US Dollar drops as US yields sink on Bessent comments

- The US Dollar dives lower on Tuesday, accelerates after Bessent's comments.

- China is facing further scrutiny from the Trump administration with more semiconductor restrictions.

- The US Dollar Index (DXY) is dipping lower, pressured by a sell off in US yields.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, trades weaker after comments from United States (US) Secretary of the Treasury Scott Bessent. Bessent said that US yields will drop lower even without the Federal Reserve (Fed) due to the Trump policy. This triggered a firm drop in US yields across the board, dragging Gold, Bitcoin and the US Dollar along with it in its sell-off, deepening earlier losses.

The rout was initiated in early trading on Tuesday after the US President Donald Trump administration gave more details on its plan to toughen semiconductor restrictions over China. In addition, the United States (US) is asking allied countries to impose tariffs as well on China in order to corner the country. Trump wants to slow down Chinese technological development, Bloomberg reports.

The US economic calendar is starting to bear some interesting data points. The Consumer Confidence for February and the Richmond and Dallas Fed Manufacturing indexes are all leading sentiment indicators that could give some insights about the current US activity. Later in the day, Fed Vice Chair for Supervision Michael Barr, Richmond Fed President Tom Barkin and Dallas Fed President Lorie Logan are set to speak.

Daily digest market movers: Data does nothing

- The Trump administration plans to expand its limitations on China's technological developments, including tougher semiconductor restrictions and pressuring allies to install restrictions on China's chip industry. Trump’s goal is to prevent China from developing a domestic semiconductor industry that could boost its AI and military capabilities, Bloomberg reports.

- At 14:00 GMT, the S&P Case Shiller Home Price Index for December came in at 4.7%, coming from 4.5% in November.

- Some leading Manufacturing indicators were released:

- The US Richmond Fed Manufacturing Index came in stronger at 6, beating the -3 expectation and the previous -4.

- The US Consumer Confidence, fell to 98.3, a miss on the 102.5 expectation and far below the revised 105.3.

- The US Dallas Fed Manufacturing Business Index came in lower at 4.6, coming from 7.4.

- At 16:45 GMT, Federal Reserve Vice Chair for Supervision Michael Barr will give a speech on key financial stability issues in New Haven, Connecticut, United States.

- Richmond Fed President Tom Barkin will give a speech called "Inflation Then and Now", followed by a Q&A at an event hosted by the Rotary Club of Richmond, expected around 18:00 GMT.

- At 21:15 GMT, President of the Federal Reserve Bank of Dallas Lorie Logan will close off this Tuesday by speaking on the future of the central bank balance sheet at Bank of England's annual BEAR research conference in London, United Kingdom.

- Equities are nosediving after the comments from US Secretary of the Treasury Scott Bessent and are tanking over 1%.

- The CME FedWatch tool shows an uptick in chances for an interest rate cut by the Federal Reserve (Fed) in June by 25 basis points (bps), growing to 50.0%, while odds for a rate pause have diminished to only 32.6%, backed by the drop in US yields this Tuesday

- The US 10-year yield trades around 4.28%, a drop of more than 6% from last week’s high at 4.574%.

