USD/CAD bears lurking ahead of the Fed

- USD/CAD traders will be eying the FOMC and the Oil price.

- USD/CAD is riding dynamic support with a focus on 1.3700.

USD/CAD ended the week at a familiar resistance near 1.3650 as oil prices moved to fresh lows while investors got set for the Federal Open Market Committee's interest rate decision this week.

The Canadian dollar travelled between 1.3586 and 1.3691 on Friday and was down 1.2%, its second straight week of declines. Crude oil has been problematic for CAD and it fell sharply again last week amid the weakening economic backdrop.

Analysts at ANZ Ban explained that the uncertainty surrounding European sanctions on Russian oil and the related price also kept volatility high. ''Newly implemented European sanctions on Russia oil have had little impact on the oil market so far. The relatively high price cap eased concerns that Russian supply would be curtailed even further.''

''However, prices gained briefly on Friday after Russian President Vladimir Putin warned that he may cut production in response, the analysts added.

Wall Street's main indexes have also fallen ahead of the Federal Reserve this week. Investors are in anticipation of a potential 50-basis point interest rate hike by the Fed when it announces its policy decision on Wednesday.

''We expect the FOMC to deliver a 50bp rate increase at its December meeting, lifting the target range for the Fed funds rate to 4.25%-4.50%,'' analysts at TD Securities. ''In doing so, the Committee would finally move the inflation-adjusted policy stance into restrictive territory. We also look for the FOMC to signal that they will have to move to a higher terminal rate than anticipated in September.''

USD/CAD technical analysis

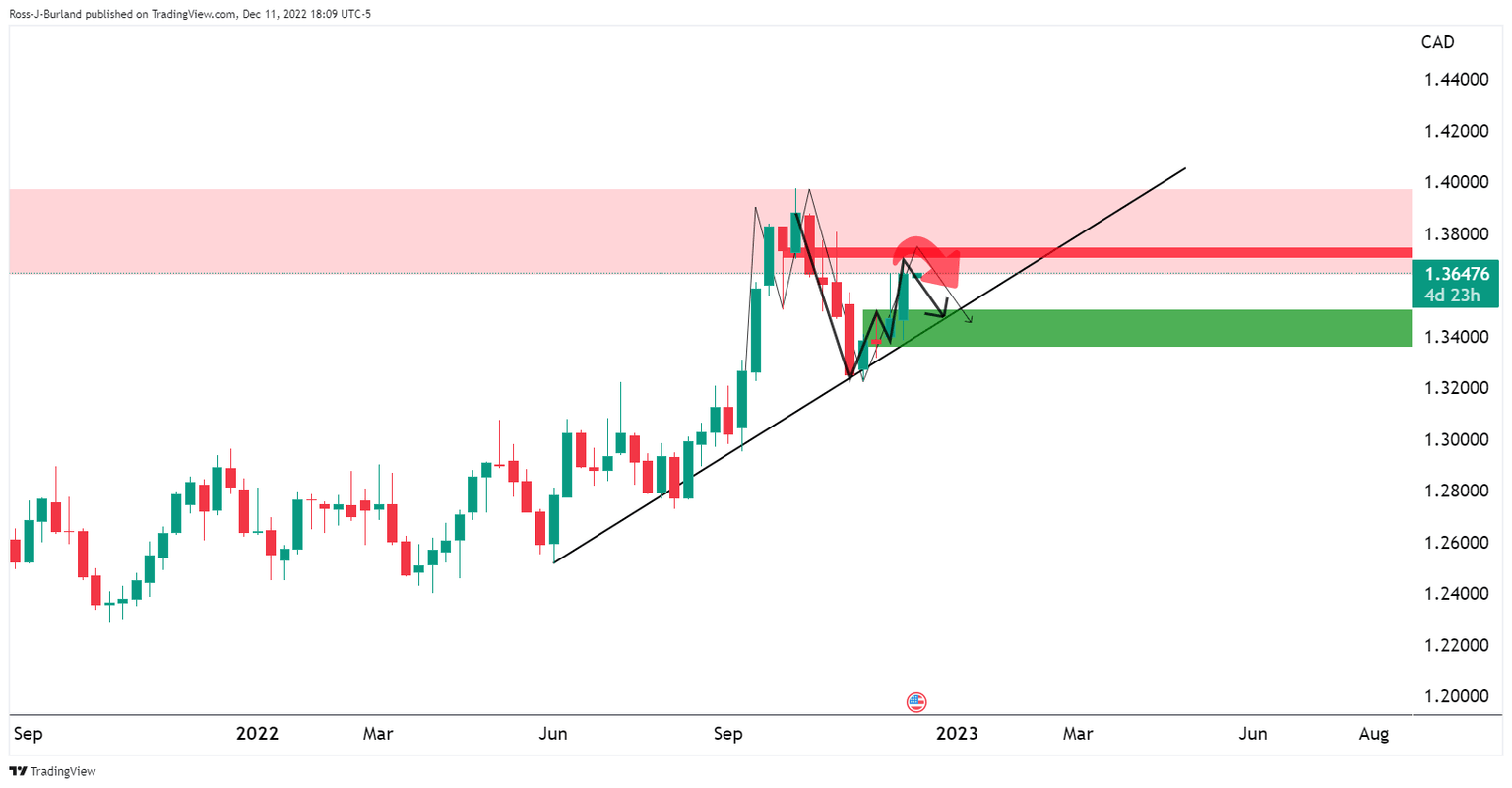

The daily chart, above, shows USD/CAD's W-formation. This is a reversion pattern so there could be opportunities for shorting into the bull trend once bearish structure has formed on the lower time frames.

