US COVID-19 surge could trigger a double-dip recession, according to a report in the Financial Times.

Markets are ignoring the possibility that severe lockdowns may be needed in many states

Key notes

- So far, the US policy response has been muted, certainly compared to nationwide lockdowns in other countries in March.

- Markets remain surprisingly relaxed, reportedly because investors are optimistic that an effective vaccine from the Oxford university or Moderna trials may be “within sight”.

- But even the most favourable outcome in vaccine development would come too late to save the US economy from the spread of the virus over the next three months.

- Unless public policy can control the rate of infections across the American sunbelt, there could be adverse consequences for any US economic recovery over the rest of this year.

- Consensus economic forecasts have not yet given much weight to this increasing risk, although the US Federal Reserve is increasingly worried.

- Fulcrum economists have developed a new model. It suggests that the virus’s effective reproduction number, known as R, is now above the critical level of 1 in all but five of the US’s 50 states.

- Weighted by gross domestic product, this means that 95 per cent of the US economy is affected by a viral reproduction rate high enough to cause an exponential rise in the number of cases — unless something intervenes to prevent this.

- This spread of R levels above 1 is the broadest it has been since the epidemic started.

- In March, absolute levels of R were higher in the northeast, when the reproduction rate exceeded 3 for several weeks and infection numbers doubled every few days.

- The key economic question now is how much damage to activity will be incurred as policy lockdowns and voluntary social distancing bring the epidemic under control.

- So far, the answer is very little.

- Fulcrum economists have modelled an alternative scenario where full lockdowns are eventually needed in states where the R is currently above 1.5, with partial lockdowns in states where R lies between 1.25 and 1.5, and no lockdowns elsewhere.

- This would lead to a large drop in activity — in effect, a double dip — of about 7 percentage points through the whole economy while the lockdowns last. If the situation persisted for three months, it would knock almost 2 percentage points from this year’s growth rate, compared to the latest consensus forecasts.

- This double-dip may not be the most likely outcome, right now. But is a highly plausible worst-case scenario if the national spread of the virus is not brought under control soon.

