US Dollar Index pushes higher and targets 91.00

- DXY keeps the daily advance well in place near 91.00.

- US yields appear side-lined around the 1.65% area.

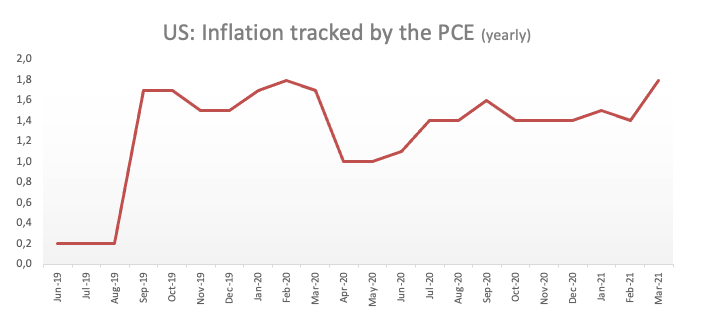

- US Core PCE rose 1.8% YoY, headline PCE up 2.3% YoY.

The greenback stays bid and flirts with the key hurdle at the 91.00 area when measured by the US Dollar Index (DXY).

US Dollar Index bid on data, month-end flows

The buying pressure remains well and sound around the dollar in the second half of the week, so far motivating the index to close the week in the positive territory for the first time after three pullbacks in a row.

Month-end flows and the offered bias in the risk complex continue to sustain the move higher in the buck, helped at the same time by the rebound in US yields.

Indeed, the recent bounce off lows in yields of the US 10-year lent support to the move higher in the dollar and put further distance from 2-month lows recorded on Thursday. Indeed, yields appreciated to the 1.70% vicinity after bottoming out around 1.53% during last week. Currently, yields remain within the consolidative theme around the 1.65% region.

In the US docket, the core PCE rose in line with forecasts 1.8% on a year to March, while headline PCE gained 2.3% from a year earlier. Further data releases saw the Personal Income expanding 21.1% MoM in March and Personal Spending gaining 4.2% on a monthly basis.

Later in the session, the Chicago PMI is due followed by the final print of the Consumer Sentiment gauged by the U-Mich index.

What to look for around USD

The April pullback in the dollar remains well and sound despite the ongoing rebound from 2-month lows in the 90.40 region. The move lower in the buck follows the broad-based retracement in US yields and the loss of enthusiasm on the US reflation/vaccine trade. Also weighing on the dollar emerges the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made), and rising optimism on a strong global economic recovery, all morphing into a solid source of support for the riskier assets and a most likely driver of probable weakness in the dollar in the next months.

Key events in the US this week: Final April Consumer Sentiment.

Eminent issues on the back boiler: Biden’s plans to support infrastructure and families worth nearly $4 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

US Dollar Index relevant levels

Now, the index is gaining 0.24% at 90.84 and a breakout of 91.42 (high Apr.21) would open the door to 91.66 (50-day SMA) and finally 91.97 (200-day SMA). On the other hand, the next support emerges at 90.42 (monthly low Apr.29) followed by 89.68 (monthly low Feb.25) and then 89.20 (2021 low Jan.6).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.