US Dollar sinks for third consecutive day with Greenback losing in nearly every cross

- The US Dollar posts a third consecutive day of losses, almost erasing all gains for 2024.

- The Greenback eased on a mixture of elements as markets wait for Jackson Hole at the end of the week.

- The US Dollar index trades near dangerous levels, close to flipping in a negative performance for 2024.

The US Dollar (USD) sees another day of losses on Tuesday after a sledge hammer was pulled out on Monday and sent the US Dollar (USD) another leg lower against most major peers, with all eyes on the US Federal Reserve Jackson Hole Symposium in Wyoming, where Fed Chairman Jerome Powell is set to deliver a pivotal speech. A mixture of risk-on and a very slim data calendar in the runup to Jackson Hole convinced traders that a recession scenario could be avoided and the US economy is on the path to a soft landing. Outside the US, news that Israel could commit to the US ceasefire proposal is also reducing the safe-haven flows toward the Greenback.

On the economic data front, again a very light calendar is ahead on Tuesday, although some sort of cautiousness must be upheld. With all stars aligning for a weaker US Dollar, any comment or data point could see an aggressive reversal of Monday’s moves. With the runup towards the speech from Fed Chairman Powell on Friday, nearly all Fed members will have issued their personal outlook about the interest-rate path, which means still a lot of market-moving comments could be on the way.

Daily digest market movers: Pressure builds

- China’s government is weighing whether to let local governments issue bonds to buy homes, according to Bloomberg.

- Europe plans to issue a 9% tariff on Tesla vehicles that are being imported from China.

- At 12:55 GMT, the Redbook Index for the week ending August 16 came in at 4.9% from the 4.7% last week.

- In the runup towards Jackson Hole, nearly all Federal Open Market Committee (FOMC) members will have a window of opportunity to have their say on monetary policy. This Tuesday two members are set to issue comments:

- Federal Reserve Bank of Atlanta President Raphael Bostic gives some remarks at the Atlanta Fed's Payment Inclusion Forum in Atlanta.

- Federal Reserve Vice Chair for Supervision Michael Barr participates in a discussion about cybersecurity at the Joint Financial and Banking Information Infrastructure Committee-Financial Services Sector Coordinating Council Meeting in Washington, D.C.

- Asian equity markets are mixed, with Japanese indices up over 1% while Chinese equities are on the back foot. European and US equities are rather flat and see earlier gains ease a bit.

- The CME Fedwatch Tool shows a 77.5% chance of a 25 basis points (bps) interest rate cut by the Fed in September against a 22.5% chance for a 50 bps cut. Another 25 bps cut (if September is a 25 bps cut) is expected in November by 59.3%, while there is a 35.4% chance that rates will be 75 bps below the current levels and a 5.2% probability of rates being 100 basis points lower.

- The US 10-year benchmark rate trades at 3.87% and is looking for direction after last week’s dip.

