US Dollar flat on Trump’s softening towards China, Powell

- The US Dollar sees earlier gains evaporate and trades flat at 99.20 in the US Dollar Index.

- Bonds and equities are rallying after President Trump backtracks on earlier stances towards China and the Fed.

- The US Dollar Index remains capped below the 100.00 round level and could dip again in a technical rejection trade.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, is trading flat to marginally higher around 99.20 at the time of writing on Wednesday after a pop in early Asian trading towards the 100.00 big figure got completely erased. The pop in the DXY came on the back of comments from United States (US) President Donald Trump late Tuesday, saying that he had no intention of firing Federal Reserve (Fed) Chair Jerome Powell, despite being frustrated with the high interest rates. The President also said he would be ‘nice’ to China if they come to the negotiating table, offering an olive branch by promising tariffs on China would be much lower than they are now, Bloomberg reports.

On the economic calendar front, all eyes are on the S&P Global preliminary Purchasing Managers’ Index (PMI) numbers for April. Traders already got a flavor with the European PMI data compiled by S&P Global and Hamburg Commercial Bank (HCOB) released earlier in the day. The mean theme in European core countries is that Services in Germany, France and the Eurozone as a whole fell into contraction and missed expectations across the board.

Daily digest market movers: US data just around the corner

- At 13:45 GMT, the S&P Global PMI preliminary data for April is due:

- Services PMI is expected to decline to 52.8, from the previous 54.4.

- Manufacturing PMI is expected to contract to 49.4, coming from 50.2.

- Three Fed speakers are lined up for this Wednesday:

- At 13:00 GMT, Federal Reserve Bank of Chicago President and CEO Austan Goolsbee delivers opening remarks in a virtual presentation at the Federal Reserve Bank of Philadelphia Economic Mobility Summit.

- Near 13:30 GMT, St. Louis Fed President Alberto Musalem delivers remarks at the Fed Listens Event along with Fed Governor Christopher Waller.

- Equities are rallying across the board on the back of the softening stance from US President Trump on China and the Fed. US futures pre-market are up over 2%. The German Dax is outperforming by 3%.

- The CME FedWatch tool shows the chance of an interest rate cut by the Federal Reserve in May’s meeting stands at 4.8% against no changes at 95.2%. The June meeting still has around a 65.4% chance of a rate cut.

- The US 10-year yields trade around 4.29% as US bonds are bid together with equities, which means yields are softening.

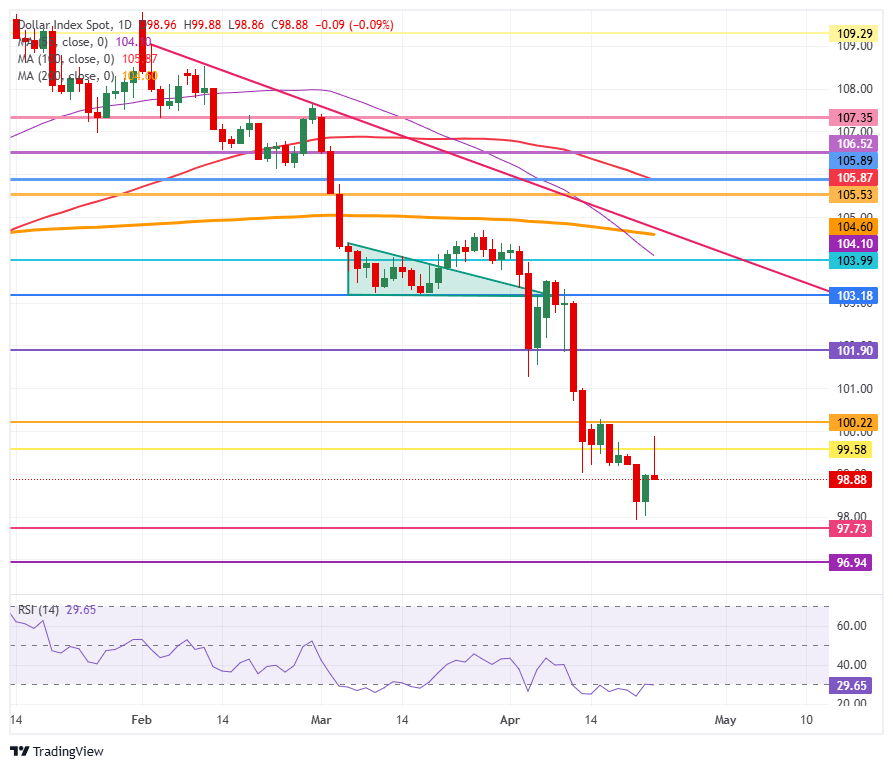

US Dollar Index Technical Analysis: Dollar bulls not convinced

The US Dollar Index (DXY) attempted to regain control at the 100.00 level, though it failed. The whole DXY gains during Asian hours this Wednesday have already been pared back. Although President Trump might have opened the door for negotiations, extended an olive branch to China, markets are clearly seeing it as a sign of weakness from the Trump administration, as they lost control over the stock market with the rout on Monday, having forced the President’s hand to ease off on his harsh stances.

On the upside, the first resistance comes in at 99.58, which has triggered a firm rejection and remains the first level to look at. Should US Dollar bulls resurface, look for 100.22 with a break back above the 100.00 round level as a bullish signal of their return. A firm recovery would be a return to 101.90.

On the other hand, the 97.73 support is very close and could snap at any moment. Further below, a rather thin technical support comes in at 96.94, before looking at the lower levels of this new price range. These would be at 95.25 and 94.56, meaning fresh lows not seen since 2022.

US Dollar Index: Daily Chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.