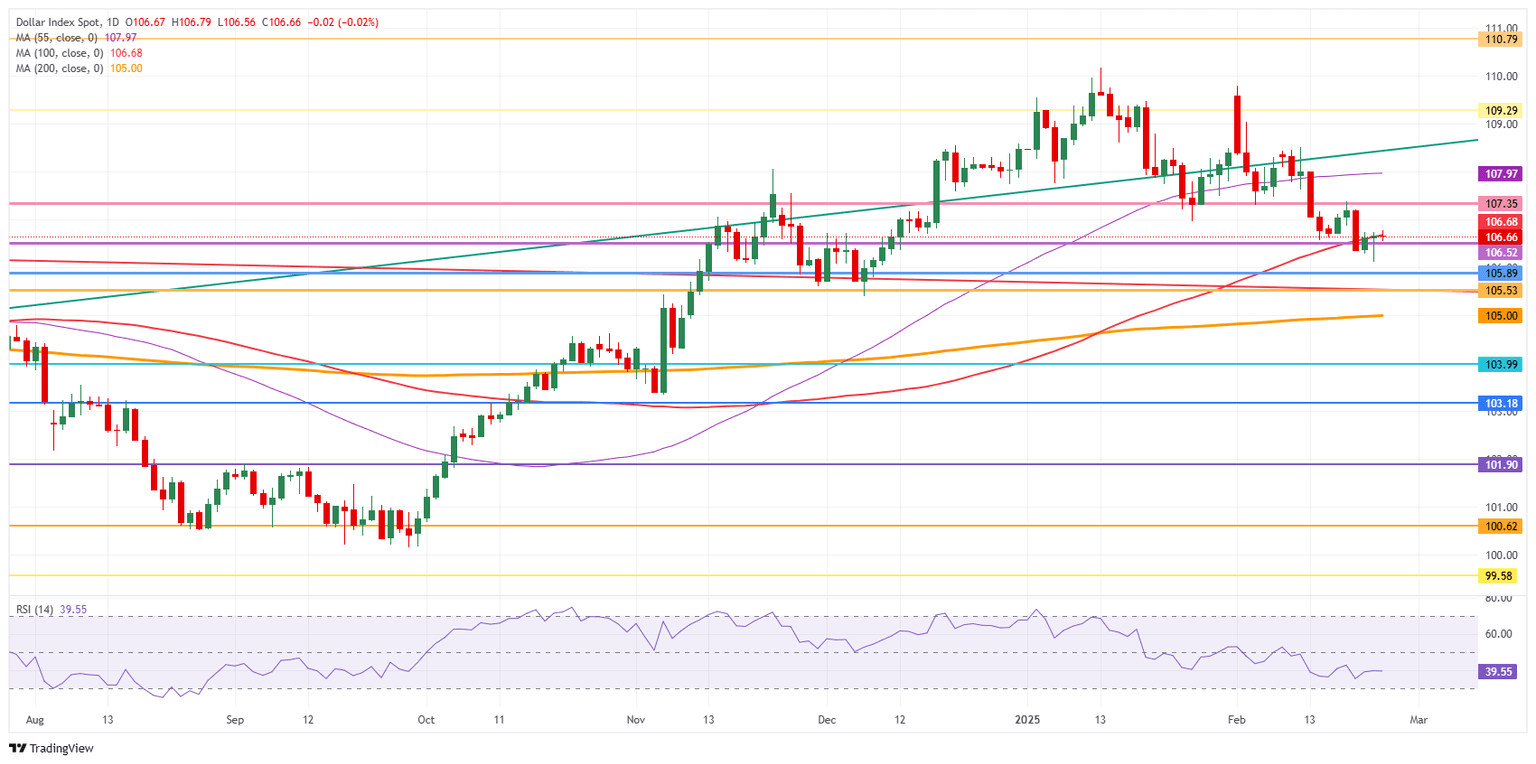

US Dollar Index Technical Analysis: There goes the washout

The US Dollar Index (DXY) is clearly not included in traders' decisions on the back of comments from US President Donald Trump or his administration. Moves are seen in equities, Gold, and Bonds, while the DXY has become too much of a risk and has been left aside by traders for now.

On the upside, the 100-day Simple Moving Average (SMA) could limit bulls buying the Greenback near 106.68. From there, the next leg could go up to 107.35, a pivotal support from December 2024 and January 2025. In case US yields recover and head higher again, even 107.97 (55-day SMA) could be tested.

On the downside, the 106.52 (April 16, 2024, high) level has seen a false break for now. However, that does mean quite a few stops might have been triggered in the markets, with a few bulls having been washed out of their long US Dollar positions. Another leg lower might be needed to entice those Dollar bulls to reenter at lower levels, near 105.89 or even 105.33.

US Dollar Index: Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.