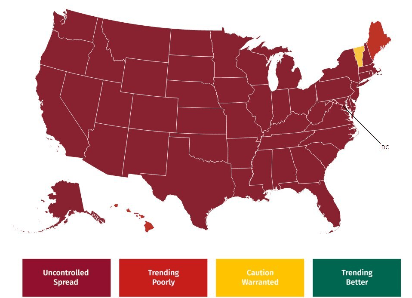

- Nearly every US state is now classified as having an uncontrolled spread of the virus.

- Investors positioning for prolonged fiscal stimulus measures and move away from economically growth-sensitive stocks.

The trajectory of the US coronavirus spread has been going from bad to worse in recent weeks with new cases surging across all states of America.

Texas has just become the first state to hit one million in total cases.

Other states, including Illinois, Wisconsin, Minnesota, California and Florida, have also seen numbers rise.

CBS News reports 15 states saw the numbers of patients in the hospital due to the virus double in the last month.

According to a study by covidexitstrategy.org, nearly every US state is now classified as having an uncontrolled spread of the virus.

While Americans' attention has been centred on the outcome of the presidential election, the country quietly hit a grim milestone, marking a record-breaking 102,831 last week in new COVID-19 infections for a single day.

Update: 144,000 new confirmed cases 11/11/2020.

The US has been seeing more than 100,000 new cases per day over the last 10 days in what experts say may be a worse outbreak than those seen in the spring and summer.

There are now over some 10 million confirmed US cases and 239,732 deaths so far.

The death toll is moving up to an average of over 900 a day and experts have warned hospitals across the country could soon be overwhelmed.

The Wall Street Journal has written that New York will set a 10 p.m. curfew for most bars and restaurants and will limit gatherings at private residences to 10 people as the number of novel coronavirus cases and hospitalizations continued to rise around the state.

The Democratic governor, Gov. Andrew Cuomo said Wednesday, has been reported by the WSJ to have also said gyms must close by 10 p.m. The new restrictions take effect on Friday.

''Mr. Cuomo said private gatherings, bars, restaurants and gyms have been a source of increase for the virus, which killed 21 New Yorkers on Tuesday.''

Meanwhile, the US infectious disease chief Dr Anthony Fauci offered some hopeful news.

He said the new Covid vaccine by Pfizer, which in human trials suggest it is 90% effective, was expected to go through an emergency authorisation process in the next week or so.

Welcomed news of the vaccine wearing off

As for the markets, the welcomed news of the vaccine has started to wear off as we have seen investors move back into the technology and away from economically sensitive sectors.

At 2:40 p.m. EST, the Dow Jones Industrial Average was losing 62.24 points, or 0.21%, to 29,358.68 and the Nasdaq Composite added 201.66 points, or 1.75%, to 11,755.51.

The US dollar's relief rally is also coming under pressure as markets prepare for prolonged fiscal stimulus measures:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold gives away some gains, slips back to $2,980

Gold retraced from its earlier all-time highs above the key $3,000 mark on Friday, finding a footing around $2,980 per troy ounce. Profit-taking, rising US yields, and a shift to a risk-on environment seem to be putting the brakes on further gains for the metal.

EUR/USD remains firm and near the 1.0900 barrier

EUR/USD is finding its footing and trading comfortably in positive territory as the week wraps up, shaking off two consecutive daily pullbacks and setting its sights back on the pivotal 1.0900 mark—and beyond.

GBP/USD remains depressed, treads water in the low-1.2900s

GBP/USD is holding steady in consolidation territory after Friday’s opening bell on Wall Street, hovering in the low-1.2900 range. This resilience comes despite disappointing UK data and persistent selling pressure on the USD.

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

Week ahead – Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears. Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637407241412659813.png)