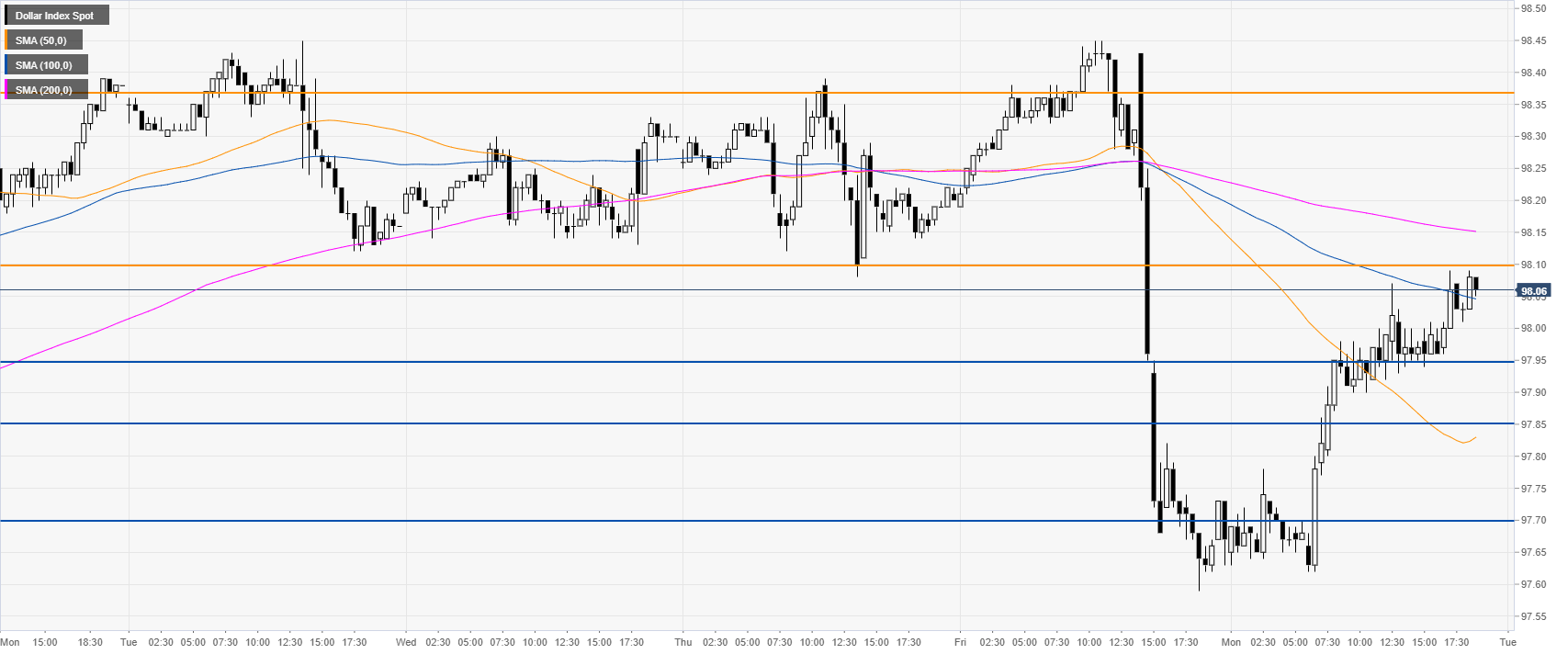

- DXY (US Dollar Index) is erasing parts of Friday’s drop.

- The market is testing an important resistance level at the 98.10 level.

