US Dollar Index (DXY) extends its gains for five weeks, eyeing the 100 mark

- The DXY gains 0.59% in the day, as USD bulls eye the 100 as the New York session winds down.

- The US imposes a new tranche of sanctions on Russia.

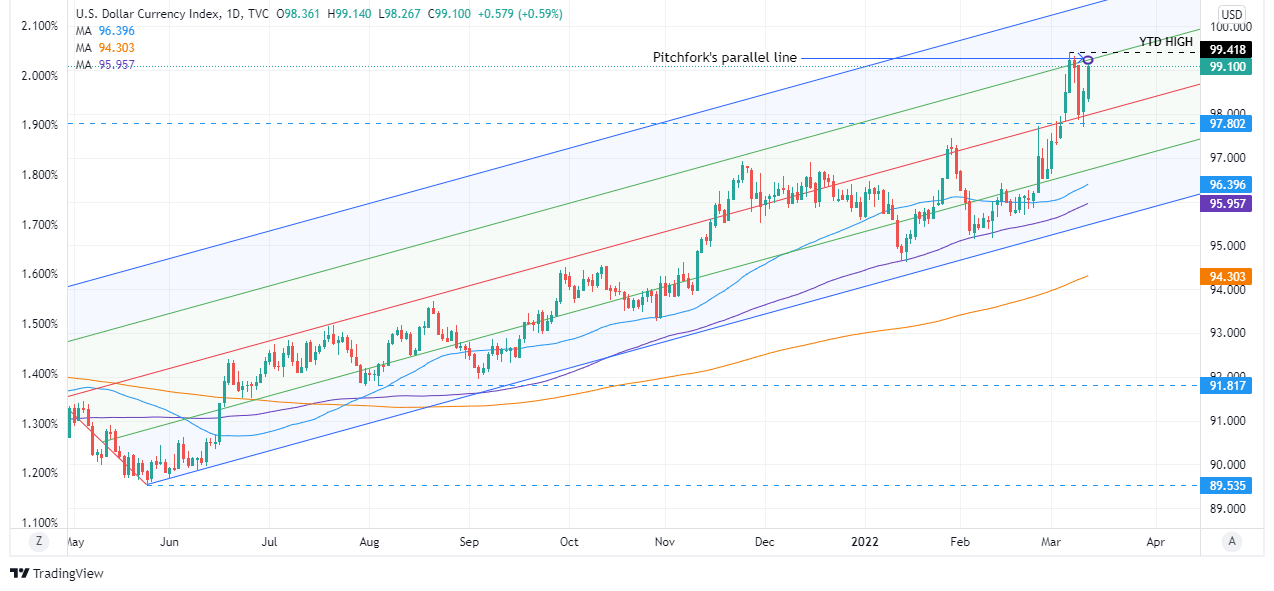

- US Dollar Index (DXY) Technical Outlook: Upward biased, though testing Pitchfork’s parallel line just above the 99.00 mark.

The US Dollar Index (DXY), a gauge of the greenback’s value against a basket of six rival currencies, advances 0.60% during the North American session, reflecting a risk-off market mood, as investors sought out to safe-haven peers, being the US dollar the safest. At the time of writing, the DXY is at 99.119.

The market sentiment fluctuated throughout the day. In the mid-European session, news that Russia-Ukraine talks according to Russia’s President Vladimir Puttin saying that there had been “certain positive shifts” in negotiations with Ukraine. However, late in the day, Ukraine Foreign Minister Dmytro Kubela said on Friday that “there had been zero progress in talks with Russia on Thursday,” as reported by BBG.

Meanwhile, sanctions on Russia keep escalating. US President Joe Biden on Friday said that the United States will revoke Russia’s “permanent normal trade relations” status to punish Moscow over its invasion of Ukraine. At the same time, the US will ban imports from Russia, which could disrupt more than $1 billion in export revenues for Russia, according to the White House.

In the meantime, US Treasury yields are mixed, led by the short-term of the yield curve, with 2s, and 5s, rising two-and-half, and one-and-half basis points, respectively up at 1.746% and 1.956%. The 10-year T-note rises one-basis point sits at 2%.

US Dollar Index (DXY) Price Forecast: Technical outlook

The DXY is upward biased, advancing steadily within Pitchfork’s ascending channel. In fact, at press time, is pressing the mid-line between the top and central parallel lines, once broken, would expose the YTD high at 99.418, followed by the 100 mark and then the top-trendline of Pitchfork’s channel around the 100.500 area.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.