- Blink Charging Co and Ideanomics Inc have the potential to surge if the harness their combined synergies.

- NASDAQ: BLNK is set for a correction after surging over 40% on Tuesday.

- NASDAQ: IDEX is fending off concerns about its finances and seems ready to rise.

NASDAQ: BLNK and NASDAQ: IDEX have both been gaining ground in recent months amid growing demand for electric vehicles. EVs have been popularized by Elon Musk's Tesla and by two other factors. The coronavirus pandemic has sent people away from public transport and into socially distanced vehicles – and the trend of going green is gaining ground, especially with less pollution during the lockdown.

Regardless of COVID-19, the two firms have a clear synergy – Ideanomics makes the cars and Blink Charging makes the charges. Will they collaborate? It is essential to note that Miami-based Blink and Delaware-registered Ideanomics operate in different places – BLNK in the US and IDEX in Asia. Will this make cooperation complicated or prevent fears of competition?

For the time being, both firms operate independently and their stocks are worth separate examination.

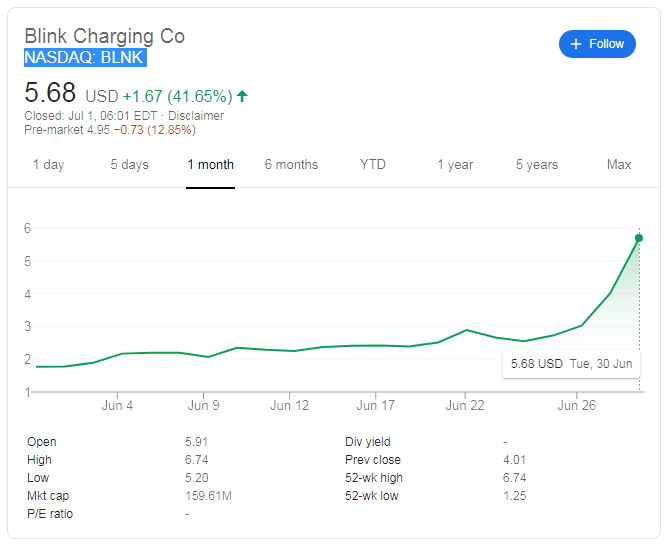

BLNK Stock Price

NASDAQ: BLNK closed at $5.68 on Tuesday, up over 40%, and over 250% above the levels it changed hands at in early June. Premarket indicators are pointing to a downside correction. Is it a "buy the dip" opportunity? Bargain-seekers – perhaps using the Robinhood app – may find it attractive.

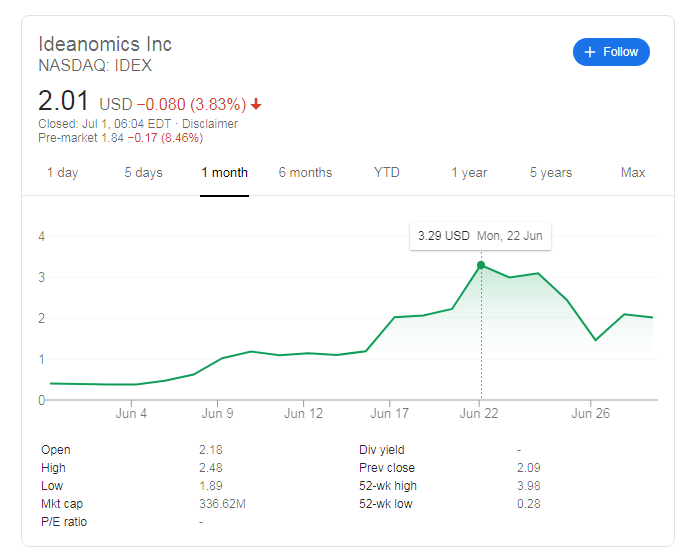

Ideanomics Inc stock

NASDAQ: IDEX has also enjoyed an upward trajectory, surging from a penny stock status early last month to a peak of $3.98. However, it has been under pressure from short-sellers in recent days. Several investors raised suspicions that the firm is in dire financial straits, triggering a denial from Ideanomics.

Premarket trading suggests that Ideanomics Inc is set to extend this downside correction and fall below the $2 mark. Also here, bargain-seekers may come into play.

Both stocks are set for short-term falls, but like in electronics, two negatives can turn into a positive if they are placed together.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD rebounds from session lows, stays below 1.0600

EUR/USD recovers from the session low it set in the European session but remains below 1.0600 on Tuesday. Although the US Dollar struggles to gather strength following disappointing housing data, the risk-averse market atmosphere caps the pair's rebound.

GBP/USD remains under pressure below 1.2650 after BoE Governor Bailey testimony

GBP/USD trades in the red below 1.2650 on Tuesday, pressured by safe-haven flows. BoE Governor Bailey said a gradual approach to removing policy restraint will help them observe risks to the inflation outlook but this comment failed to boost Pound Sterling.

Gold pulls away from weekly-high, holds above $2,600

Gold retreats slightly from the daily high it touched near $2,640 but holds comfortably above $2,600. Escalating geopolitical tensions on latest developments surrounding the Russia-Ukraine conflict and the pullback seen in US yields help XAU/USD hold its ground.

Bitcoin Price Forecast: Will BTC reach $100K this week?

Bitcoin (BTC) edges higher and trades at around $91,600 at the time of writing on Tuesday while consolidating between $87,000 and $93,000 after reaching a new all-time high (ATH) of $93,265 last week.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.