- Tensions between the US and China over trade war is easing.

- The US Dollar index is under pressure as the week starts.

The US Dollar Index is trading at around 89.09 down 0.46% on the day so far as tensions of a trade war between the US and China seem to somewhat cool off.

The US and China are negotiating trade agreements so that the US can have access to Chinese markets. China is willing to buy more semiconductors from the US in addition to opening up the financial services sector to foreign investment, according to the Financial Times.

The China retaliation to US tariffs should have minimal impact as only a “relatively small part of trade is being impacted and the retaliatory steps seem symbolic”. According to BBH analysts.

New York Federal Reserve Bank President William Dudley has a speech scheduled at 17:30 GMT about regulatory reform at the US Chamber of Commerce while Cleveland Federal Reserve Bank President Loretta Mester will speak about monetary policy at 20:30 GMT.

Earlier the Chicago Fed National Activity came in at 0.88 vs 0.19 expected while the Dallas Fed Manufacturing Index in March came in at 21.4 vs 33.4.

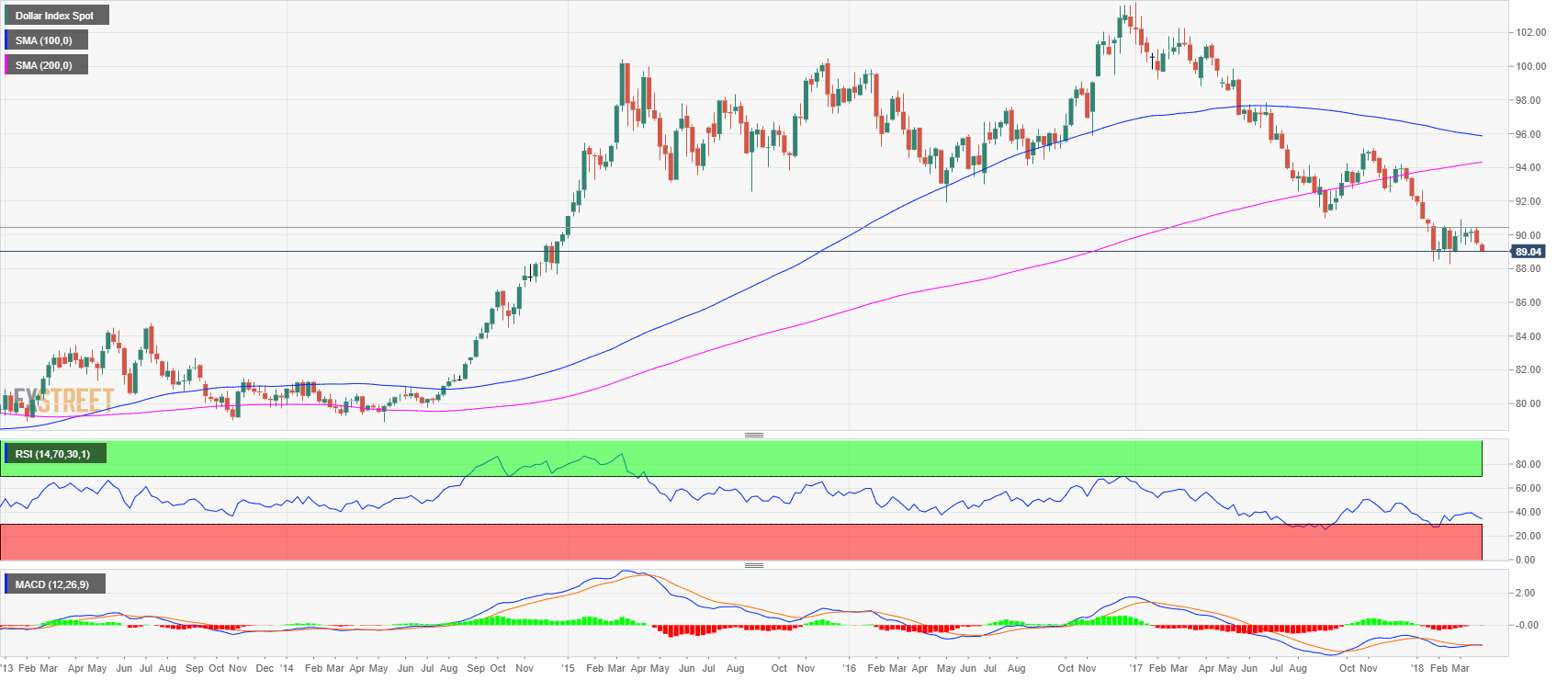

US Dollar Index weekly chart

Weekly support is seen at 89.00 supply/demand level; followed by 88.25 last cyclical low. On the other hand, weekly resistance is seen at the 90.00 psychological mark, followed by 90.96 last cyclical high.

