US Stocks Forecast: Wall Street mixed as US yields take the spotlight

- The S&P 500 added 17.14 points, or 0.38%, to end at 4,536.77.

- The Nasdaq Composite dropped 6.25 points, or 0.05%, to 15,121.68.

- The Dow Jones Industrial Average climbed 157.95 points, or 0.45%, to 35,615.26.

The S&P 500 and the Dow were moving towards record highs on Wednesday following strong forecasts from healthcare companies Anthem and Abbott. However, the Nasdaq was unable to match form and wilted below the prior days closing level which likely spurred some additional profit-taking as US yields tried to rebound mid-day.

The S&P 500 did close up for a sixth-straight session. The Dow hit a new intraday high but moved lower later in the day and it failed to set a record close. According to preliminary data, the S&P 500 added 17.14 points, or 0.38%, to end at 4,536.77 points, while the Nasdaq Composite dropped 6.25 points, or 0.05%, to 15,121.68. The Dow Jones Industrial Average climbed 157.95 points, or 0.45%, to 35,615.26.

US yields in focus

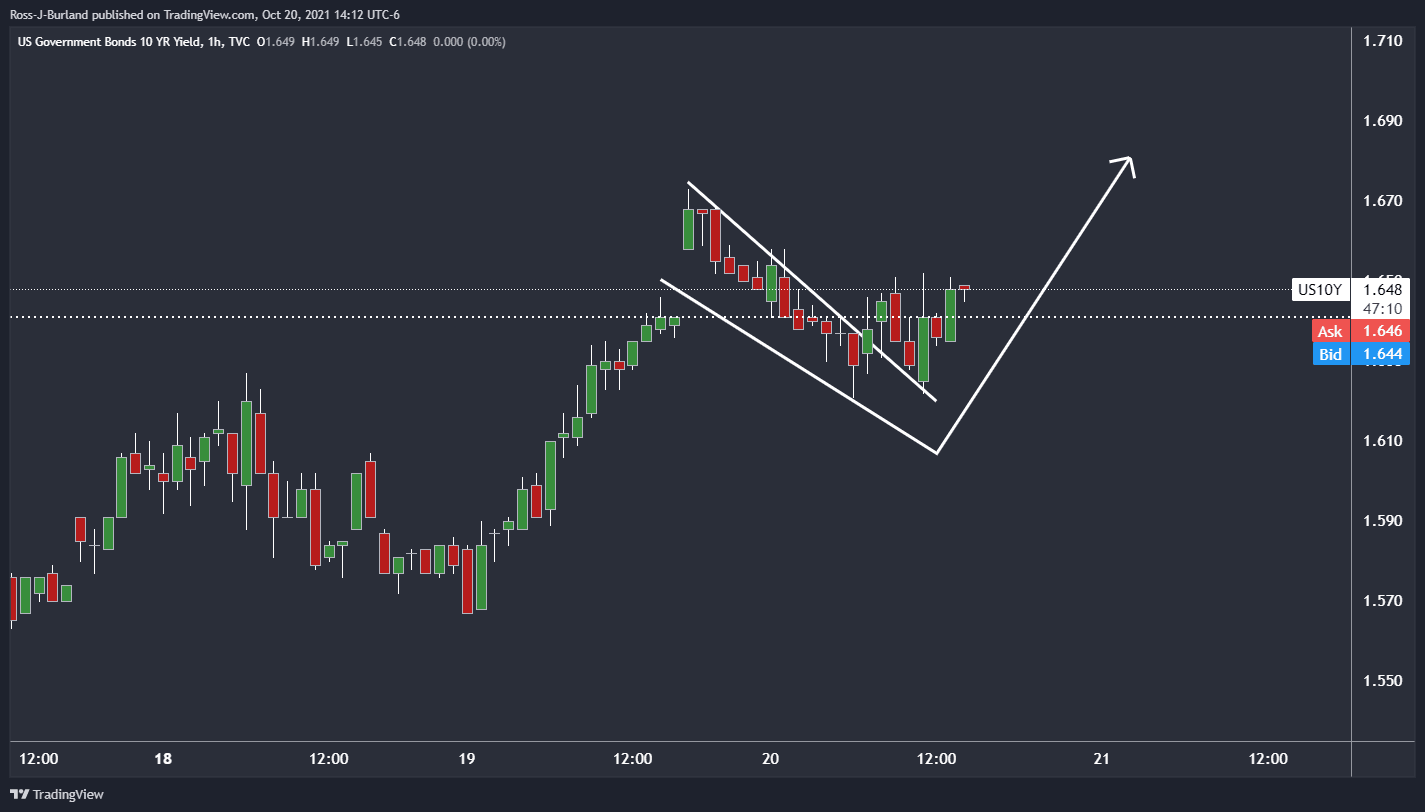

This as the US 10-Year Treasury yield rallied to 1.6730% to score a fresh five-month high before it sank to 1.62% on Wednesday from a high of 1.673%. However, they are now steadied and could be on the verge of another surge to the upside from a technical perspective as the yield spikes from the 21-50 hour SMMA cloud and building demand at counter-trendline support following a break of the hourly flag resistance:

A rise in yields could put pressure on the benchmarks as investors fret about inflation and rising borrowing costs.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.