US Dollar dips on University of Michigan data sparking stagflation concerns

- Traders are chasing safe havens such as Gold to fresh all-time highs ahead of reciprocal tariffs.

- Markets see US PCE and University of Michigan numbers release adding to equity sell off.

- The US Dollar Index breaks below 104.00, no safe-haven flow in the Greenback.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, is currently set to close off this Friday in a loss at 103.90 at the time of writing on Friday. Traders are not really looking at the Greenback but rather at an exodus from Equities and Cryptocurrencies into the precious metals’ market, where Gold has hit another all-time high this Friday at $3,086. The reciprocal tariff deadline is approaching fast, April 2, and clearly has struck a nerve amongst traders and market participants.

On the economic data front, all eyes were on the Federal Reserve (Fed) preferred inflation gauge, the US Personal Consumption Expenditures (PCE) data for February. Nog big beats or surprises. Later this Friday Fed Vice Chairman Michael Barr and Atlanta Fed President Raphael Bostic are still due to speak.

Daily digest market movers: Just ahead of next week

- The US Personal Consumption Expenditures data for February has been released:

- The monthly headline PCE came in at 0.3% as expected, unchanged from the previous 0.3%. The yearly gauge remained stable at 2.5%.

- The monthly core PCE grew by 0.4%, beating the 0.3% expected. The yearly core PCE ticked up to 2.8% from 2.6%.

- At the same time, the US Personal Income month-on-month for February jumped to 0.8%, a big beat of the 0.4% expected and from 0.9% previously. The US Personal Spending for February fell to 0.4%, below the expected 0.5%, coming from the previous contraction of 0.2%.

- The University of Michigan Consumer Sentiment Index reading for March cames in softer at 57, missing the 57.9 estimate and previous reading. The 5-year Consumer Inflation Expectations surged to 4.1% from 3.9% previously.

- At 16:15 GMT, Federal Reserve Bank Vice Chair for Supervision Michael Barr will speak on Banking Policy at the 2025 Banking Institute in Charlotte, N.C.

- At 19:30 GMT, Federal Reserve Bank of Atlanta President Raphael Bostic will moderate a policy panel at the third annual Georgia Tech-Atlanta Fed Household Finance Conference at the Atlanta Fed, Atlanta, Georgia.

- Equities are diving lower with losses between 0.5% to 2% crossing from Asia over Europe and into US futures.

- According to the CME Fedwatch Tool, the probability of interest rates remaining at the current range of 4.25%-4.50% in May’s meeting is 87.1%. For June’s meeting, the odds for borrowing costs being lower stand at 65.5%.

- The US 10-year yield trades around 4.28%, looking for direction with some small safe haven inflow.

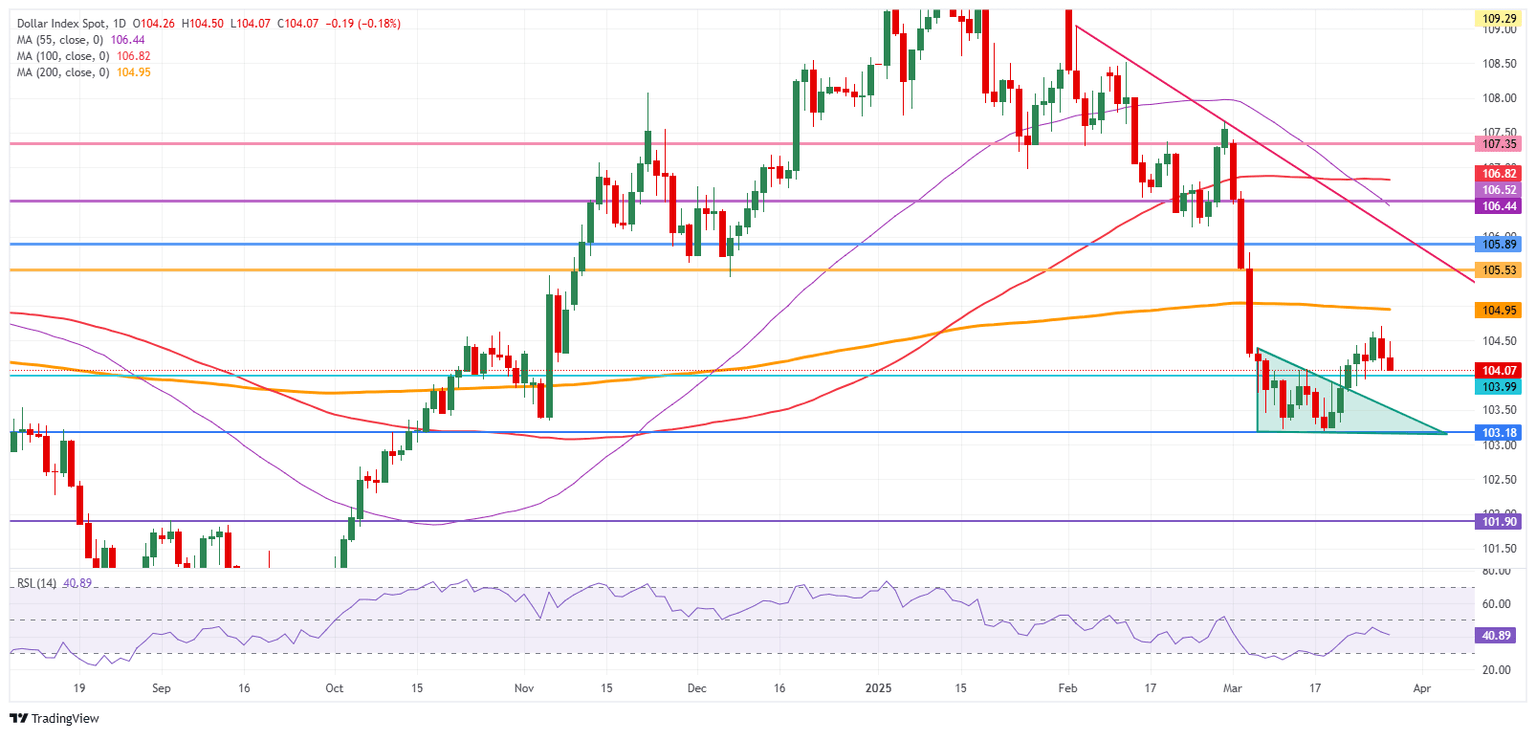

US Dollar Index Technical Analysis: There is the pitch

The US Dollar Index (DXY) has been roughly consolidating since that seismic drop at the start of March. Slowly but surely, some small unwinding of that big move lower is starting to unfold. Look for a synchronized move, with Gold paring back gains and the rate differential between the US and other countries widening again, for a comeback of the DXY to 105.00/106.00.

With the weekly close above 104.00 last week, a return to the 105.00 round level could still occur in the coming days, with the 200-day Simple Moving Average (SMA) converging at that point and reinforcing this area as a strong resistance at 104.95. Once broken through that zone, a string of pivotal levels, such as 105.53 and 105.89, could limit the upward momentum.

On the downside, the 104.00 round level is the first nearby support after a successful bounce on Tuesday. If that level does not hold, the DXY risks falling back into that March range between 104.00 and 103.00. Once the lower end at 103.00 gives way, watch out for 101.90 on the downside.

US Dollar Index: Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.