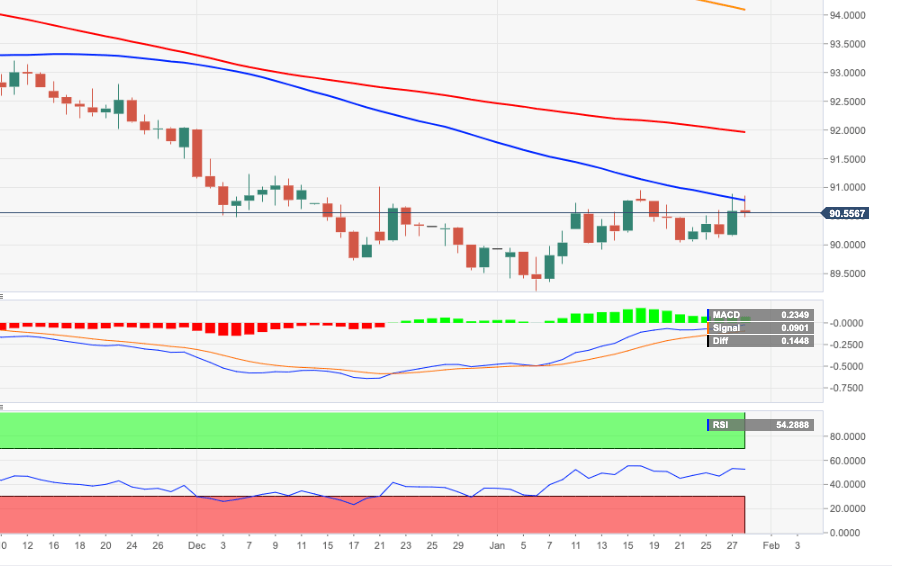

- DXY adds to the uptrend and trades closer to 91.00.

- The 2020-2021 resistance line also sits near 91.00.

DXY picks up extra pace and approaches the key hurdle in the 91.00 neighbourhood in the second half of the week.

The 91.00 area emerges as the immediate target of significance. In this area coincides weekly tops (December 21), the so far 2021 high (January 18) and the 2021 resistance line. The 55-day SMA, today ay 90.78, reinforces this resistance. Above this region, the selling pressure is forecast to mitigate somewhat.

The ongoing rebound is seen as corrective only and in the longer run, as long as DXY trades below the 200-day SMA, today at 94.08, the negative view is expected to persist.

DXY daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD hovers around 1.0530 after mixed US data

EUR/USD bounced from a fresh 2024 low at 1.0495, but gains were modest ahead of US data releases. Initial Jobless Claims beat expectations, but wholesale-level inflation was hotter than anticipated. Demand for the US Dollar prevails despite overbought conditions.

GBP/USD depressed around 1.2650 on relentless US Dollar buying

GBP/USD is holding losses while flirting with multi-month lows near 1.2650 in the early American session. The pair remains vulnerable amid a broadly firmer US Dollar and softer risk tone even as BoE policymakers stick to a cautious stance on policy. Speeches from Powell and Bailey are eyed.

Gold depressed around $2,550 and at risk of falling further

Gold consolidates at two-month lows as the prevalent demand for the US dollar overshadows that for the safe-haven metal in a risk-averse environment. Central bank leaders' speeches stand out in the American session.

XRP struggles near $0.7440, could still sustain rally after Robinhood listing

Ripple's XRP is trading near $0.6900, down nearly 3% on Wednesday, as declining open interest could extend its price correction. However, other on-chain metrics point to a long-term bullish setup.

Trump vs CPI

US CPI for October was exactly in line with expectations. The headline rate of CPI rose to 2.6% YoY from 2.4% YoY in September. The core rate remained steady at 3.3%. The detail of the report shows that the shelter index rose by 0.4% on the month, which accounted for 50% of the increase in all items on a monthly basis.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.