-

Emini S&P June futures headed lower as predicted to my target & strong support at 5050/40. We made a low for the day exactly here as predicted.

-

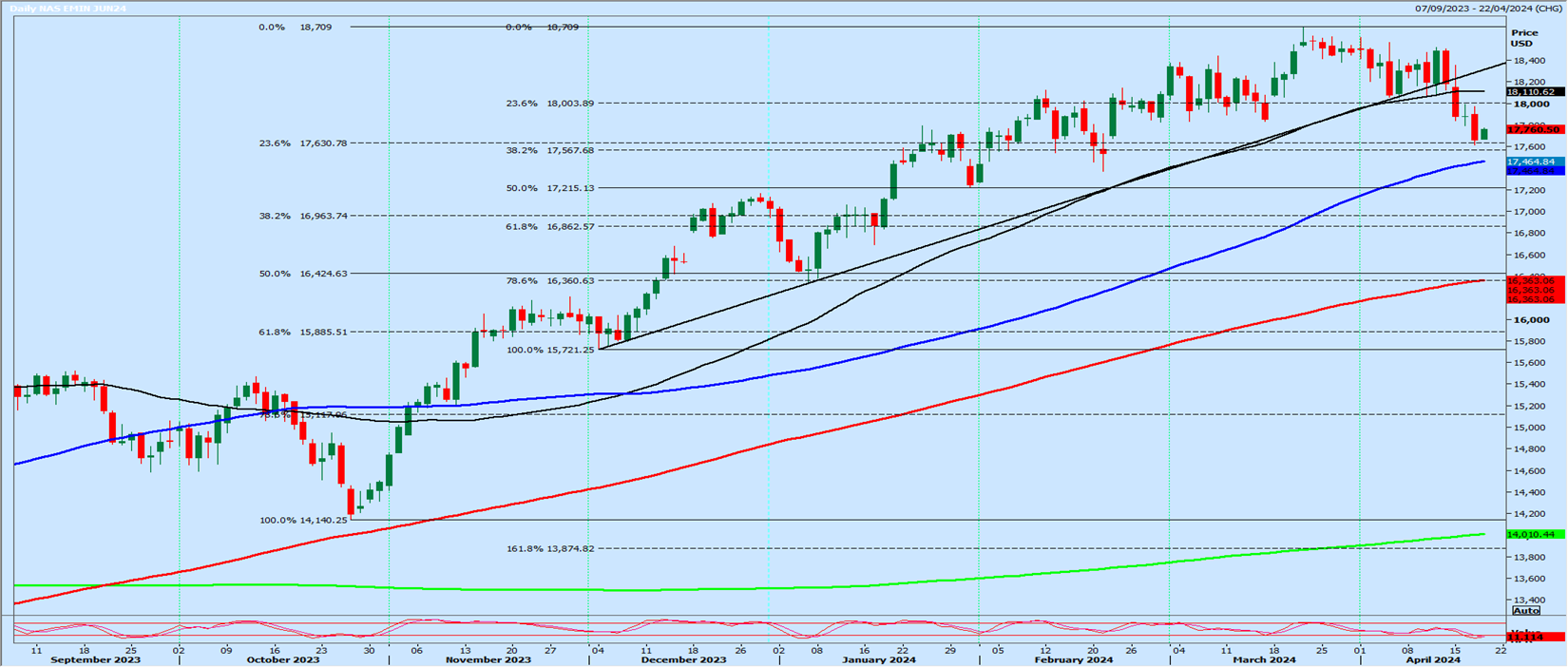

Emini Nasdaq if you were short on the break below 18000 or managed to short on the bounce towards this level, the shorts worked perfectly as we hit my target of 17680/670 for profit taking. A chunky 300 ticks profit.

Emini S&P: broke 5140 as expected to trigger my sell signal targeting strong support at 5050/40. A low for the day exactly here & an easy 900 tick profit on the trade.

-

Targets for our longs are 5080 & 5110. If we continue higher above 5120 look for 5140/50 for profit taking on any remaining longs.

-

Strong resistance at 5150/60 & shorts need stops above 5170.

Nasdaq June futures: collapsed breaking my buying opportunity at 18050/18000 for a short term sell signal targeting 17840/830 & 17680/670 for profit taking on shorts.

-

We now have long positions at my buying opportunity at 17640/580, with a low for the day exactly here yesterday & longs need stops below 17500. Targets: 17830, 17950

-

Obviously we have strong resistance again at 18,000/18,100 & shorts need stops above 18,200.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended content

Editors’ Picks

AUD/USD remains vulnerable near multi-month low after Aussie data

AUD/USD reacts little to better-than-expected Australian Goods Trade Balance data and hangs near a multi-month low touched on Wednesday amid rising bets for an early RBA rate cut. Furthermore, China's economic woes, US-China trade war fears and geopolitical risk undermine the risk-sensitive Aussie.

USD/JPY retreats further from the weekly top, slides below mid-150.00s

USD/JPY struggles to build on the previous day's strong move up to the weekly top and trades with a mild negative bias during the Asian session on Thursday. Bets for a December BoJ rate hike and the overnight sharp fall in the US bond yields lend some support to the lower-yielding JPY.

Gold price lacks firm near-term direction and is stuck in a familiar range

Gold price extends its sideways consolidative price move in a familiar range, awaiting a fresh catalyst before the next leg of a directional move. Geopolitical tensions, trade war fears and the overnight decline in the US bond yields offer support to the safe-haven XAU/USD.

Ripple's XRP could see a price rebound despite retail activity decline, RLUSD launch delay

XRP traded near $2.4 on Wednesday as Ripple Labs clarified that its RLUSD stablecoin will not debut on exchanges despite a rumored launch among crypto community members. Amid a sharp decline in XRP's price, on-chain data shows the remittance-based token still has the potential to resume its rally.

Four out of G10

In most cases, the G10 central bank stories for December are starting to converge on a single outcome. Here is the state of play: Fed: My interpretation of Waller’s speech this week is that his prior probability for a December cut was around 75% before the data.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.