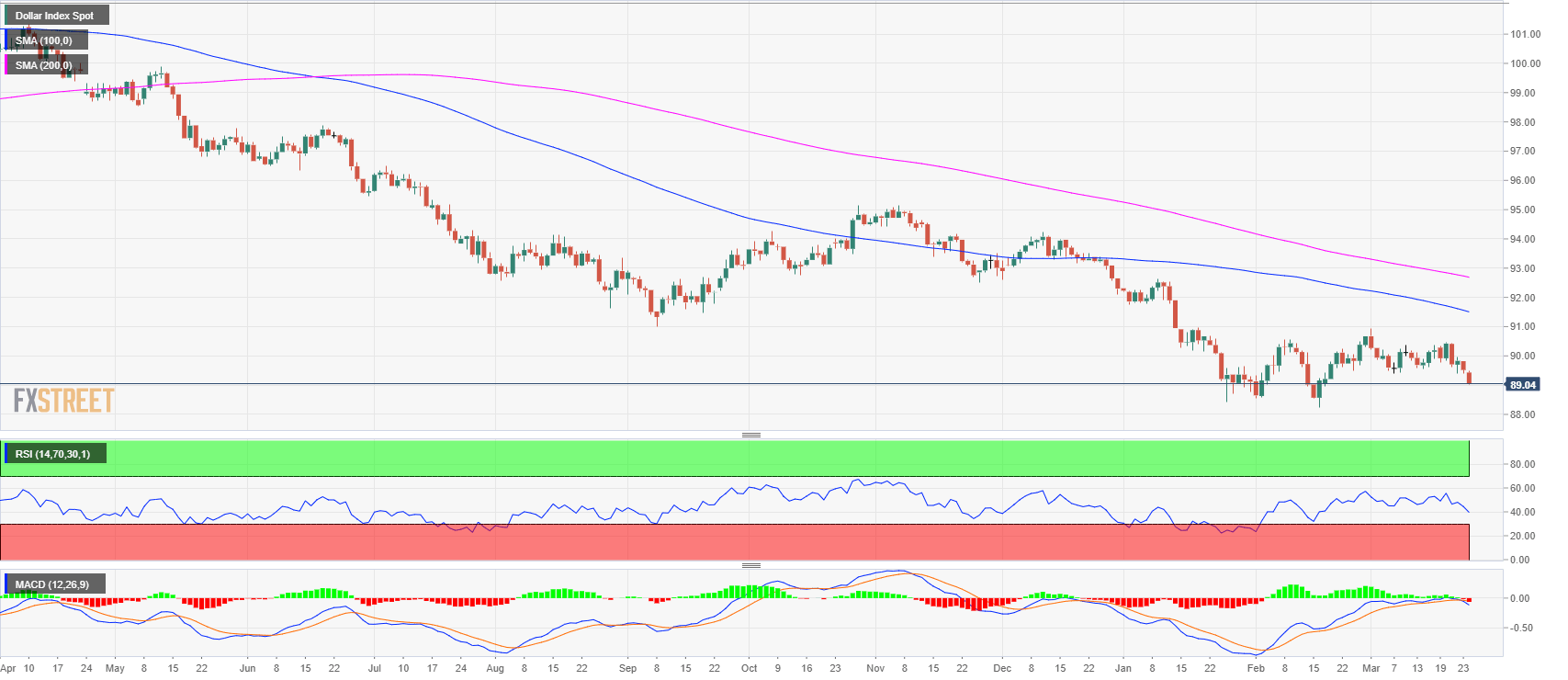

US Dollar daily chart

Support is seen at 88.50, previous demand level; followed by 88.25 cyclical low. Resistance is seen at 89.45 supply level and the 90.00 psychological mark. Both Relative Strength Index (RSI) and Movcing Average Convergence/Divergence (MACD) are bearishly configured.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD holds firm near 1.1100 ahead of US NFP, Powell

EUR/USD is holding ground near 1.1100 in the early European morning on Friday. Recession fears due to a global trade war lft Fed rate cut expectations, exacerbating the US Dollar's pain while keeping the pair afloat. Traders look to the US NFP report and Fed Chair Powell's speech for fresh directives.

GBP/USD retakes 1.3100 as US NFP data looms

GBP/USD is defending minor bids above 1.3100 in early Europe on Friday. Persistent US Dollar weakness on recession fears and dovish Fed expectations underpin the pair as traders look forward to the US payrolls data and Fed Chair Powell speech for placing fresh bets.

Gold price hovers near $3,100; bullish bias remains ahead of US NFP report

Gold price meets with a fresh supply on Friday, though the downside potential seems limited. Trump’s tariffs-inspired risk-off mood might continue to act as a tailwind for the precious metal. Fed rate cut bets weigh on the USD and should contribute to limiting losses for the XAU/USD pair.

XRP finds new lifeline as Coinbase Derivatives eyes XRP futures on April 21

Ripple price reclaims the $2.00 support level and trades at $2.06 at the time of writing on Friday in the wake of a drawdown to $1.96 during Thursday’s session. Traders continue to exercise caution after Trump’s tariffs hit 100 countries, as per a CryptoQuant report.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.