US Dollar eases after NY Manufacturing data contracts against all odds

- The US Dollar rally hits a curb and has difficulties passing through several important levels against most major G10 currencies.

- Markets are gearing of for Fed speakers to convince markets on the Fed's approach going forward.

- The US Dollar Index hovers above 103.00, but struggles to move higher.

The US Dollar (USD) trades a touch softer on Tuesday after reaching a 10-week high on Monday, fueled by investors’ views that the Federal Reserve won’t cut interest rates as quickly and aggressively as previously expected. Moreover, markets seem to be betting on a possible win for former President Donald Trump in the November 5 presidential election after several betting websites and polls showed the Republican nominee starting to lead.

The US economic calendar is again rather light on Tuesday. The NY Empire State Manufacturing Index for October came in softer, even into contraction, which was against the expectations. Later this Tuesday, three Fed officials that are scheduled to speak.

Daily digest market movers: NY Manufacturing hits Greenback

- At 12:30 GMT, the NY Empire State Manufacturing Index for October was released. The October number fell into contraction by 11.9 against the previous increase of 11.5, while a positive 2.3 was expected.

- At 15:30 GMT, Federal Reserve Bank of San Francisco President Mary Daly delivers keynote remarks and participates in a moderated conversation and an audience Q&A in an event hosted by NYU Stern School of Business.

- Around 17:00 GMT, Federal Reserve Governor Adriana Kugler participates in a webcast about career opportunities and diversity in Economics.

- Federal Reserve Bank of Atlanta President Raphael Bostic will close off this trading day with comments while participating in a moderated conversation at the Gathering Spot on how the economy affects small businesses near 23:00 GMT.

- Equities are all over the place, with Chinese stocks having closed substantially lower, while Japan was up on the day. European equities are set to close in the red while US equities are looking for direction after the US opening bell.

- The CME Fed rate expectation for the meeting on November 7 shows an 86.8% probability of a 25 basis point rate cut, while the remaining 13.2% is pricing in no rate cut. Chances for a 50 bps rate cut have been fully priced out.

- The US 10-year benchmark rate is trading at 4.07%, a touch softer than the high from last week at 4.11% on Thursday.

US Dollar Index Technical Analysis: The daily close might say more downside

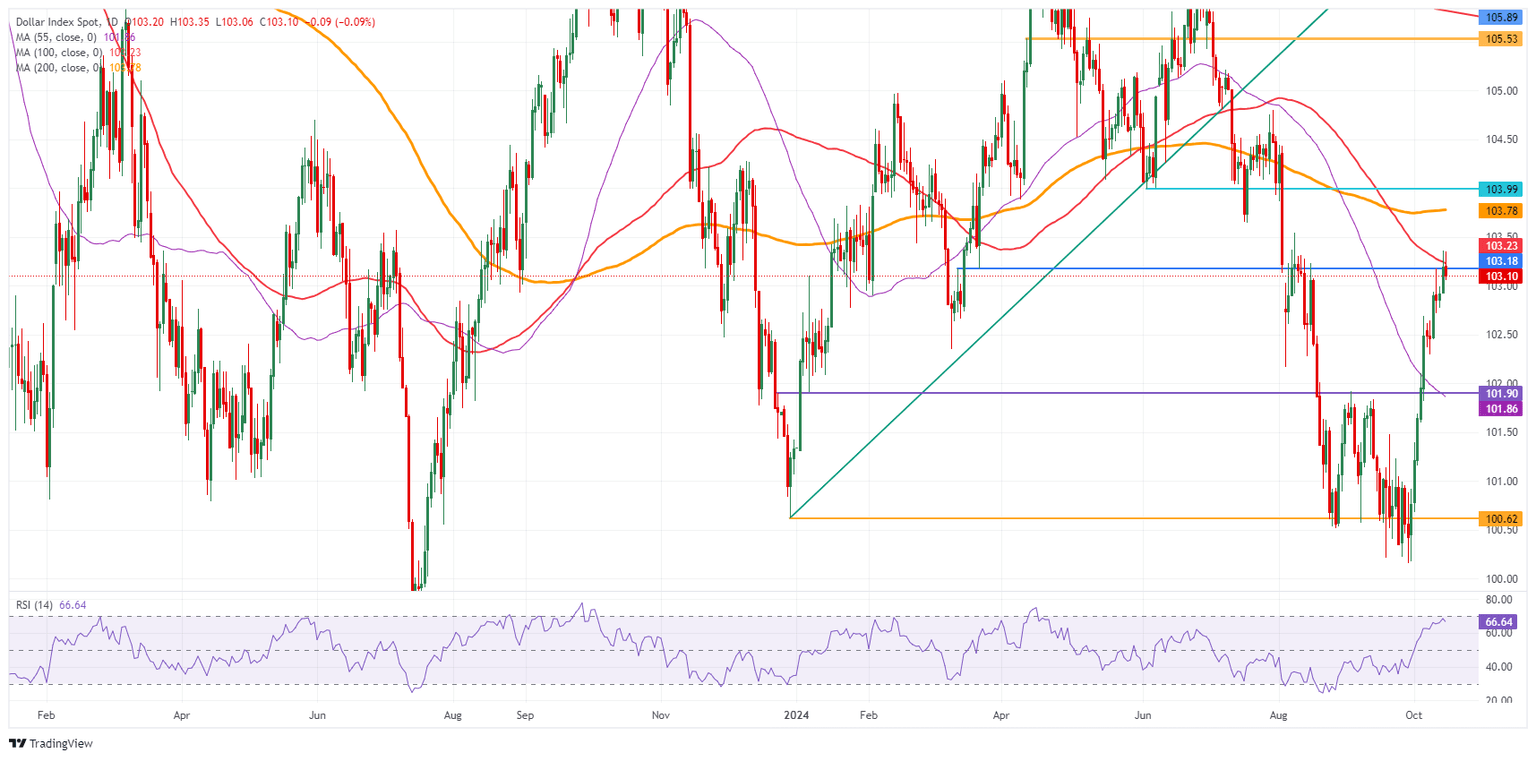

The US Dollar Index (DXY) is facing some resistance with a second false break and rejection at the 100-day Simple Moving Average (SMA) at 103.23. The risk is that, with the second rejection, the DXY sees sellers coming in and defend that 100-day SMA. A broad fade in search of support could play out with a return to 101.90 as first pivotal support level.

The first resistance level at 103.18 is under pressure, with the DXY trading around it for a second day in a row. Once above there, a very choppy area emerges, with the mentioned 100-day Simple Moving Average (SMA) at 103.23, the 200-day SMA at 103.78, and the pivotal 103.99-104.00 levels.

On the downside, the 55-day SMA at 101.90 is the first line of defence, backed by the 102.00 round level to catch any bearish pressure and trigger a bounce. If that level does not work out, 100.62 also acts as support, which was the low of December 28th 2023. Further down, a test of the year-to-date low of 100.16 should take place before more downside. Finally, and that means giving up the big 100.00 level, the July 14, 2023, low at 99.58 comes into play.

US Dollar Index: Daily Chart

Employment FAQs

Labor market conditions are a key element in assessing the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels because low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given their significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.