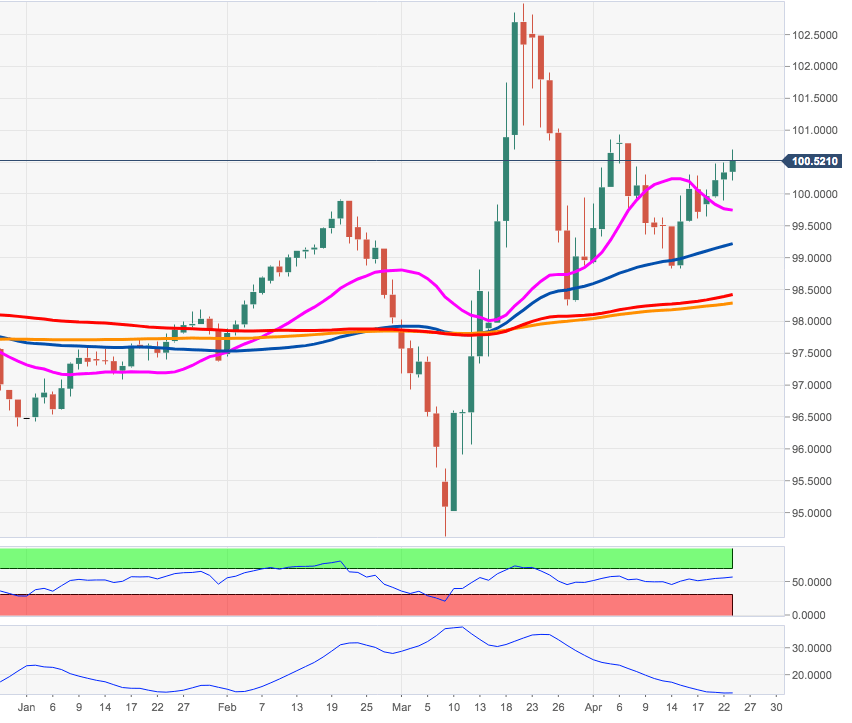

- DXY is flirting with the key barrier in the 100.50 region on Wednesday.

- Immediately to the upside emerges the April’s top near 101.00.

The upside momentum in DXY remains well and sound and is now extending the move up to the area beyond the key hurdle at 100.50.

If buyers keep pushing, then the dollar could change the monthly peaks in the 101.00 neighbourhood. From there, the only resistance of note emerges at the 2020 highs near 103.00 the figure recorded in mid-March.

Furthermore, the constructive bias is seen unchanged above the 200-day SMA, today at 98.27.

DXY daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Further gains need more conviction

AUD/USD reversed two-daily pullbacks in a row on Tuesday, staging a decent comeback from Monday’s troughs near 0.6220 to the boundaries of the 0.6300 hurdle propped up by the RBA hawkish hold and firm data from Chinese business activity.

EUR/USD consolidates as traders holder their breath ahead of tariffs

EUR/USD stuck to familiar levels on Tuesday, churning chart paper close to the 1.0800 handle as investors brace for US President Donald Trump’s long-threatened “reciprocal” tariffs package, due to be announced on Wednesday at 1900 GMT.

Gold nears $3,100 as fears receded

Gold is easing from its fresh record high near $3,150 but remains well supported above the $3,100 mark. A generalised pullback in US yields is underpinning the yellow metal, as traders stay on the sidelines awaiting clarity on upcoming US tariff announcements.

US Government to conclude BTC, ETH, XRP, SOL, and ADA reserves audit next Saturday

Bitcoin price rose 3% on Tuesday, as MicroStrategy, Metaplanet and Tether all announced fresh BTC purchase. However, BTC price is likely to remain volatile ahead of the anticipated disclosure of U.S. government crypto holdings, which could fuel speculation in the coming days.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.