US Dollar slides lower after Consumer Confidence takes a turn for the worse

- The US Dollar trades lower in the US trading session on softer US data.

- US equities are giving up earlier gains and are turning red after the US data.

- The US Dollar Index breaks out of its September bandwidth and dips lower again.

The US Dollar (USD) eases on Tuesday after the start of the US trading session. Main driver for the downturn comes after both the Consumer Confidence for September and the Richmond Fed Manufacturing Index for September both are coming in lower than expected. The softer numbers are supportive for another big rate cut for the upcoming US Federal Reserve meeting in November.

On the economic data front, all is done and dusted with markets now looking forward towards Wednesday with New Home Sales for August. Main pivotal point this week will rather be Thursday with Durable Goods and the US Gross Domestic Product release. For that same Thursday, Fed Chairman Jerome Powell is expected to make some comments as well.

Daily digest market movers: Data driven means volatility

- On the geopolitical front, a United Nations emergency meeting is called on Tuesday for Lebanon after intense bombing over the weekend and on Monday by Israel.

- This Tuesday Federal Reserve Governor Michelle Bowman left a few comments for the markets to digest:

- Fed Bowman said that there are still more jobs than people looking for one.

- The Fed should keep its eye on inflation with upside risk still at hand.

- At that same time, the Housing Price Index for July came in at 0.1%, a touch softer than the expected 0.2% forecasted.

- At 14:00 GMT, the Richmond Fed Manufacturing Index for September came in at -21, a downside surprise after a -17 was expected, higher than the previous -19.

- At the same time, the Consumer Confidence reading came in as well as a downside suprise by falling to 98.7, far from the expected 104.0, and worse than the 103.3 previously.

- Equity markets are reversing in the US and are giving up earlier gains that got made on the back of that Chinese stimulus news. US equities dip lower and are down by nearly 0.25% for all three major averages.

- The CME Fedwatch Tool shows a 48.5% chance of a 25-basis-point rate cut at the next Fed meeting on November 7, while 51.5% is pricing in another 50-basis-point rate cut.

- The US 10-year benchmark rate trades at 3.75%, and retreats from its September high.

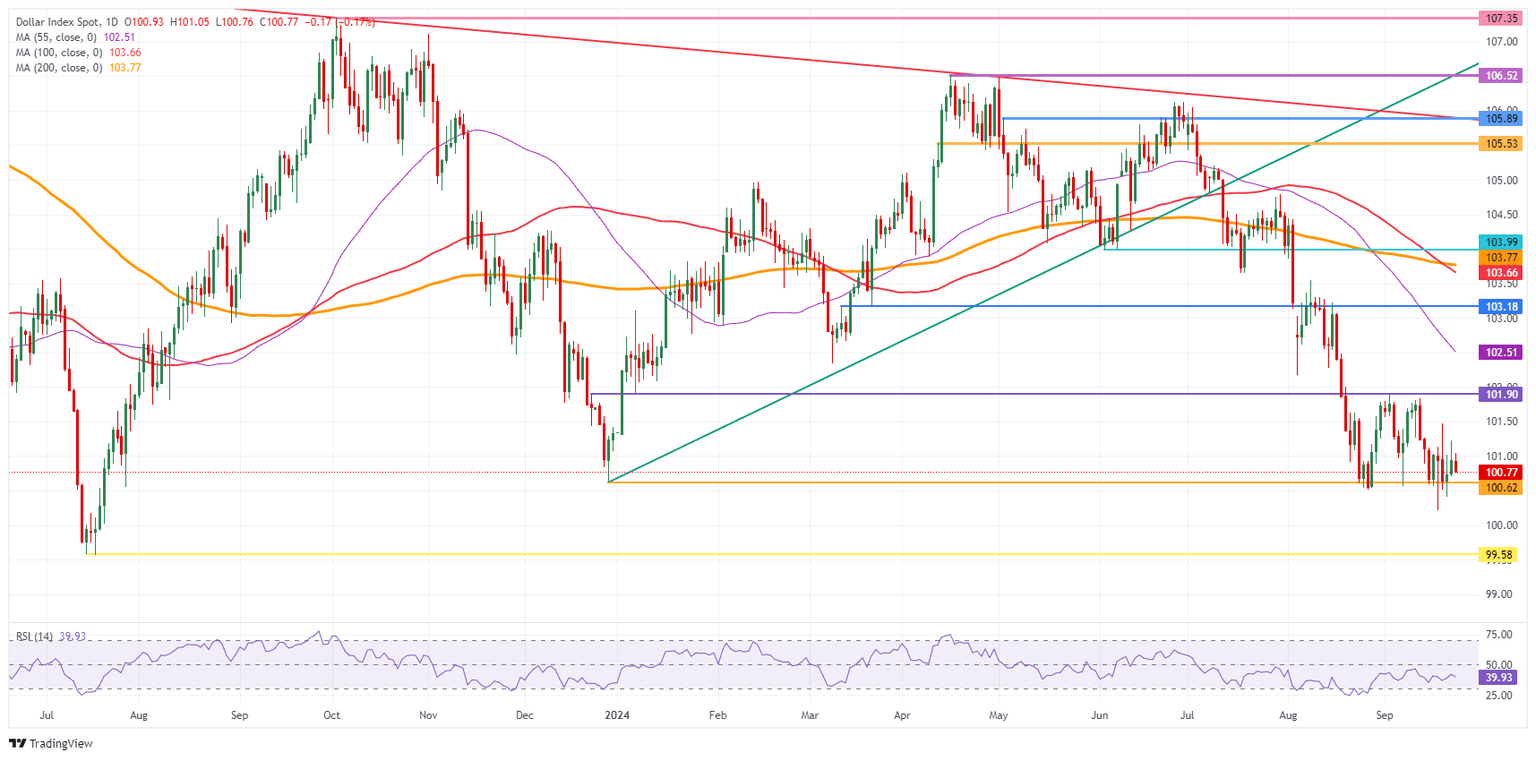

US Dollar Index Technical Analysis: DXY breaks out lower

The US Dollar Index (DXY) looks a bit stuck, broken even, and locked in again in that September tight range near the yearly lows. When looking at the yields and the interest rate differentials between the US and other countries, it does not look to add up that the US Dollar is where it is at the moment. Traders are awaiting more data to assess where the US Dollar Index needs to go and commit to a certain trend.

The upper level of the September range remains at 101.90. Further up, the index could go to 103.18, with the 55-day Simple Moving Average (SMA) at 102.51 along the way. The next tranche up is very misty, with the 100-day SMA at 103.66 and the 200-day SMA at 103.77, just ahead of the big 104.00 round level.

On the downside, 100.62 (the low from December 28, 2023) is the first support, and a break could point to more weakness ahead. Should that take place, the low from July 14, 2023, at 99.58, will be the next level to look out for. If that level gives way, early levels from 2023 are coming in near 97.73.

US Dollar Index: Daily Chart

Employment FAQs

Labor market conditions are a key element in assessing the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels because low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given their significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.