US Dollar Index comes under pressure below 93.00

- DXY debilitates further and breaks below the 93.00 mark.

- Gains in the dollar remains capped by the 93.60/70 band.

- US Consumer Sentiment gauge next of relevance in the calendar.

The greenback, in term of the US Dollar Index (DXY), is adding to Monday’s losses and returns to the sub-93.00 area at the end of the week.

US Dollar Index offered post-FOMC, looks to data

The index is now losing ground for the second consecutive session as market participants seem to have already digested the latest FOMC event and the somewhat less-dovish-than-expected message from the Fed.

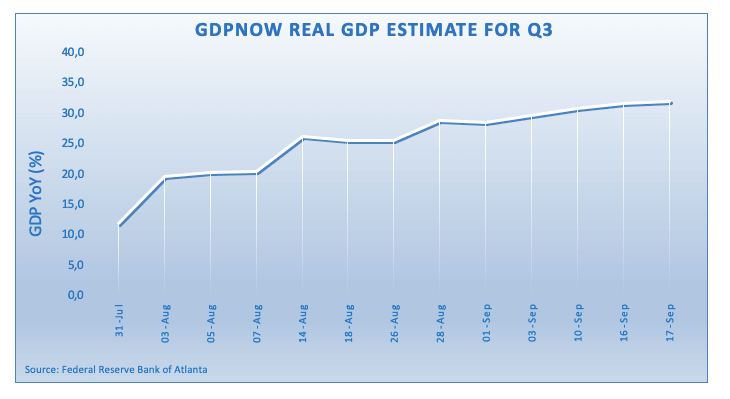

Recent mixed data releases in the US docket appears to have encouraged investors to cash out part of the recent gains in the dollar amidst renewed concerns that the economic recovery could be losing some steam.

Later in the US docket, the only release of note will be the preliminary gauge of the Consumer Sentiment for the current month tracked by the U-Mich index. Closing the week, driller Baker Hughes will publish its weekly oil-rig count.

What to look for around USD

The dollar regained the smile following the FOMC event on Wednesday and reached the 93.60 level earlier on Thursday. The move, however, was short-lived and encouraged sellers to return to the markets and forced the index to close the session in the negative territory. In the meantime, any bullish attempt in DXY is still considered as corrective only amidst the broad bearish stance surrounding the dollar, the “lower for longer” stance from the Federal Reserve, the unremitting advance of the coronavirus pandemic, the negative position in the speculative community and political uncertainty ahead of the November elections.

US Dollar Index relevant levels

At the moment, the index is losing 0.05% at 92.86 and faces the next support at 92.70 (weekly low Sep.10) seconded by 91.92 (23.6% Fibo of the 2017-2018 drop) and then 91.75 (2020 low Sep.1). On the other hand, a break above 93.66 (monthly high Sep.9) would open the door to 93.99 (monthly high Aug.3) and finally 94.20 (38.2% Fibo of the 2017-2018 drop).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.