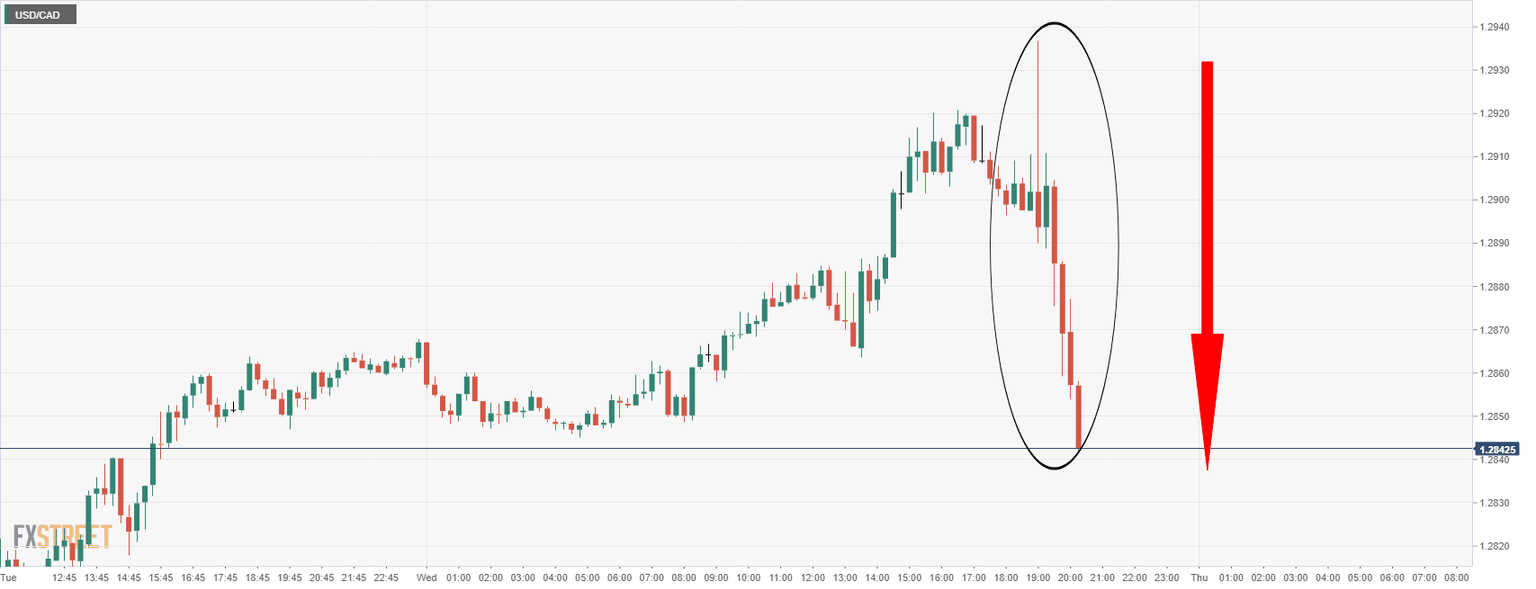

- Despite the hawkish Fed, USD/CAD drops into the abyss.

- Commodities turning around and FX follows the weaker US dollar.

Despite a seismic shift in the Federal Reserve's dot plot and language with regards to inflation, the US dollar was unable to capitalise on the hawkish outcome. Instead, the greenback is worse off since the release of the statement and has sunk to the lowest levels since the start of the New York session.

However, the commodity complex remains on the backfoot, as measured by the Thomson CRB index that reads -0.23% at the time of writing. Nevertheless, USD/CAD is now in the red for the first time this session and trades at 1.2857 following a post-Fed low of 1.2845.

Fed key takeaways

- FOMC monthly taper pace $30 billion vs $15 billion prior.

- ''In assessing monetary policy, will continue to monitor incoming information for the economic outlook.''

- ''Prepared to adjust stance of monetary policy as appropriate if risks emerge that impede its goals.''

- ''Job gains have been solid in recent months, and the Unemployment Rate has declined substantially.''

- The median forecast is now showing three hikes in 2022 and 2023. In the September Dots, the median saw only one hike by end-2022 (0.375%).

See also: Summary of Economic Projections

ECB in focus

Meanwhile, the outcome of the Fed was hawkish, more than expected when taking into account the dot plot, much of the market's thinking may have already been priced in. The US dollar has rallied by almost 4% since the start of November on the back of the Fed's tapering communications. However, the risk now comes with the European Central Bank and traders may not wish to be too long of the greenback going into Thursday's meeting. Reports suggest the upcoming ECB forecasts will show inflation remaining below the 2% target in both 2023 and 2024 and that should underpin the greenback.

US dollar sinks

USD/CAD drops 100 pips

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.