US Dollar locks in best trading week in two years with a landslide Nonfarm Payrolls print

- The US Dollar jumps higher after a massive positive Nonfarm Payrolls print.

- Tensions in the Middle East together with further pared bets of big Fed rate cuts are fueling safe-haven inflows to the Greenback.

- The US Dollar Index moves higher and says goodbey to September's tight range.

The US Dollar (USD) ties up with gains and is set to close off this week with nearly 2% gains in the US Dollar Index (DXY). The greenback gains after first the Nonfarm Payrolls print of 254,000 against the expected 140,000 was an out of this world number. The follow through which gave the Greenback another push higher came from traders unwinding bets on the number of rate cuts with a 100 basis point cut in total dropping below the 100 marker.

All other segments in the US Jobs Report might create some issues already for the November rate cut. With the Average Hourly Earnings for September coming in at 0.4%, risk of sticky inflation remains. The US Federal Reserve will need to watch incoming data more closely right up to the very last end in November before considering what to do.

Daily digest market movers: Washed out

- Expect some volatile moves in the Greenback if Israel strikes Iranian Oil fields. At the time of writing, discussions between Israel and the Biden administration for a green light on the attacks are still ongoing.

- Tthe US Jobs Report for September knocked it out of the park:

- Nonfarm Payrolls jumped to 254,000 against 159,000 in August, while that was revised from 1420,000.

- Monthly Average Hourly Earnings went from 0.5% to 0.4%, with that 0.5% being revised from 0.4% in August.

- The Unemployment rate went stronger again to 4.1%, a touch stronger than 4.2% previously.

- At 13:00 GMT, Federal Reserve Bank of New York President John Williams delivers opening remarks at the event "The Future of New York City: Focus on Jobs" organized by the New York Fed.

- Equities are applauding the positive US Jobs Report with all US indices near 1% higher.

- The CME Fedwatch Tool shows a 69.3% chance of a 25 basis-point rate cut at the next Fed meeting on November 7, while 30.7% is pricing in another 50-basis-point rate cut.

- The US 10-year benchmark rate trades at 3.95%, a 30-day high.

