US dollar bears denied a free lunch post NFP fall-out, US yields surge

- US dollar making advances through daily trendline resistance.

- US yields making good and steady headway on a daily basis.

- Central banks are the driving forces as Delta variant concerns board members.

It would appear that the US central bank is not the only pessimist in town when it comes to tapering their covid induced quantitative easing programmes.

On Tuesday, the US dollar is higher and has broken a critical level of resistance owing to the fact that the Federal Reserve, while less hawkish, will be probably joined by its peers on an even keel.

The dollar rose on both Monday and Tuesday. As measured against the DXY, the greenback is 0.37% on the day into the closing bell on Wall Street.

The DXY has broken a series of days of lower lows and rallied from near a one-month low as rising US Treasury yields prompted investors to scale back on dollar shorts into the next European Central Bank meeting this week.

Investors were probably taking a leaf out of the Reserve Bank of Australia overnight that portray a dovish sentiment among the members of the board.

The RBA left rates steady and commenced tapering but pushed back the next review. The concerns over the lockdowns sank the Aussie which in turn has left a cautious tone over risk sentiment, supporting the greenback.

The dollar also benefited from rising US Treasury yields with the US government selling new debt this week, including $58 billion in three-year notes, $38 billion in 10-year notes and $24 billion in 30-year bonds.

US 10-year yields which were around 1.299% before Friday's data release, stand now at 1.371%, up 2.37% and from a low of 1.338%.

All eyes on ECB, how hawkish can you go?

EUR/USD: ''The first P in PEPP stands for Pandemic, not Permanent''

Meanwhile, the ECB is seen debating a cut in stimulus at its meeting on Thursday.

Without anything in the way of a public pushback from the doves at the ECB, the centrist French central bank chief Francois Villeroy de Galhau had argued for such a move to be included on the agenda this week.

“The first P in PEPP stands for pandemic, not permanent, and for a good reason,”

Bundesbank President Jens Weidmann said last week.

However, while there has not been much in the way of dovish bout since from opposing members of the board to comments made by hawkish officials of late, the Delta variant remains the caveat.

The Governing Council will try to keep any tapering speculation at bay so the euro could give up some of the hawkish expectations price din should the ECB still come with a very cautious stance.

This might also be reflected in broadly unchanged inflation forecasts for 2022 and 2023.

Implied volatility in the options market is not pricing in anything much higher than normal around the meeting. The break-even on a straddle (which is a bet on higher volatility) on Thursday is currently 27 pips.

Meanwhile, analysts are expecting purchases under the ECB's Pandemic Emergency Purchase Programme (PEPP) to drop possibly as low as 60 billion euros a month from the current 80 billion, which would be considered a de-facto taper.

However, the euro might not find long-lasting support on that, for the front end is what is more crucial in terms of tapering.

Meanwhile, the caveat for the greenback's ability to sustain a bid depends on the US president's ability to convince the nation to go out and get vaccinated.

The president will address the nation this Thursday with a plan to curb the current spike.

More on this here: US Coronavirus Delta spike: The caveat to US dollar strength and the Fed's max employment goal

DXY & 10-y Yield technical analysis

Meanwhile, the US dollar is enjoying a positive correction at the start of this week and has moved back into positive territory, despite the risks pertaining to Delta.

The price has broken into critical resistance and has even priced the dynamic trendline resistance.

Should the price break higher, closing beyond a 61.8% Fibonacci on a daily closing basis, then the bulls will be well and truly in the driver's seat.

