US Dollar Index: Could a double bottom at the weekly chart drive the DXY to 111.000?

- The US Dollar Index found bids at around the YTD lows at 100.788.

- USD bulls must retake 104.000 to challenge YTD high at 105.883 and maintain a double-bottom approach.

- Contrarily, USD bears must reclaim 100.788 to test the 200-week EMA at around 99.117.

The US Dollar Index (DXY), a basket of six currencies against a basket of peers, snaps three days of straight losses and climbs 0.56% as the New York session ends. At the time of writing, the DXY exchanges hand at 101.570 as a bullish engulfing candle pattern emerges in the daily chart.

US Dollar Index Price Action

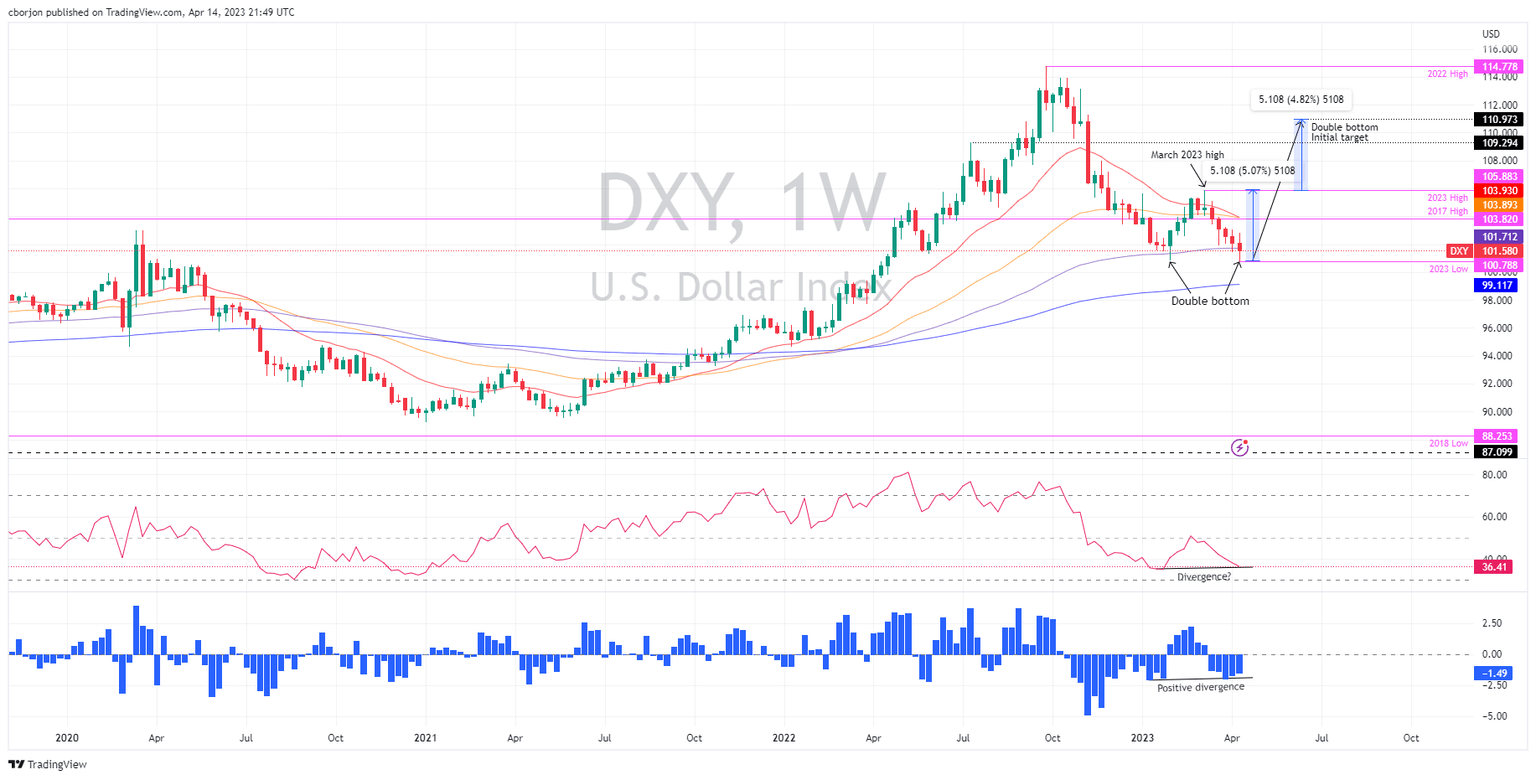

From a weekly chart perspective, the US Dollar Index remains upward biased. The DXY’s fall from around September 2022 highs at 114.728 towards 2023 lows of 100.788 bottomed around the latter, depicting a double bottom formation. Furthermore, the 200-week Exponential Moving Average (EMA) sits comfortably at around 99.117. The Relative Strength Index (RSI) is in bearish territory, but in the recent dip, the RSI is bottoming higher than the prior’s through. The Rate of Change (RoC) also displays that selling pressure is waning, which could pave the way for further upside.

Upside risks in the DXY lie at the confluence of the 50 and 20-week EMAs, around 103.893-103.930. The break above will expose the 2023 high at 105.883, the last peak, before clearing the way toward 111.000, the double-bottom initial target.

Conversely, the US Dollar Index’s first support would be 100.788. A dip below, and nothing would be in the way toward the 200-week EMA at 99.117.

US Dollar Index Weekly Chart

USD Dollar Index Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.