US JOLTs Job Openings misses consensus in March

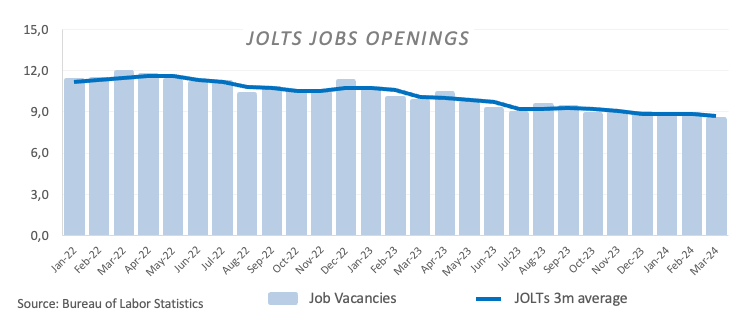

The US Bureau of Labor Statistics (BLS) revealed in its Job Openings and Labor Turnover Survey (JOLTS) on Wednesday that on the final business day of March, the number of job openings reached 8.488 million. This figure was 325K below March's revised count of 8.813 million (previously reported as 8.756 million) and came in short of market's expectation of 8.680 million.

According to the press release, "In March, the number of hires was little changed at 5.5 million but was down by 455,000 over the year. The rate, at 3.5 percent, changed little in March."

Market reaction to JOLTS Job Openings data

The US Dollar (USD) Index extended its daily corrective decline and approaches the 106.00 support ahead of the FOMC gathering.

Author

FXStreet Team

FXStreet