US 10-year on track for higher highs

Meanwhile, as for US yields, the following prior analysis is making good ground in up to date price action:

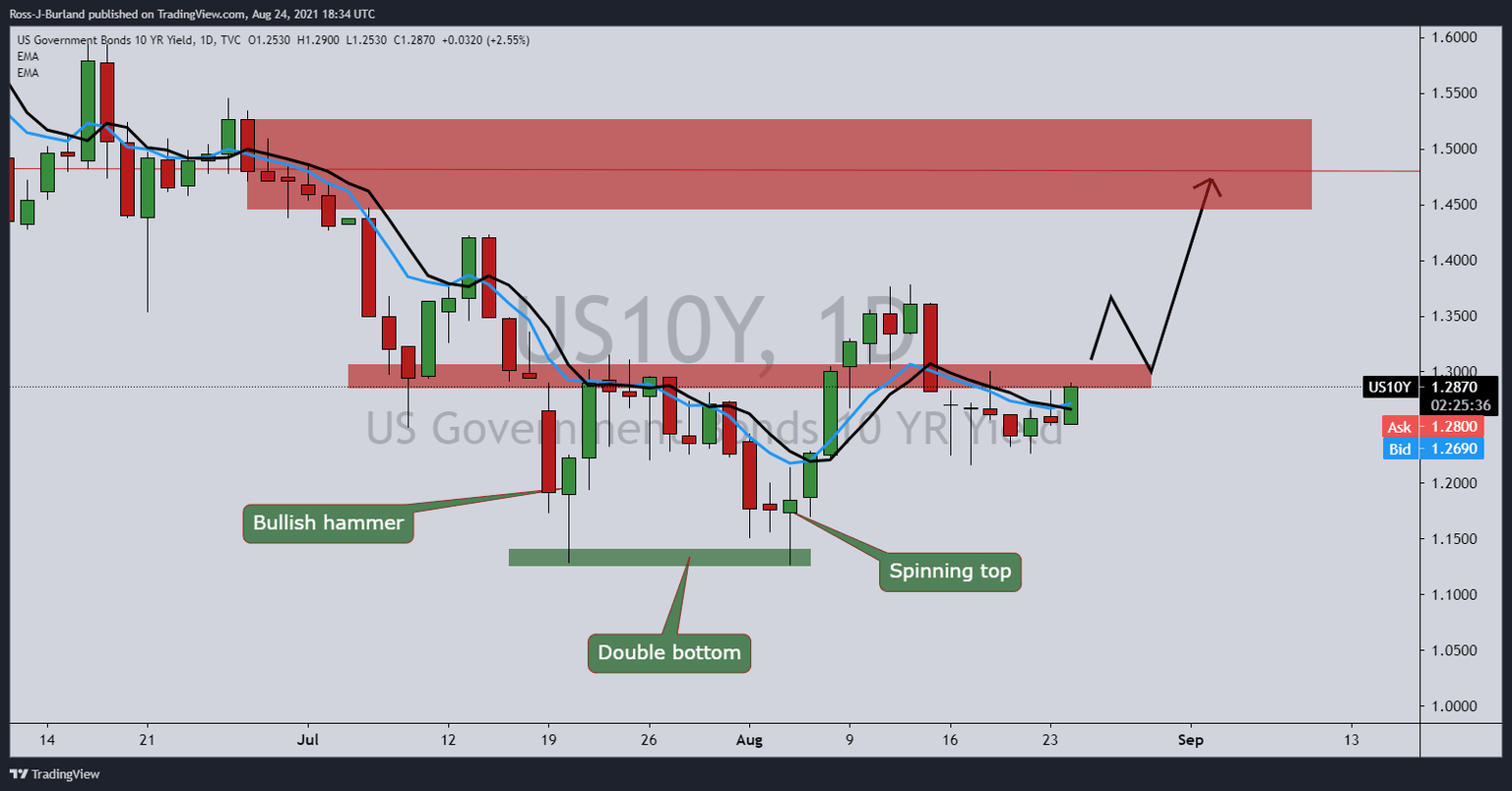

''For bulls, at least for the near term, it will be imperative that US 10 year yields extend beyond 1.3020% daily resistance and break ice above 1.3810% to confirm the bullish bottoming candle formations.

We have a bullish hammer printed on July 20, followed by a double bottom on Aug 4, although this was followed by a failure of a restest of old resistance structure near 1.2950/1.3030:

Live market update:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.