US Dollar pops after weekly Jobless Claims contradicts last week's panic

- The US Dollar erases losses and turns green against major peers.

- This week's Initial Claims number comes in stronger than expected.

- The US Dollar index pops back above 103.00 and turns green for this Thursday.

The US Dollar (USD) turns profitable again after the Initial Jobless Claims came in stronger than expected. This number helps calm nervous from traders and investors as it was the jump in Initial Claims last week which triggered a few days of mayhem in financial markets. With now that last week's number starting be a one-off event, more US Dollar strength could come in towards Friday.

On the economic data front, all eyes will now start to move forward to next week. With Friday being empty, traders will welcome a steady trading day and might offer room for all asset classes to nearly recover fully from last week and Monday's volatility patch. For next week, all eyes will be on the inflation report.

Daily digest market movers: Just a one off

- Former US President Donald Trump will hold a press conference at Mar-a-Lago later this Thursday.

- The economic calendar kicked off at 12:30 GMT with, straight away, the main event being presented: The weekly Jobless Claims

- Initial Claims for the week ending August 2 came in at 233,000, which is far under the 240,000 estimate and a decline from 250,000 from last week.

- Continuing Claims were at 1,877,000 and went to 1,875,000 for the week ending July 26.

- At 14:00 GMT, Wholesale Inventories data for June is expected to grow by 0.2%, at the same pace as the previous month.

- At 17:00 GMT, the US Treasury will auction a 30-year bond.

- Equity markets are rallying after that upbeat Jobless Claims print. US equities are firmly in the green after the US opening bell.

- The CME Fedwatch Tool shows a 72.5% chance of a 50 basis points (bps) interest rate cut by the Federal Reserve (Fed) in September. Another 25 bps cut is expected in November by 55.6%, while a 27.2% chance for a 50 bps cut and 17.2% for no cut are being pencilled in for that meeting.

- The US 10-year benchmark rate trades at 3.99%, set to print a fresh weekly high.

US Dollar Index Technical Analysis: Finally above

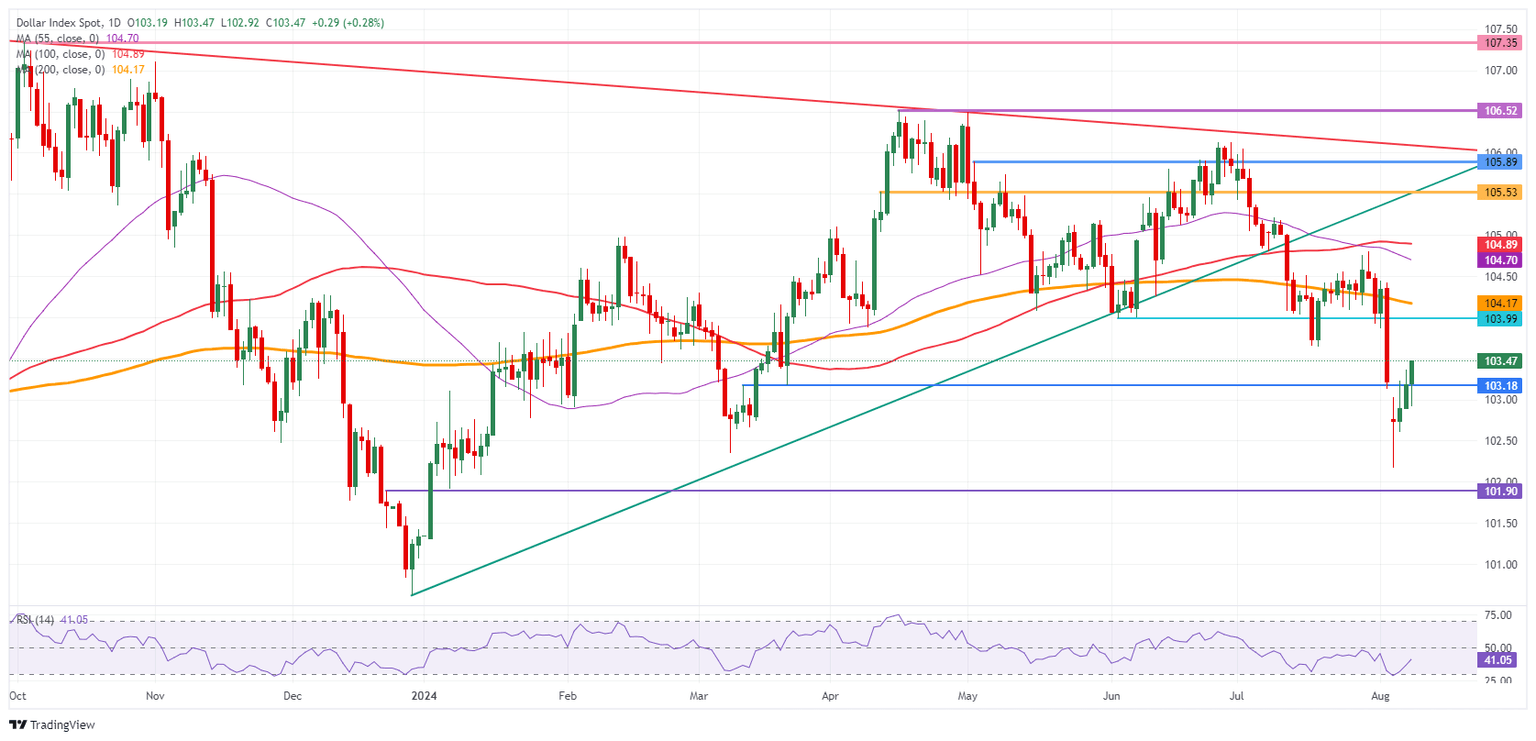

The US Dollar Index (DXY) is starting to look dangerous, as Dollar bulls cannot get that daily close above 103.18. This Thursday's decline can be seen as a firm rejection which could result in another leg lower. If the Jobless Claims report this Thursday turns ugly again, a nosedive to 101.00 could not be unthinkable.

Still the first point to recover and gain importance every day is that 103.18, a level held on Friday though snapped on Monday in the Asian hours, is being tested. Once the DXY closes above that level, next up is 104.00, which was the support from June. If the DXY can make its way back above that level, the 200-day Simple Moving Average (SMA) at 104.17 is the next resistance level to look out for.

On the downside, the oversold condition in the Relative Strength Index (RSI) indicator has eased in the daily chart and holds room again for a small leg lower. Support nearby is the March 8 low at 102.35. Once through there, pressure will start to build on 102.00 as a big psychological figure before testing 101.90, which was a pivotal level in December 2023 and January 2024.

US Dollar Index: Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.