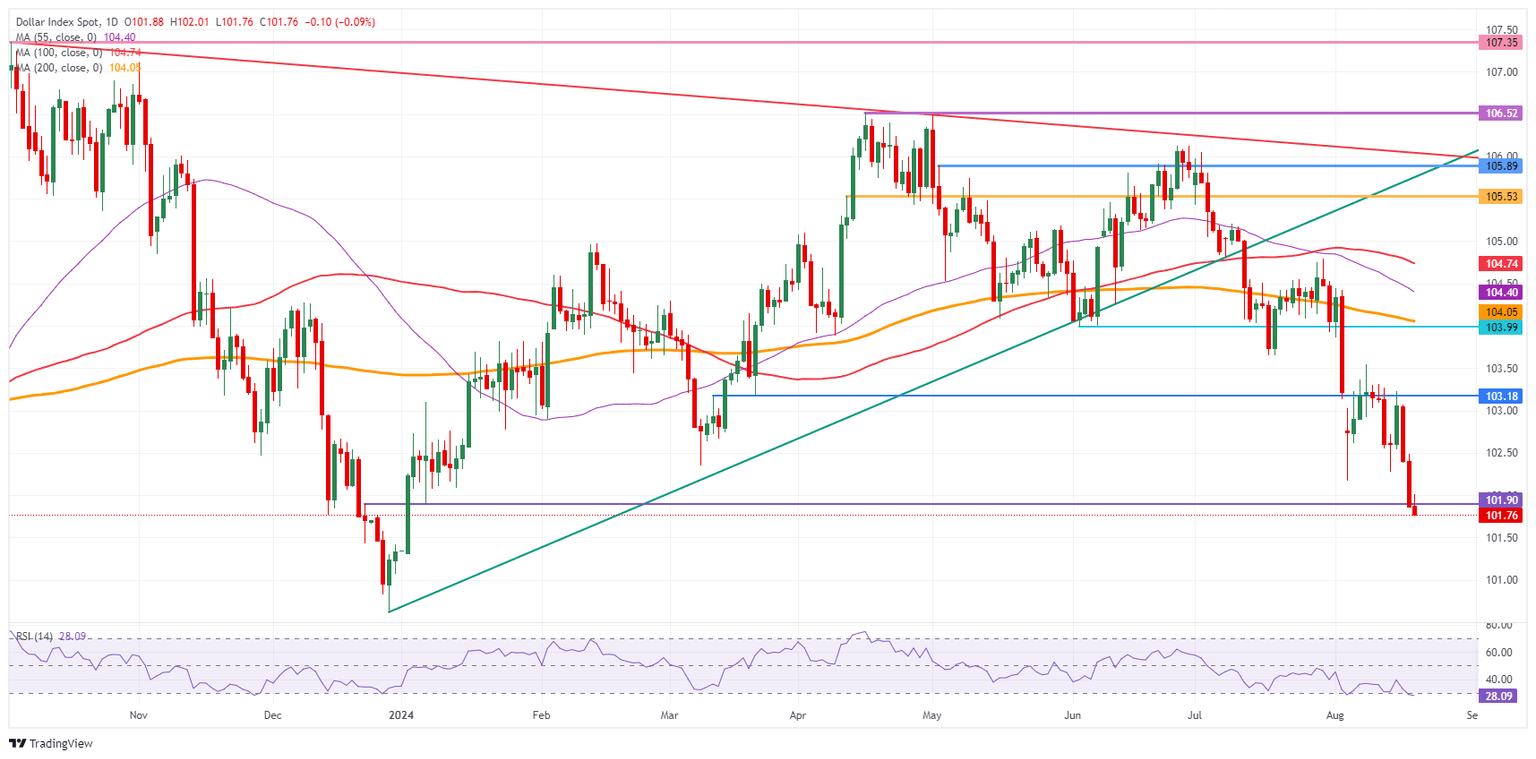

US Dollar Index Technical Analysis: It's a squeeze

The US Dollar Index (DXY) is getting very close to erasing its gains for the whole of 2024. That sends Dollar bulls back to the drawing board as the risk of this year's performance flipping into negative is a potential outcome. With this mixture of easing geopolitical tensions and markets embracing again the soft landing pattern ahead of Fed Chairman Jerome Powell’s speech at Jackson Hole, the question is if markets are not running too far ahead of themselves.

Defining pivotal levels becomes very important in order to avoid any dead-cat bounces, in which traders pile in too quickly in a trade and get caught on the wrong side of the fence once the course reverses. First up is 103.18, a level that traders were unable to hold last week. Next up, a heavy resistance level is at 103.99-104.00, and inches above there is the 200-day Simple Moving Average (SMA) at 104.07.

On the downside, the first immediate support comes up at the 101.90 level, which is under pressure at the moment. Levels not seen since early January are popping up, and even a fresh yearly low could come into play once the DXY dips below 101.30 (low from January 2). The low of December 28 at 100.62 will be the ultimate level to look out for.

US Dollar Index: Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.