US Dollar Index Price Analysis: Next on the upside comes 107.30

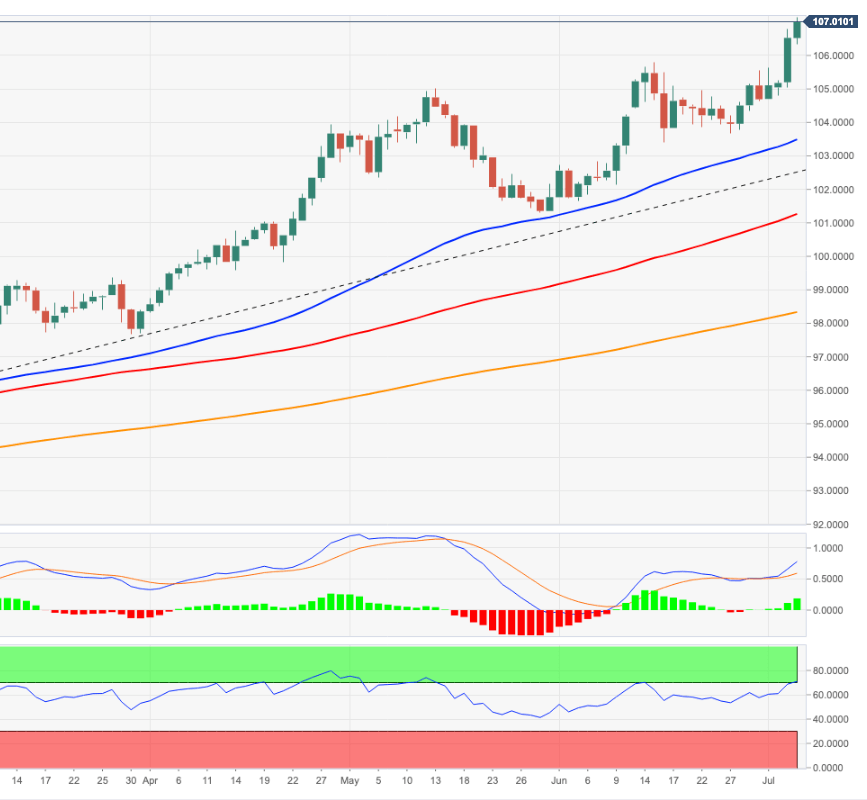

- DXY trades in cycle peaks north of the 107.00 mark.

- Extra gains look likely and target the 107.30 region.

DXY adds to the ongoing sharp uptick and leaves behind the 107.00 yardstick on Wednesday, or new YTD highs.

Further upside in the dollar remains in store in the short-term horizon. Against that, the index could now look to revisit the December 2002 top at 107.31 ahead of the October 2002 high at 108.74.

As long as the 4-month line near 102.60 holds the downside, the near-term outlook for the index should remain constructive.

The broader bullish view remains in place while above the 200-day SMA at 32.

Of note, however, is that the index trades in the overbought territory and thus could attempt a technical correction in the not-so-distant future.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.