- US dollar plummets as the Fed dials back expectations of 75bp hikes.

- The Fed gives the nod to a series of 50bps hikes instead.

Both the US dollar and US Treasury yields are under pressure following the Federal Reserve interest rate decision, statement and the Fed chair's presser. The US 2-year Treasury yield has fallen by some 5% to a low of 2.612%.

After hiking by 50bps today and formally starting quantitative tightening as the Fed seeks to get a grip on inflation, Jerome Powell gave the green light to a series of additional 50bp hikes but said 75bps was not something that was being considered.

The Federal Reserve is now "highly attentive" to inflation risks and amid “robust” job gains "ongoing increases" in the Fed funds rate will be "appropriate". The Fed is starting quantitative tightening and a press release with the Fe's plans for reducing the size of the balance sheet was released showing $47.5bn per month that will start on June 1st before getting to a "max" of $95bn in September:

The Committee intends to reduce the Federal Reserve's securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account (SOMA). Beginning on June 1, principal payments from securities held in the SOMA will be reinvested to the extent that they exceed monthly caps.

For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month. The decline in holdings of Treasury securities under this monthly cap will include Treasury coupon securities and, to the extent that coupon maturities are less than the monthly cap, Treasury bills.

For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.

Nevertheless, the markets had been pricing in a more aggressive stance at the Fed. The initial knee-jerk “sell-the-fact” reaction in the greenback as the Fed delivered the expected 50bp hike was exacerbated when Powell took 75bps rate hikes off the table. This is giving risk appetite a boost and the euro is making a case for a significant multi-week correction that could take place between now and the next meeting in June.

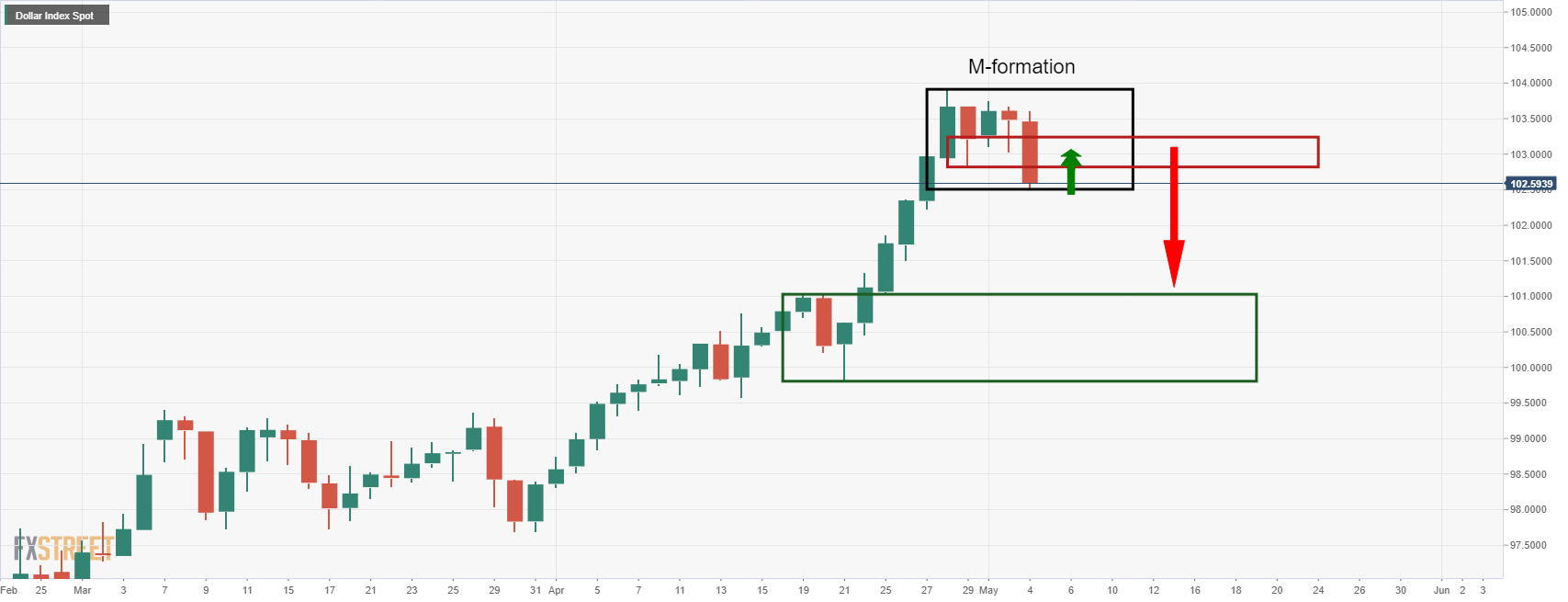

In turn, the DXY index which is calculated by factoring in the exchange rates of six foreign currencies vs. the greenback is set up for a move that could extend as far as 101.00 in the coming days/weeks:

The M-formation is a bullish reversion pattern where the price would be expected to retest the neckline, prior to a more significant move to the downside and towards the old resistance structure. However, much will depend on this week's Nonfarm Payrolls data.

If the US jobs data on Friday fuels expectations around potentially larger than 50bp rate hikes, then the DXY bulls will be back in play and the euro will be at risk of moving below 1.0500. The euro is, by far, the largest component of the DXY index, making up 57.6% of the basket.

The W-formation there is also compelling in this regard:

The euro is headed towards a 38.2% Fibonacci retracement of the daily bearish impulse. This has a confluence with prior daily highs. Either way, the W-formation is a bearish pattern and a retest of the neckline would be expected to occur in due course. Whether the euro can continue higher will depend on matters related to geopolitics as well as the market's appetite for the US dollar. Unstable risk sentiment, COVID and a lower appetite for emerging markets combined with the Fed's focus on fighting inflation are all factors that would be expected to underpin the greenback.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays directed toward 1.1000 amid intense US Dollar selling

EUR/USD is consolidating the uptick to near 1.1000 in the European session on Thursday. The pair benefits from US President Trump's tariffs-led intense US Dollar weakness. However, further upside appears capped due to escalating trade war fears, with looming EU retaliatory tariffs.

GBP/USD jumps above 1.3100 ahead of US data

GBP/USD is extending its upbeat momentum above 1.3100 in European trading on Thursday as the US Dollar slumps to a fresh YTD low. Worries about a tariff-driven US economic slowdown lift Fed rate cut bets and weigh on the Greenback. The focus now remains on the US data for further impetus.

Gold price moves further away from all-time peak; downside potential seems limited

Gold price extends its steady intraday pullback from the all-time peak touched this Thursday, though it manages to hold above the $3,100 mark through the early European session. Bullish traders opt to take some profits off the table and lighten their bets around the commodity amid slightly overbought conditions.

Bitcoin price reacts as Gold sets fresh record highs after Trump’s reciprocal tariffs announcement

Bitcoin price plunges towards $82,000 as Gold soars past $3,150 after US President Donald Trump imposed new tariffs on Israel and UK, triggering global markets turbulence.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.