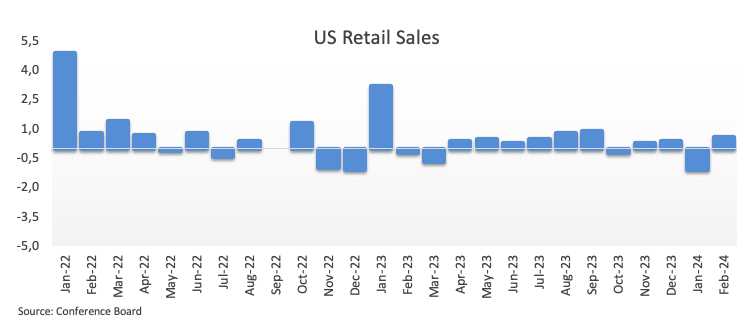

US Retail Sales regain the upward trend in February

Retail Sales in the US rose by 0.6% on a monthly basis in February to $707.7 billion, the data published by the US Census Bureau showed on Thursday. This reading followed the 1.1% drop recorded in the first month of the year ($696.7 billion) and came in short of expectations of a 0.8% gain.

Retail Sales Ex-Autos rose 0.3% in the same period, while Retail Sales Control Group came in flat vs. the previous month.

Further data from the press release highlights that retail trade sales were up 0.6 percent from January 2024, and up 0.8 percent above last year. Additionally, nonstore retailers were up 6.4 percent from last year, while food services and drinking places were up 6.3 percent vs. the same month of 2023.

Market Reaction

The Greenback, in the meantime, manages to regain further upside traction and revisits the key 103.00 zone when gauged by the USD Index (DXY).

Economic Indicator

United States Retail Sales (MoM)

The Retail Sales data, released by the US Census Bureau on a monthly basis, measures the value in total receipts of retail and food stores in the United States. Monthly percent changes reflect the rate of changes in such sales. A stratified random sampling method is used to select approximately 4,800 retail and food services firms whose sales are then weighted and benchmarked to represent the complete universe of over three million retail and food services firms across the country. The data is adjusted for seasonal variations as well as holiday and trading-day differences, but not for price changes. Retail Sales data is widely followed as an indicator of consumer spending, which is a major driver of the US economy. Generally, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Why it matters to traders

Retail Sales data published by the US Census Bureau is a leading indicator that gives important information about consumer spending, which has a significant impact on the GDP. Although strong sales figures are likely to boost the USD, external factors, such as weather conditions, could distort the data and paint a misleading picture. In addition to the headline data, changes in the Retail Sales Control Group could trigger a market reaction as it is used to prepare the estimates of Personal Consumption Expenditures for most goods.

This section below was published as a preview of the US Retail Sales data at 8:00 GMT.

- The United States Census Bureau will release Retail Sales data on Thursday.

- US Retail Sales are expected to have expanded by 0.8% in February.

- It is highly unlikely that Retail Sales readings change the Fed’s plans to cut rates in June.

The United States Census Bureau will publish the country’s Retail Sales report on Thursday, which is expected to show that the headline Retail Sales number will reverse the 0.8% monthly contraction seen in the first month of the year. So far, consumer spending among US residents has been performing erratically in recent months as market participants keep digesting the Federal Reserve’s (Fed) restrictive credit conditions.

According to the Census Bureau, “advanced estimates of U.S. retail and food services sales for January 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $700.3 billion, down 0.8 percent (±0.5 percent) from the previous month, and up 0.6 percent (±0.7 percent) above January 2023.”

The Greenback, in the meantime, managed to regain some balance and motivate the USD Index (DXY) to bounce off recent multi-week lows near 102.30 (March 8), always amidst rising bets that the Fed might start its easing cycle in the summer, with June being the most likely candidate.

The recent move higher in the US Dollar was almost exclusively driven by higher-than-anticipated US inflation figures for February, which demonstrated that, despite the downward trend in domestic consumer prices, inflation remains a sticky issue. According to the US Bureau of Labor Statistics, the headline Consumer Price Index (CPI) rose 3.2% in the year to February and 3.8% when it came to the Core CPI.

Back to the potential rate cuts in the next few months, Powell's remarks at both his congressional testimonies hinted at the likelihood of interest rate reductions within the year. However, such measures would only be enacted once the Fed gains greater confidence in the trajectory of inflation returning to its targeted annual rate of 2%.

What to expect in the February US Retail Sales report?

The headline Retail Sales are likely to expand by 0.8% from a month earlier, following the monthly 0.8% drop recorded in the previous month. Core Retail Sales, which exclude the automobile sector, are seen increasing by 0.5% on a monthly basis.

Ahead of the release, analysts at TD Securities noted that “we also look for retail sales to rebound a strong 0.8% m/m in February following January's retreat of a similar magnitude. Volatile auto and gasoline station sales will likely boost growth, with the control group also acting as a key driver.”

When will US Retail Sales data be released, and how can it affect EUR/USD?

The US Retail Sales data for February is due at 12:30 GMT. Barring a large surprise in either direction, and amidst the ongoing data dependent stance by the Fed, the readings are unlikely to derail the central bank’s intentions to kick-start its easing cycle at its June 12 event.

That said, “price action around the US Dollar is predicted to maintain its current familiar range, although extra losses should not be ruled out while below its key 200-day Simple Moving Average (SMA) at 103.70," Senior Analyst at FXStreet Pablo Piovano says.

Regarding EUR/USD, Pablo does not rule out further consolidation in the very near term, while the pair looks for further catalysts to spark a challenge of the March high of 1.0981 (March 8), and eventually a test of the psychological 1.1000 barrier.

Pablo adds that the pair’s outlook should remain constructive as long as it keeps the trade above the 200-day SMA at 1.0836.

Economic Indicator

United States Retail Sales ex Autos (MoM)

The Retail Sales ex Autos data, released by the US Census Bureau on a monthly basis, measures the value in total receipts of retail and food stores in the United States excluding the key sector of motor vehicles and parts. A stratified random sampling method is used to select approximately 4,800 retail and food services firms whose sales are then weighted and benchmarked to represent the complete universe of over three million retail and food services firms across the country. The data is adjusted for seasonal variations as well as holiday and trading-day differences, but not for price changes. Retail sales data is widely followed as an indicator of consumer spending, which is a major driver of the US economy. Generally, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Author

FXStreet Team

FXStreet