US Dollar turns positive after wild ride with China markets reopening after one-week holiday

- The US Dollar turns around intraday loss into a profit after the start of the US trading session on Tuesday.

- China markets are back online after the Golden Week closure, sparking a surge in volatility.

- The US Dollar Index trades above 102.00, and is looking for direction with a small fade still at hand.

The US Dollar (USD) is trying to brush off the small fade that tried to put pressure on the Greenback for a second day in a row after investors welcoming China back to the markets. It is not a warm welcome, with the Chinese Hang Seng 300 Index down over 9% at its closing bell. A surge in risk-off is taking place, with European stocks on the backfoot as well.

The economic calendar is light and should not create big waves on Tuesday, with the Goods Trade Balance and the Economic Optimism Index not expected to be market movers. Comments from Federal Reserve Bank of Atlanta President Raphael Bostic and Federal Reserve Vice Chair Phillip Jefferson, however, could be.

Daily digest market movers: US markets power through

- China has reopened again after a week of festivities for the Golden Week. The festive mode has rather quickly dampened, with the Hang Seng Index correcting near 10% at its closing bell. The negative reaction spilled over into European markets and some risk-off across the board.

- At 10:00 GMT, the National Federation of Independent Business (NFIB) released its Business Optimism Index for September, which raised to 91.5 from 91.2 in August, falling short of economist expectations of 91.7.

- The Goods and Services Trade Balance data from August revealed a larger than expected recovery in the deficit. The Actual number came in at $-70.4 billion against the previous deficit of $-78.8 billion and better than the expected $-70.6 billion estimate.

- The TechnoMetrica Institute of Policy and Politics has released the Economic Optimism Index for October. The actual number came in at 46.9, just shy of the 47.2 estimate, and better than the 46.1 from September.

- At 16:45 GMT, Federal Reserve Bank of Atlanta President Raphael Bostic (2024 FOMC voting member) speaks about the US economic outlook at the Atlanta Consular Corps luncheon. At 22:30 GMT, Federal Reserve Vice Chair Phillip Jefferson (2024 FOMC voting member) delivers a speech at an event organized by the Davidson College in Davidson, North Carolina.

- European equities are off their lows, though still trading in red, while US equities are gearing up to start the US trading session in green.

- The CME Fedwatch Tool shows an 88.7% chance of a 25 basis point (bps) interest rate cut at the next Fed meeting on November 7, while 11.3% is pricing in no rate cut. Chances for a 50 bps rate cut have been fully priced out now.

- The US 10-year benchmark rate trades at 4.04%, the highest level since mid-August.

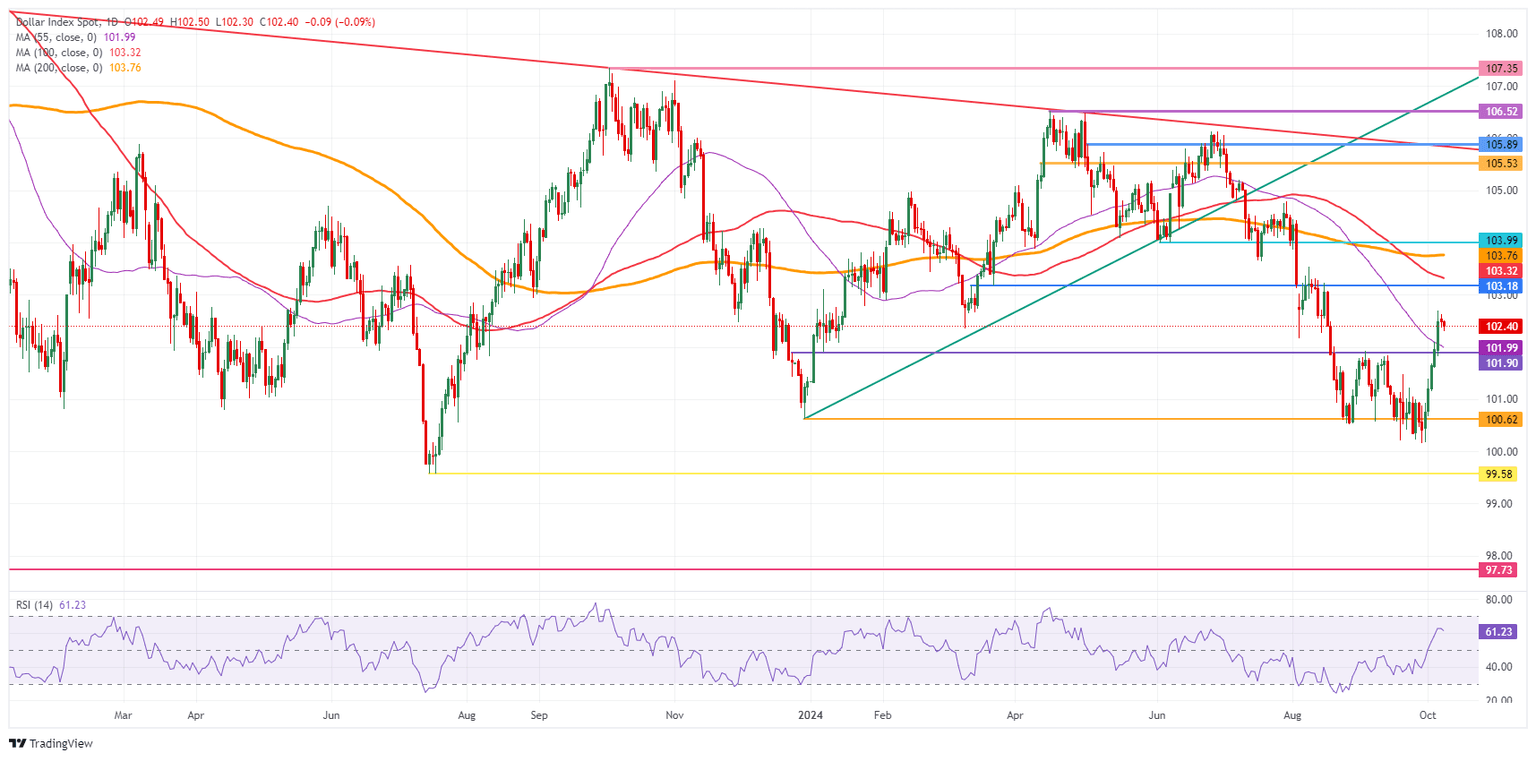

US Dollar Index Technical Analysis: Window of opportunity

The US Dollar Index (DXY) is easing a touch for the second day in a row. The sharp rally from last week is seeing some profit-taking for the second day in a row. The fact that the US Dollar can not gain further even with the risk-off tone from Asia could mean that a short squeeze has been completed and might see a slow grind lower from here.

The psychological 103.00 is the first level to tackle on the upside. Further up, the chart identifies 103.18 as the very final level for this week. Once above there, a very choppy area emerges, with the 100-day Simple Moving Average (SMA) at 103.32, the 200-day SMA at 103.76, and the pivotal 103.99-104.00 levels in play.

On the downside, the 55-day SMA at 101.99 is the first line of defence, backed by the 102.00 round level and the pivotal 101.90 as support to catch any bearish pressure and trigger a bounce. If that level does not work out, 100.62 also acts as support. Further down, a test of the year-to-date low of 100.16 should take place before more downside. Finally, and that means giving up the big 100.00 level, the July 14, 2023, low at 99.58 comes into play.

US Dollar Index: Daily Chart

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.