US Dollar Index Technical Analysis: Another scenario for the coming months

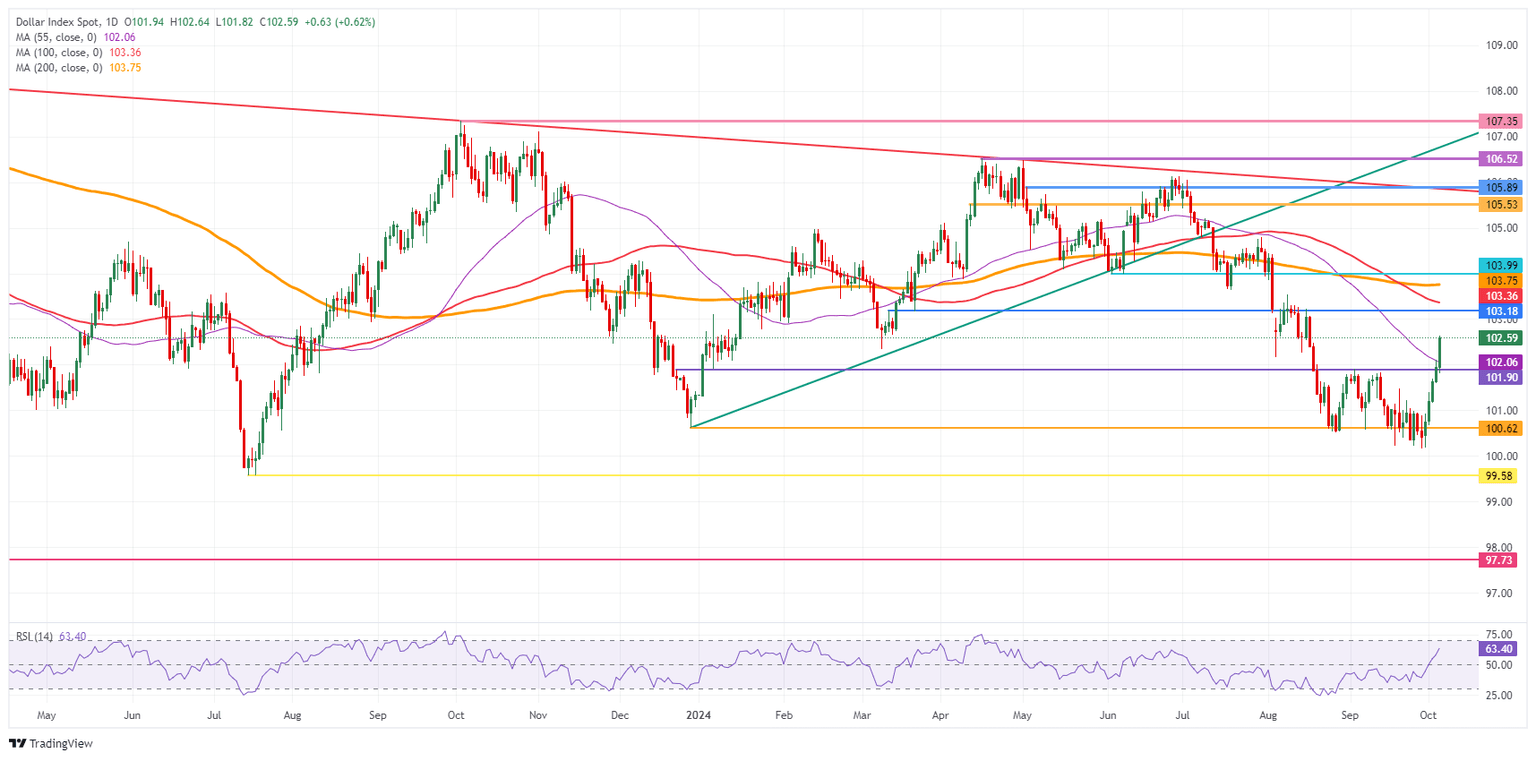

The US Dollar Index (DXY) has made a stellar recovery this week with the cherry on the cake Thursday, when it was able to break out of September’s range. The 55-day Simple Moving Average (SMA) at 102.05 has refused to let the DXY trade higher and shows its strength as a resistance level. Expect the US Jobs Report to be the catalyst that snaps that level for more upside or sees the DXY fall back into range.

The 55-day Simple Moving Average (SMA) at 102.05 has already acted as resistance and is the first level that needs to be broken for more upside. A leg higher, the chart identifies 103.18 as the very final level for this week. Once above there, a very choppy area emerges with the 100-day SMA at 103.36, the 200-day SMA at 103.75 and the pivotal 103.99-104.00 levels in play.

On the downside, 100.62 is flipping back from resistance into support in case the DXY closes above it this week. The fresh low of 2024 is at 100.16, so a test of this level should take place before more downside. Further down, and that means giving up the big 100.00 level, the July 14, 2023, low at 99.58 comes into play.

US Dollar Index: Daily Chart

Banking crisis FAQs

The Banking Crisis of March 2023 occurred when three US-based banks with heavy exposure to the tech-sector and crypto suffered a spike in withdrawals that revealed severe weaknesses in their balance sheets, resulting in their insolvency. The most high profile of the banks was California-based Silicon Valley Bank (SVB) which experienced a surge in withdrawal requests due to a combination of customers fearing fallout from the FTX debacle, and substantially higher returns being offered elsewhere.

In order to fulfill the redemptions, Silicon Valley Bank had to sell its holdings of predominantly US Treasury bonds. Due to the rise in interest rates caused by the Federal Reserve’s rapid tightening measures, however, Treasury bonds had substantially fallen in value. The news that SVB had taken a $1.8B loss from the sale of its bonds triggered a panic and precipitated a full scale run on the bank that ended with the Federal Deposit Insurance Corporation (FDIC) having to take it over.The crisis spread to San-Francisco-based First Republic which ended up being rescued by a coordinated effort from a group of large US banks. On March 19, Credit Suisse in Switzerland fell foul after several years of poor performance and had to be taken over by UBS.

The Banking Crisis was negative for the US Dollar (USD) because it changed expectations about the future course of interest rates. Prior to the crisis investors had expected the Federal Reserve (Fed) to continue raising interest rates to combat persistently high inflation, however, once it became clear how much stress this was placing on the banking sector by devaluing bank holdings of US Treasury bonds, the expectation was the Fed would pause or even reverse its policy trajectory. Since higher interest rates are positive for the US Dollar, it fell as it discounted the possibility of a policy pivot.

The Banking Crisis was a bullish event for Gold. Firstly it benefited from demand due to its status as a safe-haven asset. Secondly, it led to investors expecting the Federal Reserve (Fed) to pause its aggressive rate-hiking policy, out of fear of the impact on the financial stability of the banking system – lower interest rate expectations reduced the opportunity cost of holding Gold. Thirdly, Gold, which is priced in US Dollars (XAU/USD), rose in value because the US Dollar weakened.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.