USD/CAD bears dive in and eye strong correction prospects after jobs data

- USD/CAD bears move in aggressively on the Canadian jobs reports and a miss in US UR.

- US Dollar is under pressure as a consequence of the NFP disappointments.

USD/CAD fell to a low of 1.3766 from a high of 1.3862 following both the US Nonfarm Payrolls and the Canadian Employment report. The Canada jobs gain has doubled expectations which throw the rate pause sentiment into scrutiny while the US Unemployment Rate ticked high unexpectedly, adding fuel to the USD/CAD's bears engine.

- Canadian Net Change in Employment Febuuary: 21.8K (exp 10.0K; prev 150.0K).

- Previous month:150K. In December jobs rose 69K

- Employment gain for February 21.8K vs 10.0K estimate.

- Unemployment rate 5.0% vs 5.1% expected.

- Full-time employment 31.1K vs 121.1K last month.

- Part-time employment -9.3K vs 28.9K last month.

- Participation rate 65.7% versus 65.7% expected.

- Average hourly wages permanent employees 5.4% versus 4.5% last month.

US Nonfarm Payrolls

- US change in Nonfarm Payrolls Feb: 311K (exp 225K; prev 517K).

- REVISIONS - US Change in Nonfarm Payrolls Feb: 311K (exp 225K; prev 517K; prevR 504K).

- US Unemployment Rate Feb: 3.6% (exp 3.4%; prev 3.4%).

- US Average Hourly Earnings (MoM) Feb: 0.2% (exp 0.3%; prev 0.3%).

- Average Hourly Earnings (YoY) Feb: 4.6% (exp 4.7%; prev 4.4%).

The main disappointments come in the Unemployment Rate while average hourly earnings were a big disappointment also. The DXY US Dollar index fell to a low of 104.6660 after the data from 105.1620 ahead of the data.

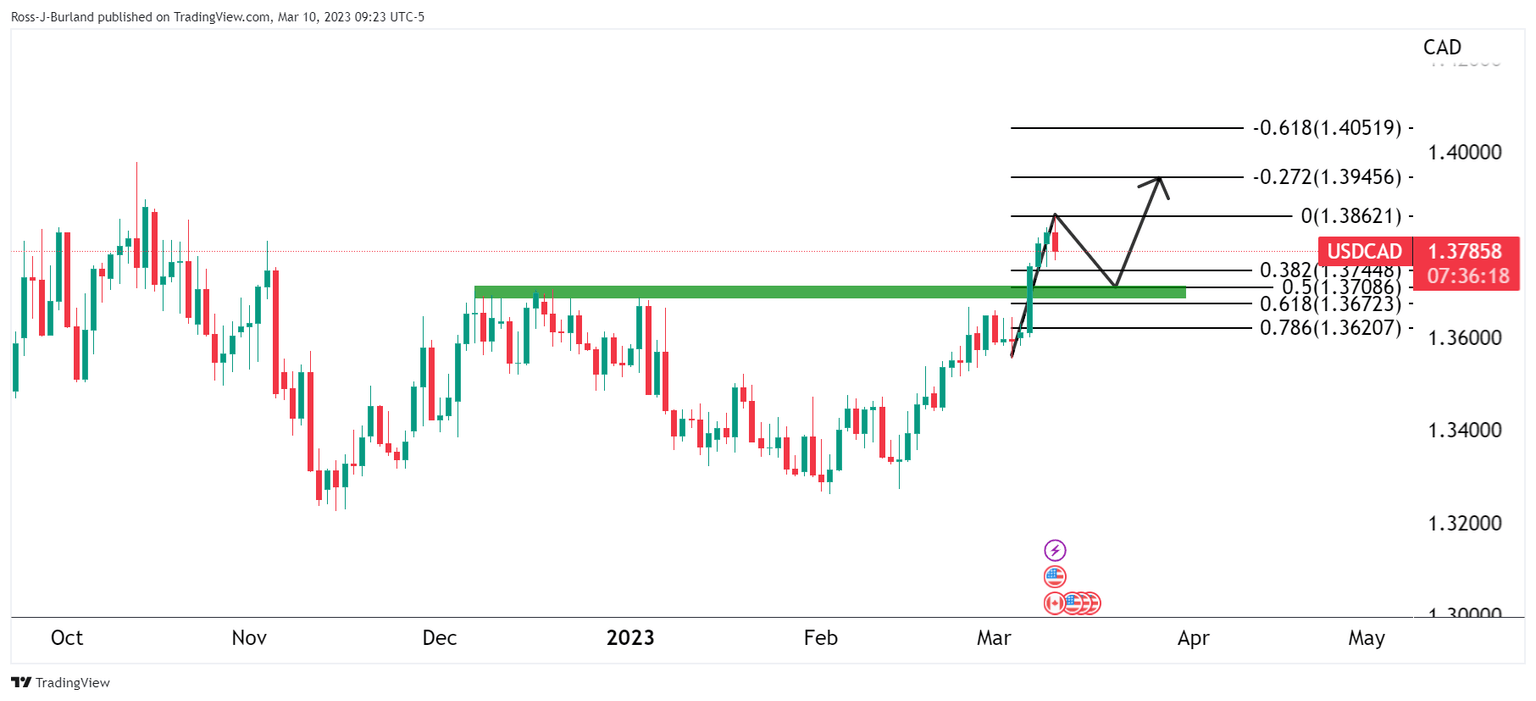

USD/CAD technical analysis

The price is higher on the daily chart and could be due for a correction back into the prior resistance that meets a 50% mean reversion area.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.