US Dollar Index Asia Price Forecast: Greenback regains the 100.00 mark, bullish

- US Dollar Index (DXY) is nearing the May highs.

- The level to beat for bulls is the 110.40 resistance.

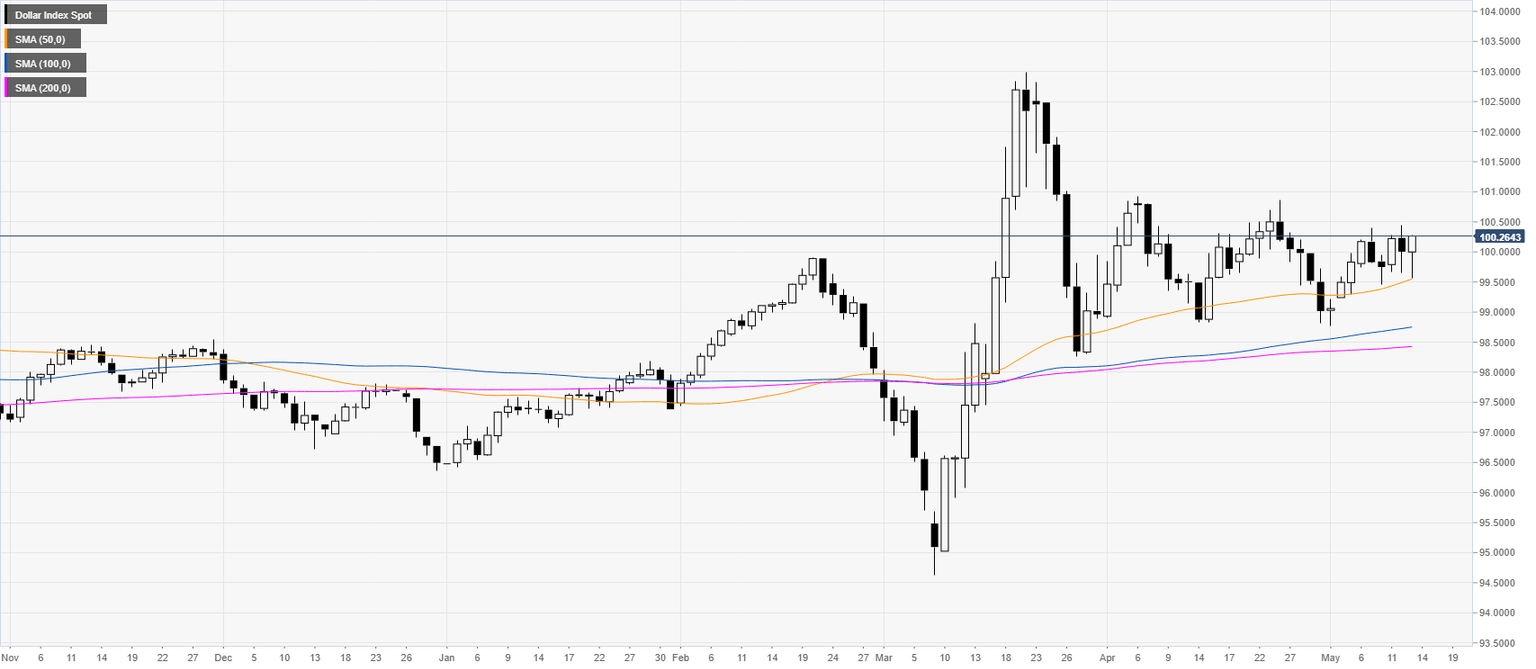

DXY daily chart

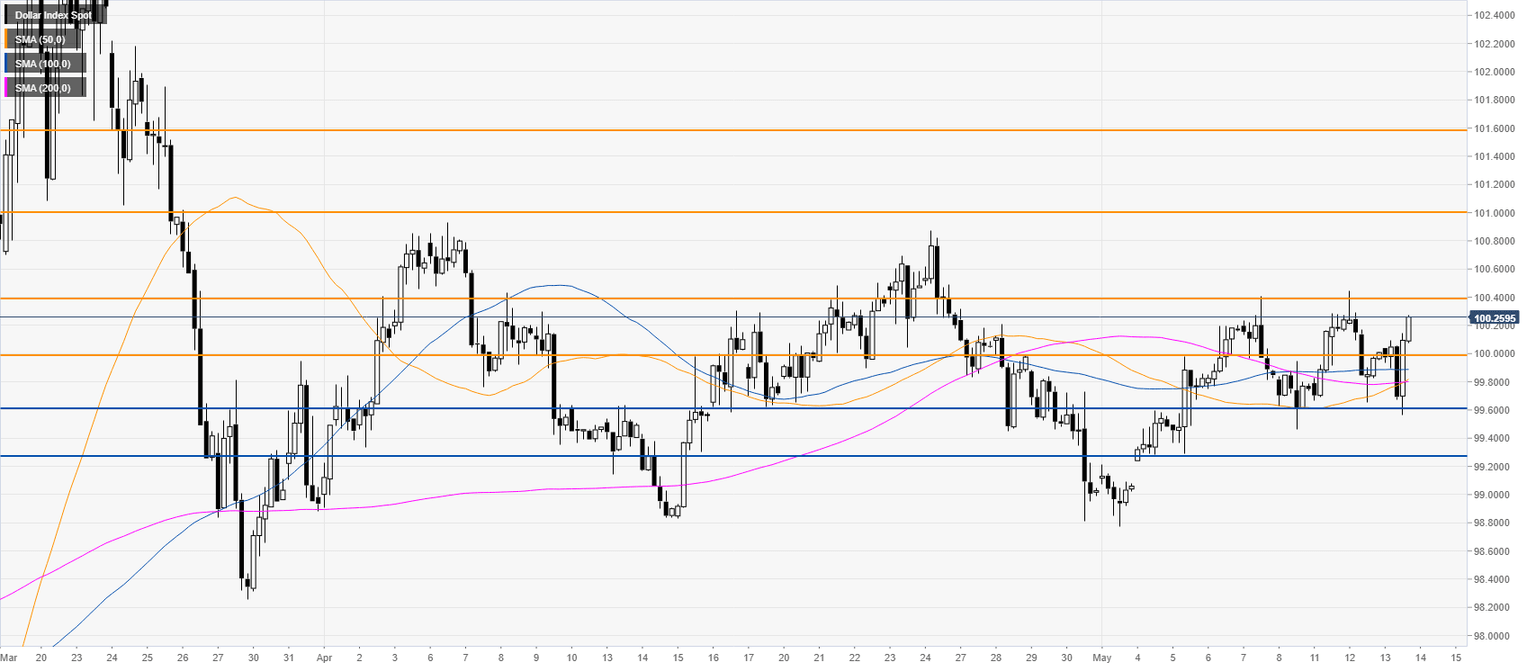

DXY four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst