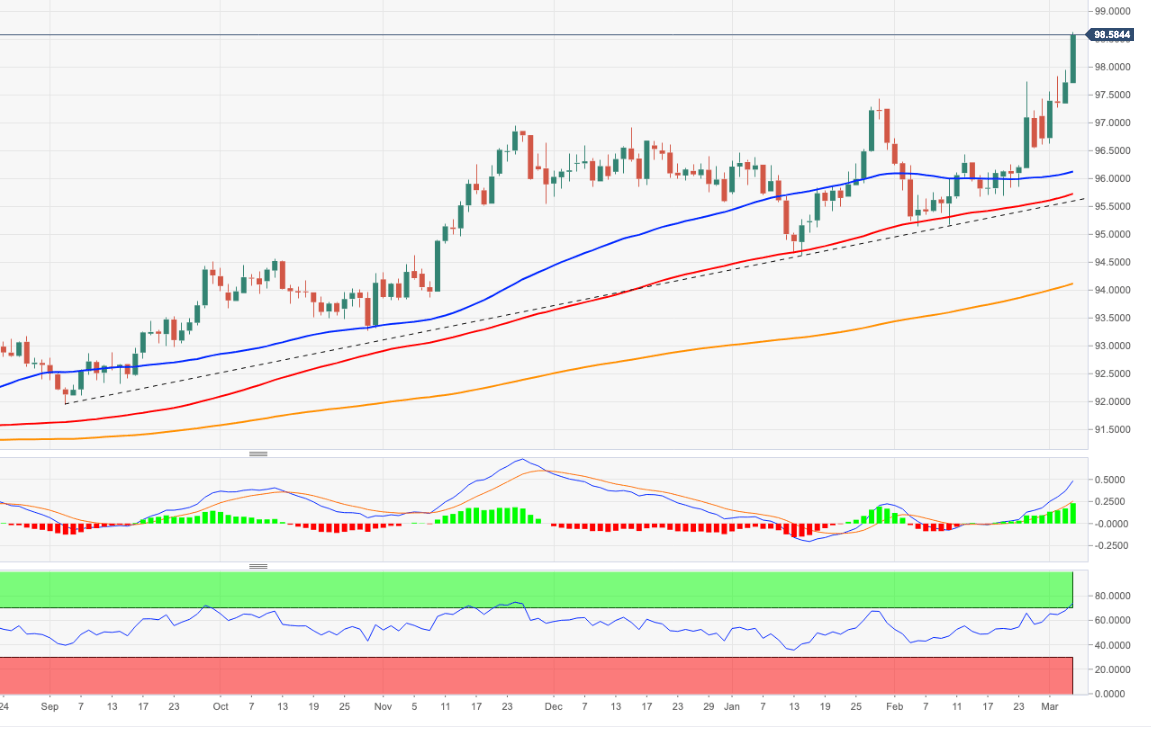

US Dollar Index Price Analysis: Door open to… 100.00?

- DXY quickly surpasses the 98.00 mark on Friday.

- Next on the upside comes the triple-digit barrier.

DXY clinches fresh cycle tops well north of the 98.00 mark at the end of the week.

There is scope for the continuation of the uptrend in the very near term. Against that, there are no hurdles of relevance until the the 99.97 level (May 25 2020 high), which precedes the psychological 100.00 mark.

The short-term bullish stance remains supported by the 5-month line, today near 95.60, while the longer-term outlook for the dollar is seen as constructive above the 200-day SMA at 94.08.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.