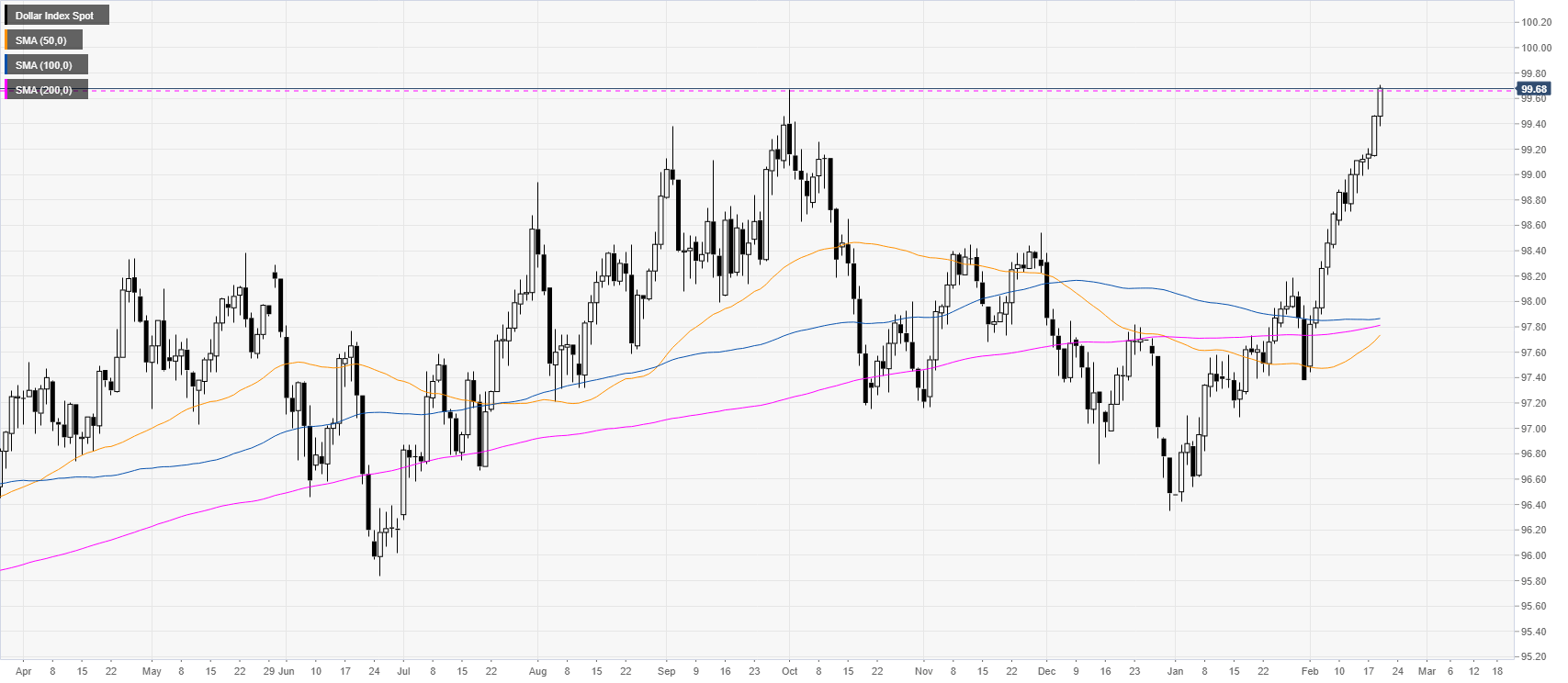

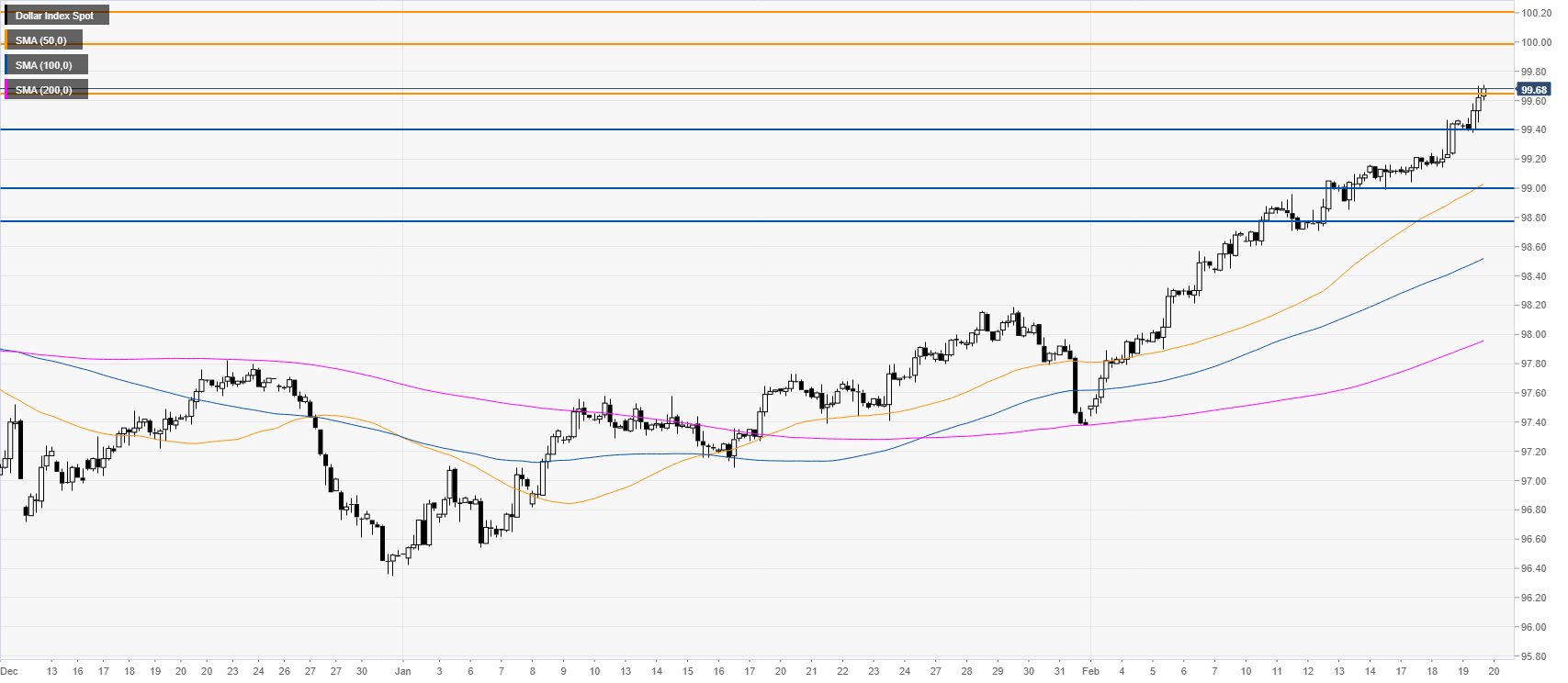

- DXY is trading at levels not seen since May 2017.

- The level to beat for buyers is the 99.20 resistance.

- The FOMC Minutes will be released at 19.00 GMT.

DXY daily chart

DXY four-hour chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD eases below 1.0900 amid cautious mood

EUR/USD has erased gains to trade on the back foot below 1.0900 early Tuesday. The pair treads water amid a cautious market mood, as traders weigh the US political updates and China slowdown worries. The US Dollar remains subdued, in the absence of top-tier economic data.

GBP/USD drops toward 1.2900 as US Dollar looks to stabilize

GBP/USD is dropping toward 1.2900, lacking firm direction in European trading on Tuesday. The US Dollar looks to stabilize after the early decline, weighing on the pair. Traders await mid-tier US housing data for fresh trading impetus.

Gold's struggle with $2,400 extends amid market caution

Gold price is making another attempt to reclaim $2,400 on a sustained basis, replicating the moves seen during Monday’s Asian trading. Gold price appears to be benefiting from a typical market caution and renewed China’s economic worries and ahead of key US earnings reports.

Bitcoin finds support around the $67,000 level

Bitcoin and Ripple prices are holding steady around their respective weekly and daily support levels, hinting at an imminent rally. Meanwhile, Ethereum is encountering resistance at the $3,530 mark; a decisive close above this level would signal a bullish breakthrough.

Earnings review

While Nvidia’s results are still extremely important for overall sentiment, there is a hope that sales growth and revenues can pick up across a broad range of global markets and sectors.