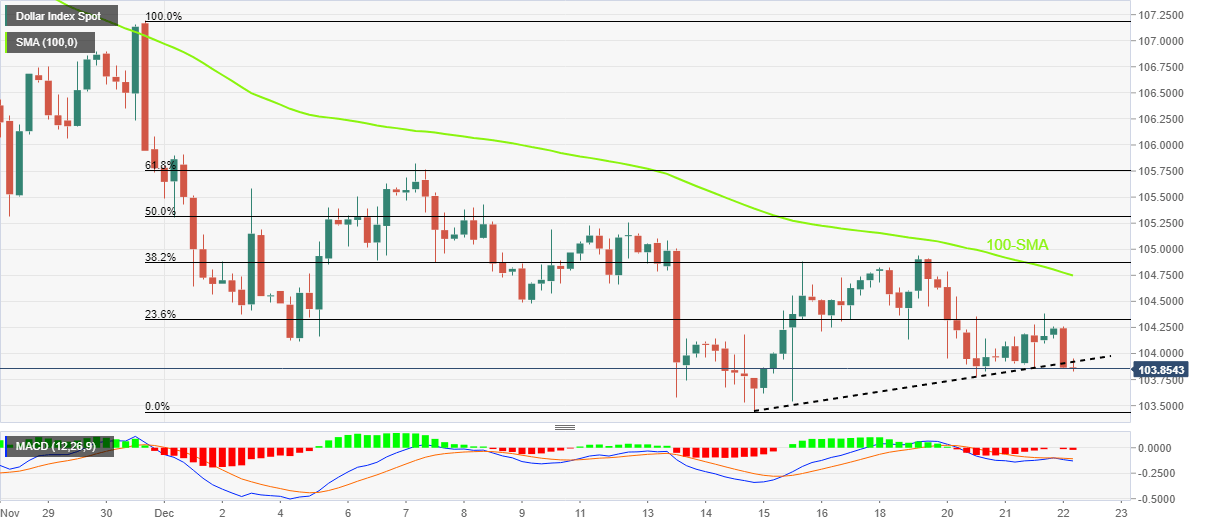

US Dollar Index Price Analysis: DXY breaks weekly support with eyes on 103.40

- US Dollar Index takes offers to refresh intraday low, breaks one-week-old ascending trend line.

- Bearish MACD signals allow sellers to aim for the previous weekly low, also the lowest level in six months.

- 100-SMA, weekly top add to the upside filters even if buyers manage to cross support-turned-resistance line.

US Dollar Index (DXY) retreats towards the weekly low, marked the previous day, taking offers to refresh the intraday low near 103.83 during early Thursday in Europe.

In doing so, the greenback’s gauge versus the six major currencies breaks a one-week-old ascending support line, now resistance near 103.92, while approaching the six-month low marked in the last week.

It’s worth noting that the bearish MACD signals and a U-turn from 104.93 during early weekdays also favor the DXY sellers to approach the multi-day low surrounding 103.40.

During the fall, the weekly bottom near 103.80 and horizontal support around 103.60 could test the US Dollar Index bears.

Additionally, the DXY’s sustained weakness past 103.40 will highlight the 103.00 round figure ahead of directing bears toward the May 2022 low near 101.30.

On the contrary, the previous support line around 103.92 precedes the 104.00 round figure to restrict short-term US Dollar Index rebound.

Following that, the 100-SMA and the weekly top could challenge the DXY bulls around 104.75 and 104.95 in that order.

Also acting as an upside filter is the 105.00 round figure, a break of which could welcome DXY bulls targeting the monthly high of 105.82.

US Dollar Index: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.