US Dollar flat as trade war tensions start to ease

- The Greenback edges lower while markets rebound from Monday's massacre.

- DXY shows little moves in comparison to equities or yields.

- The US Dollar Index trades back above 103.00 and looks to consolidate further.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, trades around 103.00 at the time of writing on Tuesday, after some comments from Secretary Scott Bessent. Over the past few days, the overall risk-off sentiment had rather devalued the Greenback substantially, though since the strong Nonfarm Payrolls (NFP) released on Friday, the DXY has been climbing back. The question will be if the index can hold on to this recovery when more US data comes in.

On the economic calendar front, some light data is set to be published. The National Federation of Independent Business (NFIB) will release its Business Optimism Index for March. With the current tariffs narrative, markets will be sensitive to see how business sentiment is in the US, as this is often seen as a leading indicator.

Meanwhile US Secretary Scott Bessent said already 70 countries have reached out for negotiations. President Trump will be personally involved in these talks each time. Countries that did not escalate will get priority. Meanwhile in Europe, the European President Ursula von der Leyen is open to negotiating with the US regarding the import tariffs announced last week by US President Donald Trump. However, she also made it clear that the EU is prepared to take countermeasures if necessary.

Daily digest market movers: No news yet

- The NFIB Business Optimism Index for March is due. The actual number comes in at 97.4, missing the elevated estimate at 101.3 and below the previous reading at 100.7.

- At 17:00 GMT, a 3-Year Note Auction will be released in the US.

- At 18:00 GMT, Federal Reserve Bank of San Francisco Mary C. Daly moderates a discussion with Brigitte C. Madrianm Dean of the Brigham Young University Marriott School of Business.

- A change from the red numbers this Tuesday, with both the Japanese Nikkei and Topix having closed off over 6% higher. Europe and the US face gains of over 3% across the board.

- The CME FedWatch tool shows chances for an interest rate cut by the Fed in May standing at 28.6%, falling back from nearly 50% on Monday. For June, the chances of a rate cut are 94.5%, with a slim 5.5% chance for no rate cut at all.

- The US 10-year yields trade around 4.25%, rallying higher and further away from its five-month low at 3.85%. Considering this surge back above 4.00%, interest rate cut bets for the upcoming Fed meeting in May are being pared back.

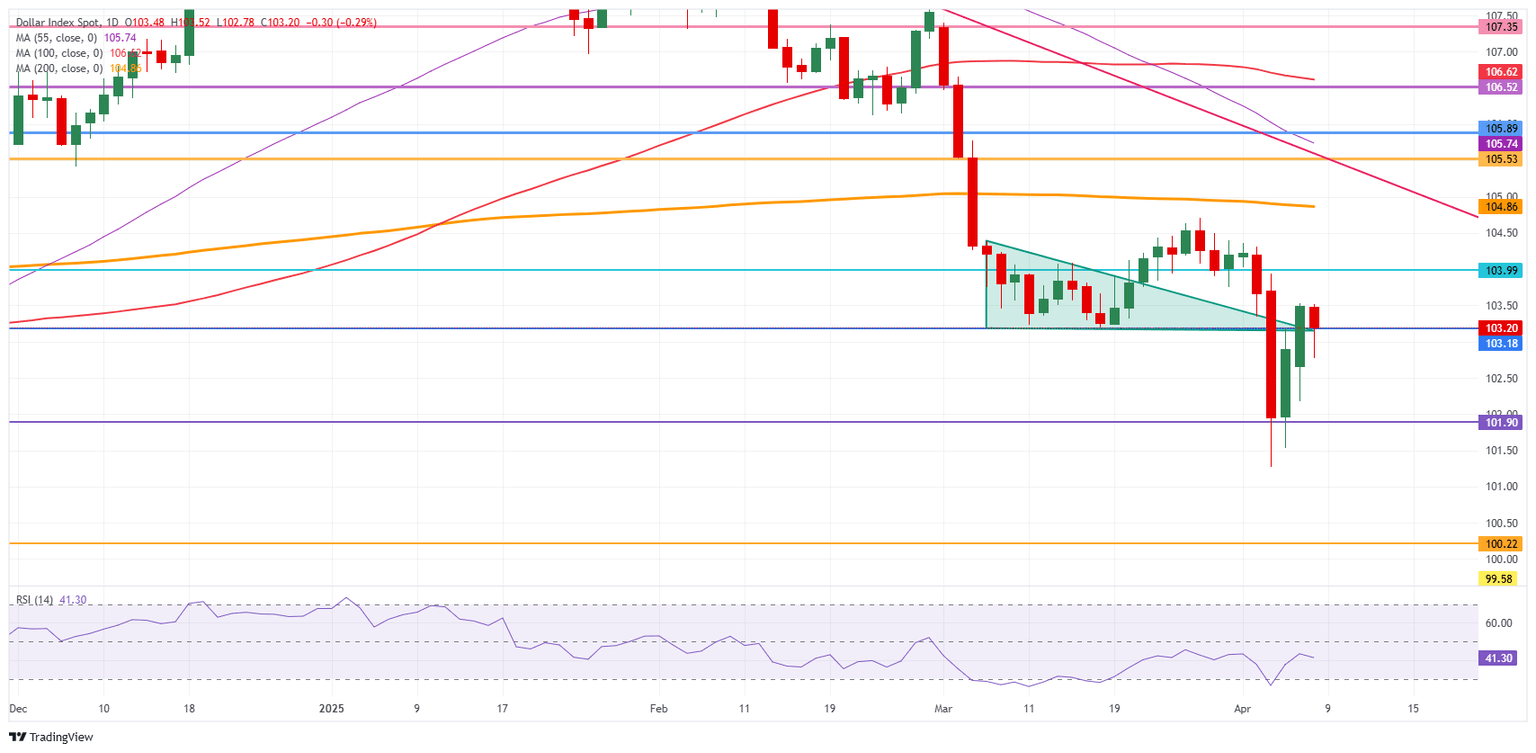

US Dollar Index Technical Analysis: Licking its wounds

A parental disclosure for the US Dollar Index is in its place here. With the significant moves and pickup in volatility, the DXY could again fall or jump quite quickly. Traders will need to stick to known levels and trade what they see instead of trying to outsmart the market under these conditions.

The first level to watch out for is 103.18, which needs to see a daily close above it. Above there, the 104.00 round level and the 200-day Simple Moving Average (SMA) at 104.86 come into play.

On the downside, 101.90 is the first line of defense, and it should be able to trigger a bounce as it has been able to hold the last two trading days. Maybe not on Tuesday, but in the coming days, a break below 101.90 could see a leg lower towards 100.00.

US Dollar Index: Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.