For now, the price remains on the front side of the bullish dynamic support and this leaves prospects of a continuation in the meantime. However, should the price reach into1.3700, bears will be looking for signs of deceleration and distribution.

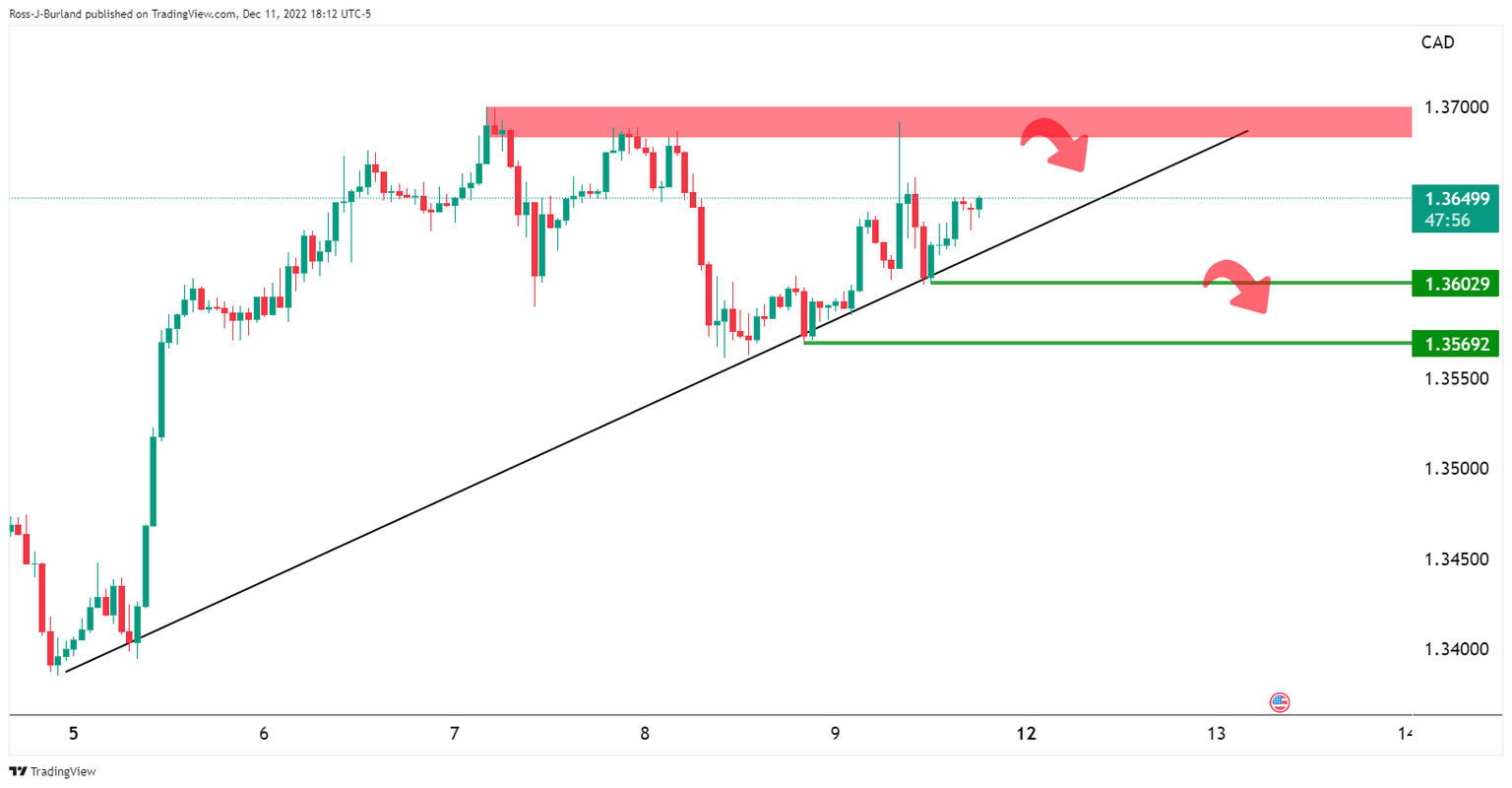

USD/CAD H1 chart

A break above 1.3700 will put the focus on 1.3800.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.