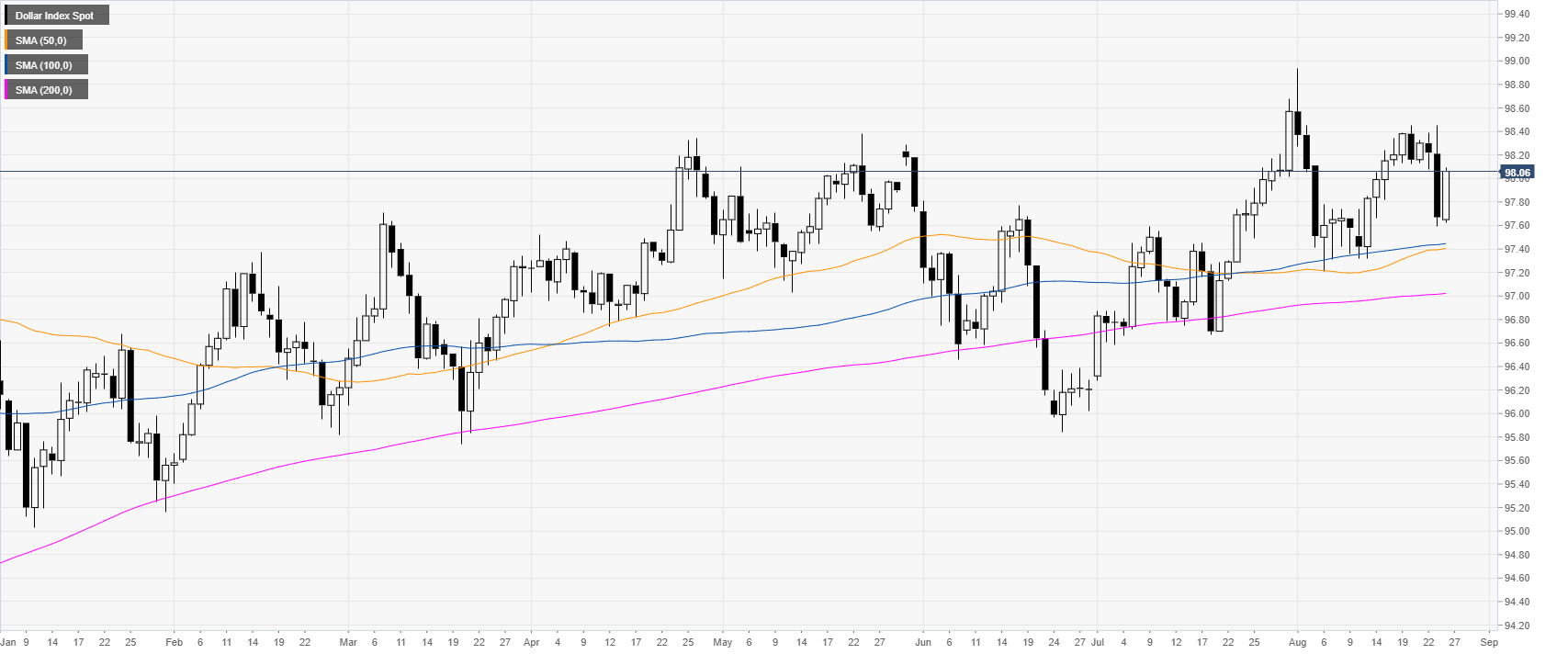

DXY daily chart

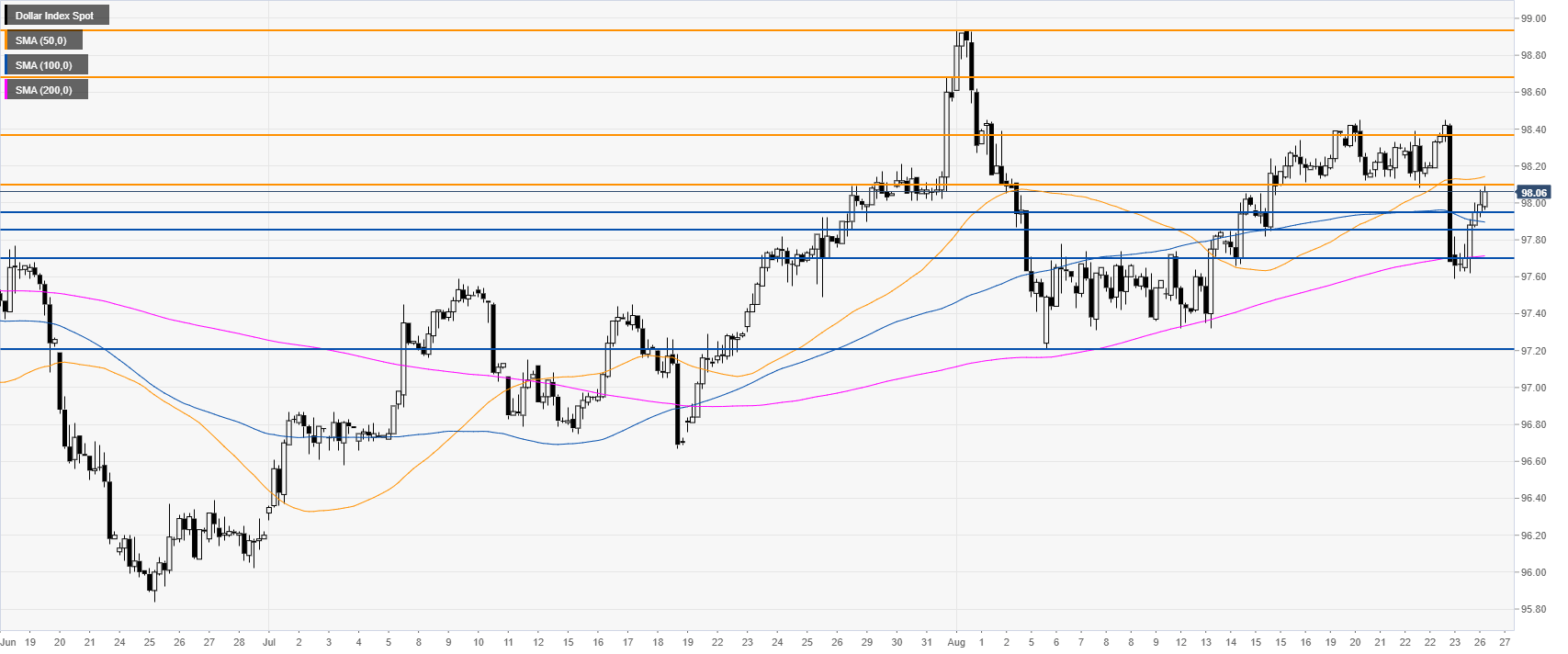

DXY 4-hour chart

DXY 30-minute chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD: Next upside target comes at 0.6550

AUD/USD managed well to shrug off the marked advance in the Greenback as well as geopolitical tensions, regaining the area above the 0.6500 hurdle ahead of preliminary PMIs in Australia.

EUR/USD: Further losses now look at 1.0450

Further strength in the US Dollar kept the price action in the risk-associated assets depressed, sending EUR/USD back to the 1.0460 region for the first time since early October 2023 prior to key releases in the real economy.

Gold faces extra upside near term

Gold extends its bullish momentum further above $2,660 on Thursday. XAU/USD rises for the fourth straight day, sponsored by geopolitical risks stemming from the worsening Russia-Ukraine war. Markets await comments from Fed policymakers.

Ethereum Price Forecast: ETH open interest surge to all-time high after recent price rally

Ethereum (ETH) is trading near $3,350, experiencing an 10% increase on Thursday. This price surge is attributed to strong bullish sentiment among derivatives traders, driving its open interest above $20 billion for the first time.

A new horizon: The economic outlook in a new leadership and policy era

The economic aftershocks of the COVID pandemic, which have dominated the economic landscape over the past few years, are steadily dissipating. These pandemic-induced economic effects are set to be largely supplanted by economic policy changes that are on the horizon in the United States.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.