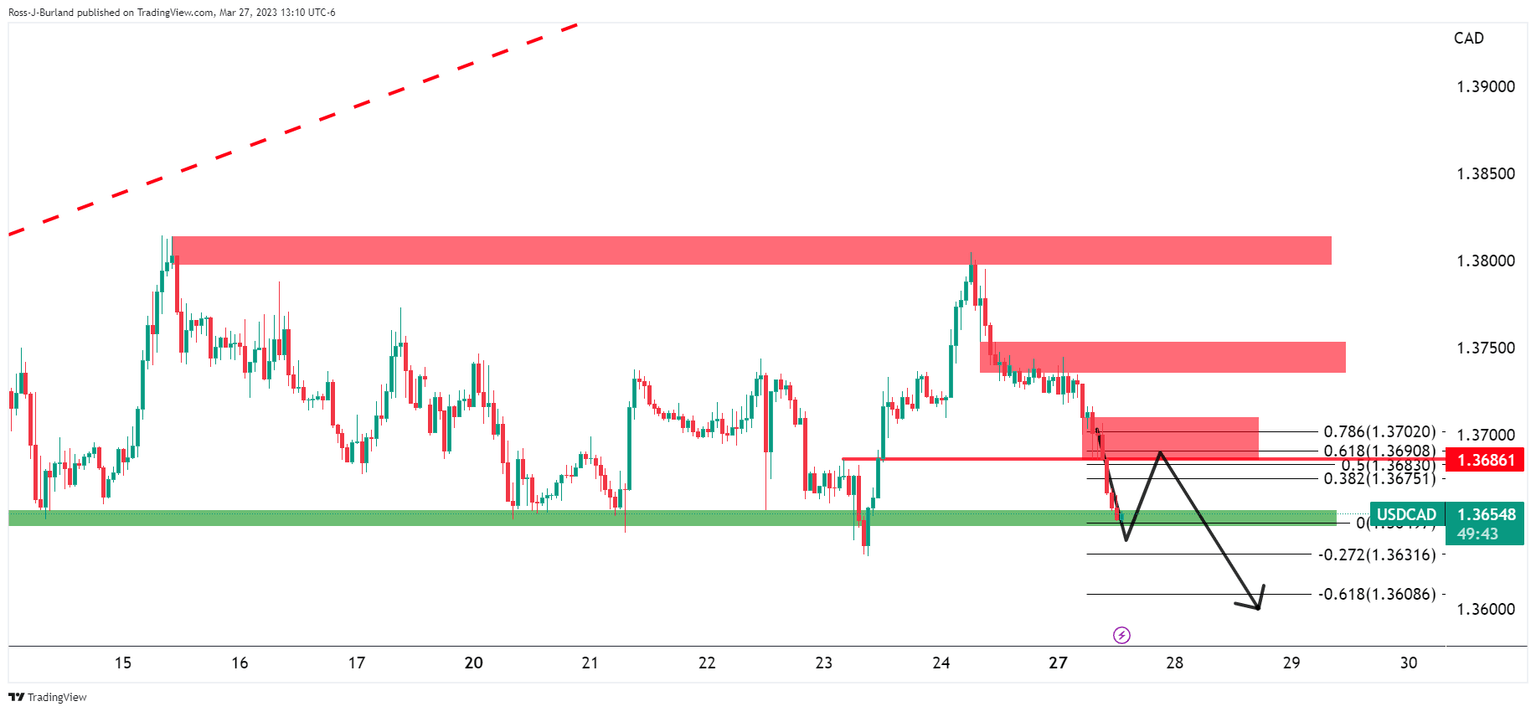

USD/CAD bears run into key daily support, correction eyed

- USD/CAD bulls eye a move into prior support that meets a 61.8% ratio.

- Canada's budget is due on Tuesday is on the radar.

USD/CAD made its biggest drop in two weeks as the commodity complex picks up a bid in the face is easing stress in the banking sector and contributing to a surge in oil prices.

USD/CAD was down some 0.6% at the time of writing, losing space from a high of 1.3745 and reaching a low of 1.3649 on the day so far. The financial system was calmed after First Citizens BancShares said it would take on the deposits and loans of failed Silicon Valley Bank, supporting a risk-on mood. Additionally, the price of oil, a major Canadian export, settled 5.1% higher at $72.18 a barrel on hopes that banking sector issues would be contained, supporting the Loonie.

Looking at the calendar, Canada's budget is due on Tuesday. It will introduce a system to lock in future carbon credit prices, a move meant to boost investments by giving businesses certainty to develop low-carbon technologies, a senior government source with knowledge of the document told Reuters. Analysts at TD Securities said they look for January GDP to print above flash estimates at +0.4%. Growth should be broad-based, with unseasonably warm weather providing a tailwind. ´´A 0.4% print would leave Q1 GDP tracking well above BoC forecasts, though financial stability concerns take precedent for the moment. We look somewhat larger deficit projections in the budget compared to the Fall Economic Statement.´´

USD/CAD technical analysis

The price is meeting support and this leaves prospects of a move into prior support that meets a 61.8% ratio.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.