The US President Donald Trump will hold a news conference on China this Friday. This will likely include the president's opinions on COVID-19 and China's handling of it, trade relations, currency wars and the US administration's political response to China’s parliament approving a decision to go forward with national security legislation for Hong Kong. This was a move that has triggered widespread concern about democratic freedoms.

So far, we know that the US has already announced that it has cancelled visas for Chinese students with ties to military schools and that it has stripped Hong Kong of its special treaty status, certifying it as no longer autonomous.

Market implications

The ramifications for financial markets could be enormous. We have already seen the value of the CNY weaken vs. the USD which will likely raise concerns that China could be weaponising its currency to support external trade.

FX markets will be keeping a close eye on these developments and AUD, JPY, HKD, USD and CNH markets will all be responding in kind. Equities could also take a hammering, (S&P 500 losing 30 points on the announcement and DJIA has now fallen into negative territory for the day).

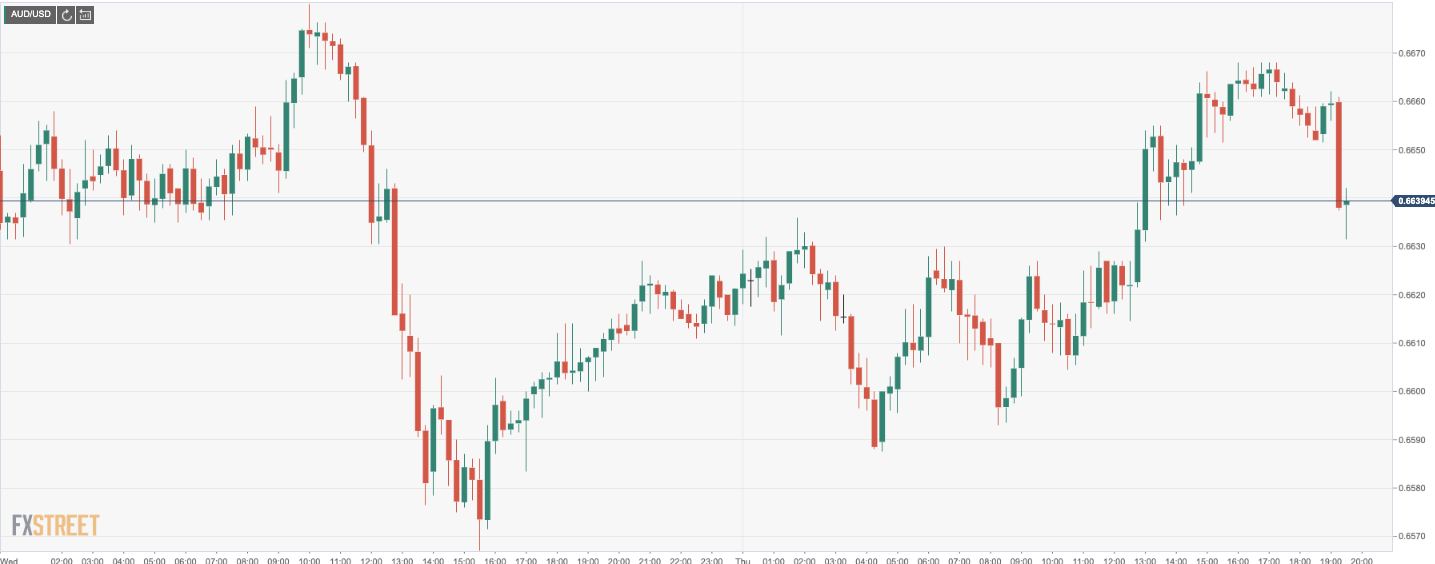

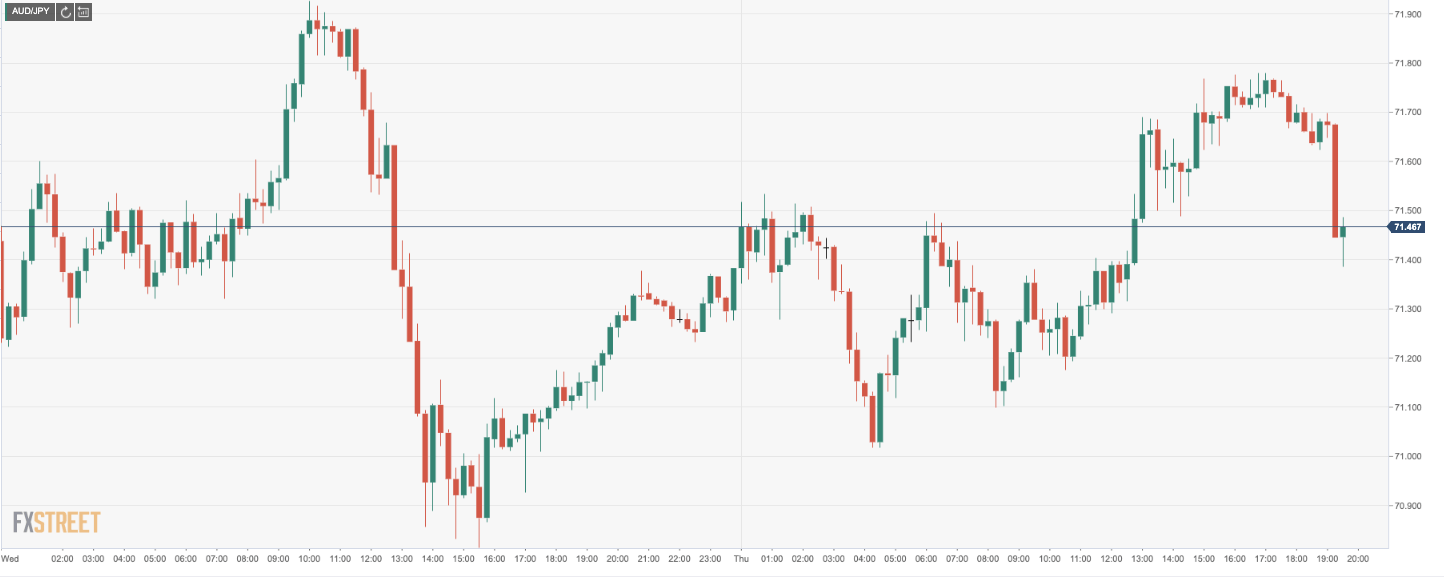

AUD/USD and AUD/JPY are already falling in anticipation as well:

AUD/USD 15 mins chart

AUD/JPY 15 mins charts

This is a theme that has been brewing since the start of this week. More on all of this in the following notes from earlier this week:

- China's plan of national security law in Hong Kong puts Trump in an unwelcome spot with Xi

- The Hong Kong Dollar, the next black swan?

- Chart of the Week analysis – AUD/JPY

- How do experts view financial conflict of top two economies? – The Global Times

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold jumps to new record-high above $3,220 as China ramps up tariffs on US goods

Gold extends its relentless rally and trades at a new all-time high above $3,220 in the European session on Friday. The precious metal benefits from safe-haven flows following China's decision to raise additional tariffs on US imports to 125% from 84%.

EUR/USD climbs to fresh multi-year high above 1.1400 on intense USD weakness

EUR/USD continues to push higher and trades at its strongest level since February 2022 above 1.1400 in the European session on Friday. The US Dollar (USD) stays under heavy pressure after China raised tariffs on US imports in retaliation, fuelling the pair's upsurge.

GBP/USD extends the advance to near 1.3100 as USD selloff picks up steam

GBP/USD preserves its bullish momentum and advances to near 1.3100 in the European session. The persistent USD weakness remains the main market theme as fears over the deepening China-US trade conflict triggering a recession in the US continue to grow.

Bitcoin, Ethereum and Ripple show weakness while XRP stabilizes

Bitcoin and Ethereum prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple broke and found support around its critical level; maintenance suggests a recovery on the cards.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.