US round up: What next for tech?

Tech stocks have dominated US stock markets this year. Nvidia is the best performing stock on the S&P 500 YTD, rising 115%, and the semiconductor index is the best performing sector, rising more than 50%, as AI has been the main trading theme in financial markets. Even amongst US mega cap tech stocks, Nvidia was by far and away the best performer for most of this year. However, there has been a major shift in the leadership of US tech stocks as volatility has risen and the stock market rally in the US has broadened out.

Apple’s resurgence

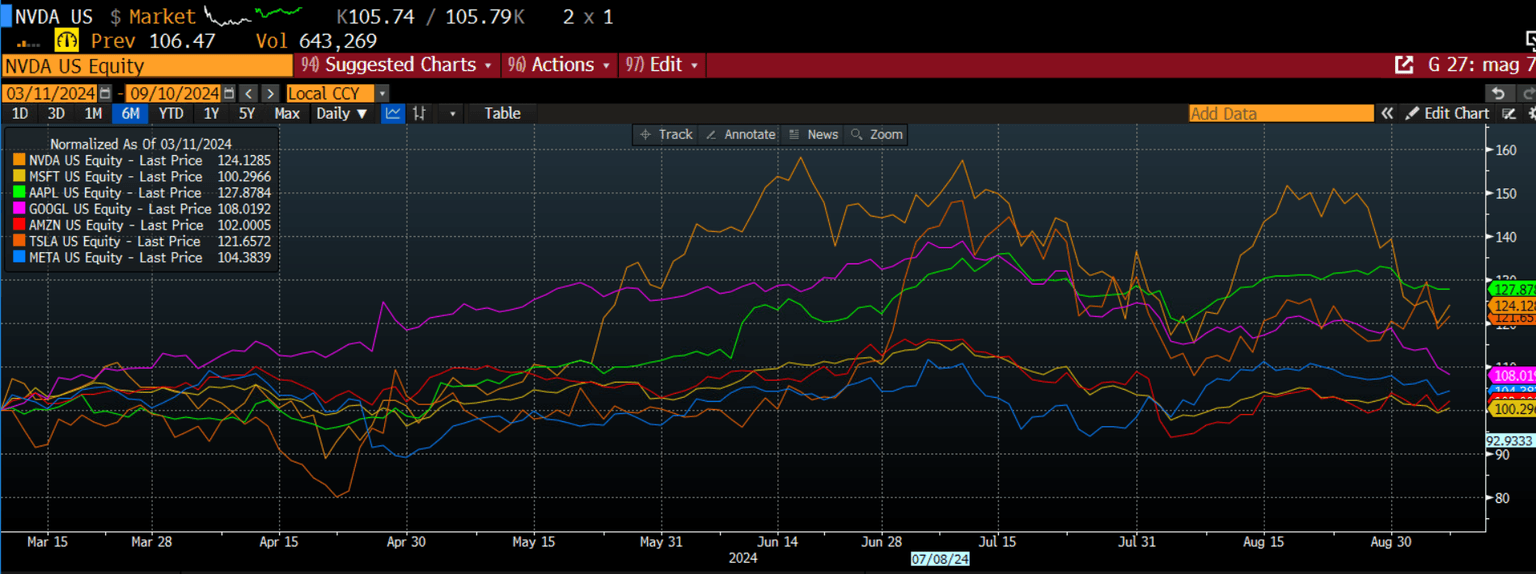

Earlier this year, Apple was one of the weakest performing stocks in the Magnificent 7. However, times have changed. Apple is now outperforming Nvidia, as you can see in the chart below. Nvidia has been plagued by volatility, concerns that its stellar earnings growth cannot be maintained, and worries about the uptake of AI. Apple has been able to take advantage of the decline in global inflation rates, which is good news for the consumer, along with falling interest rates. Its stock price has also risen on the back of its tie up with Open AI.

Chart 1: Six-month chart of Apple and Nvidia, normalized to show how they move together

Source: Bloomberg and XTB

But the question now is, can this outperformance last? After underperforming other big tech firms in recent years, Apple is hoping that its latest product launch, the Apple 16, will help to sustain interest in its stock. However, in pre-market trading on Tuesday, Apple’s stock price is down more than 1%, suggesting that the market is not that impressed. The new Apple iPhone offers new AI features, but it is hardly groundbreaking. It does not look particularly different: there are new colours and a few new camera features.

Added to this, Apple’s rally also looks intriguing because it is a lot less profitable than Nvidia, as you can see below. This suggests that Apple is rallying due to defensive qualities that Nvidia does not have, perhaps because of Apple’s qualities as a consumer stock and its long track record of generating huge cash piles.

Chart 2: Apple and Nvidia, EPS growth

Source: XTB and Bloomberg

Another development to note, is that Tesla has also seen its share price outperform. It had been the weakest performer in the Magnificent 7 in the first half of the year, but in recent months it has outperformed Google, Amazon and Microsoft, even though its revenue growth has sunk along with earnings per share.

Why has Nvidia fallen from the top spot

The shift in performance among the Magnificent 7 suggests two things about investor behavior: 1, they are favouring stocks that are linked to the consumer. Nvidia is not a consumer tech firm yet, it is an AI software wholesaler to industry as companies build up their AI infrastructure. Also, the rise of Tesla suggests that investors are looking for bargains and are now willing to buy stocks that have sold off sharply this year. Tesla’s share price is up nearly 10% in the past month, but it is still down 13% YTD.

Nvidia’s volatility surges

Tech market leadership is changing, and there is no denying that Nvidia has become more volatile in recent weeks. The 3-month implied volatility rate for Nvidia is nearly 55%, compared with less than 20 for the Vix, which measures volatility for the overall S&P 500, so it is no wonder that investors are staying away. Investors are also wary of the potential legal wrangles Nvidia may face due to US regulators probing anti-trust accusations against the chip maker.

Apple is also facing challenges of its own, including losing a legal battle in the EU, which means that it will have to pay $13bn to the Irish government.

The future for big tech

As we enter the final months of the year, price action tells us that investors’ attitudes towards tech are shifting. Apple and Tesla are outperforming Nvidia, Google and Microsoft. This suggests that AI is falling out of favour, investors are worried about Nvidia’s potential legal woes (Apple is an old hand at dealing with complicated legal situations) and investors are also happy to pick up unloved Magnificent 7 stocks like Tesla. However, if the AI darlings see their price fall further, maybe investors will once again warm to the AI theme.

Chart 3: The new order for the Magnificent 7

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.