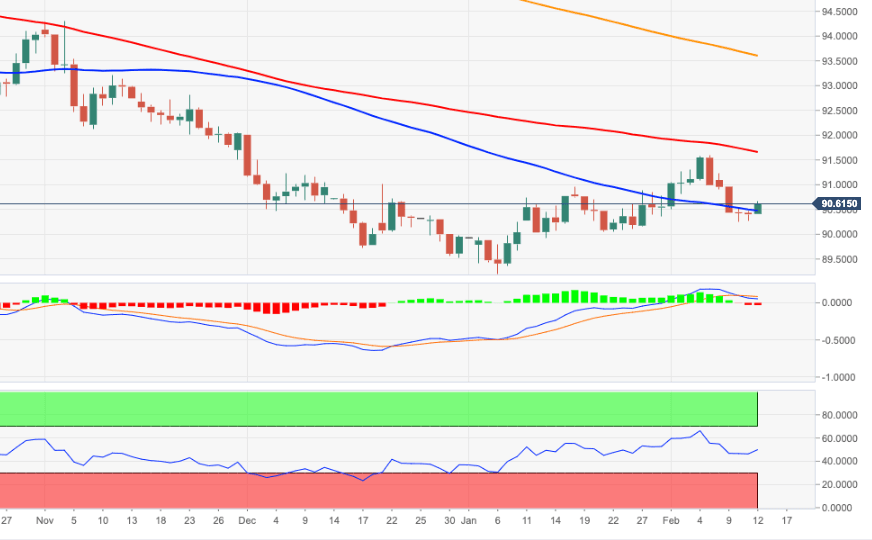

US Dollar Index Price Analysis: Solid support aligns at 90.00

- The weekly downside in DXY meets support around 90.20.

- A breach of this level should open the door to 89.20.

The weekly decline in DXY decline appears to have met quite decent contention in the low-90.00s for the time being. This zone is also reinforced by the 2020-2021 support line, currently near 90.30.

A sustainable breach of this area should open the door to a probable visit to the weekly lows around 90.00 (January 22) in the short-term. Below this psychological level is located the 2021 lows around 89.20 ahead of the March 2018 low at 88.94.

In the meantime, occasional bouts of upside pressure in the dollar are seen as corrective only and in the longer run, as long as DXY trades below the 200-day SMA (93.60), the bearish stance is expected to persist.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.