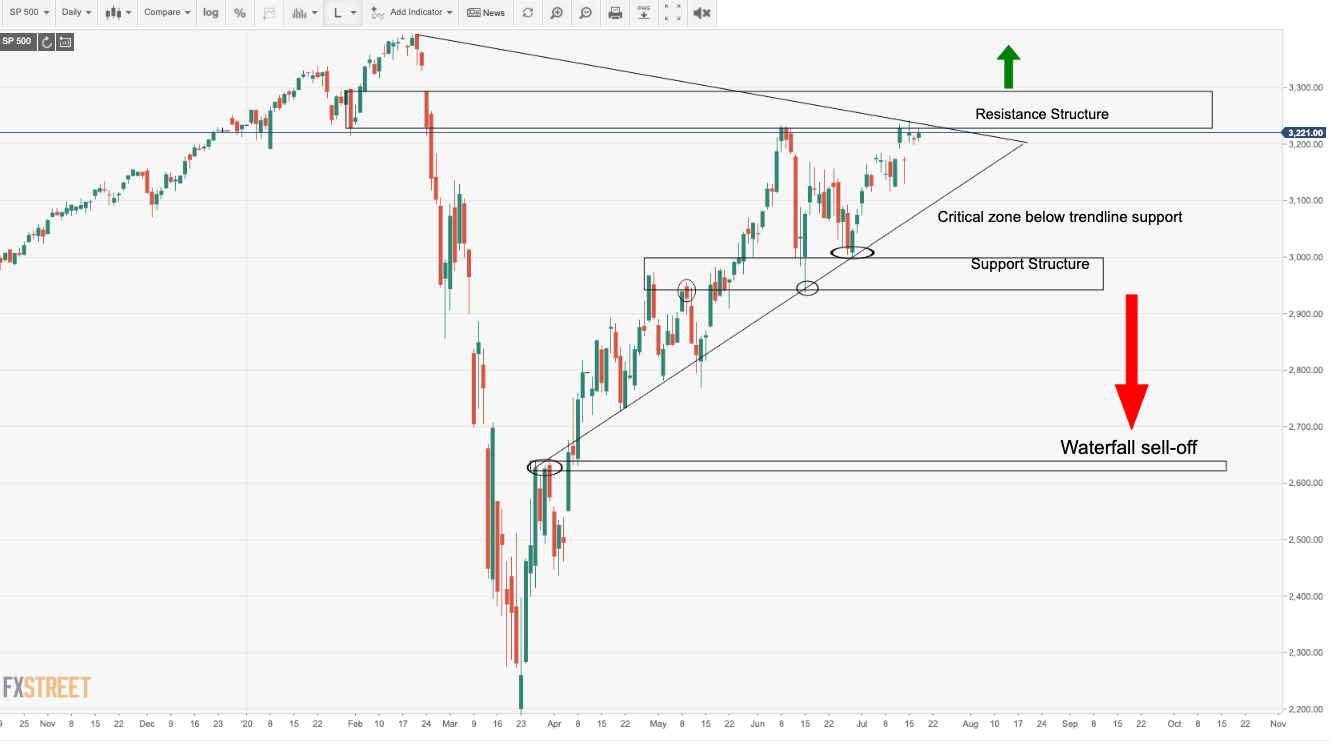

Market implications

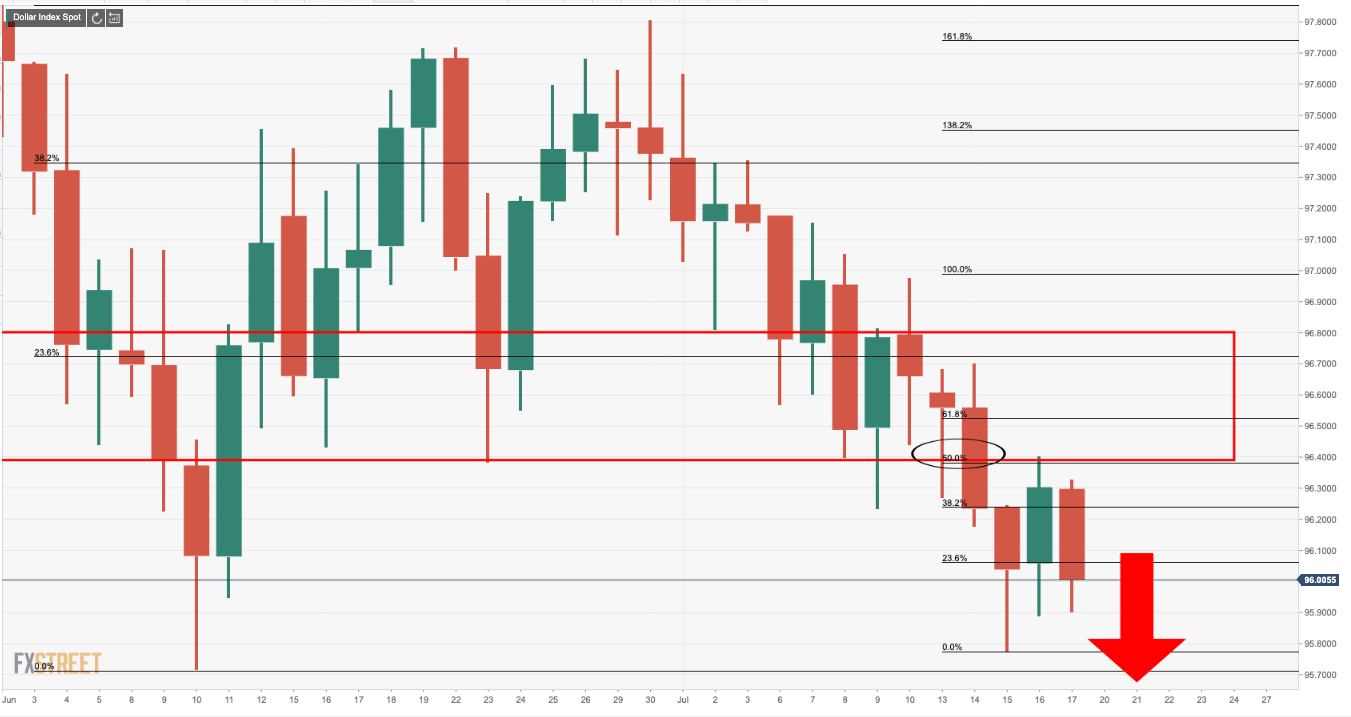

DXY crumbles supporting a bid in the EUR

DXY bears in control:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD hangs near multi-year low as traders await US NFP report

AUD/USD consolidates just above its lowest level since October 2022 as traders move to the sidelines ahead of Friday's release of the closely-watched US NFP report. In the meantime, rising bets for an early RBA rate cut, China's economic woes, US-China trade war fears, geopolitical risks and a softer risk tone act as a headwind for the Aussie.

USD/JPY bulls turn cautious near multi-month peak ahead of US NFP

USD/JPY moves little following the release of household spending data from Japan and remains close to a multi-month top amid wavering BoJ rate hike expectations. Furthermore, the recent widening of the US-Japan yield differential, bolstered by the Fed's hawkish shift, undermines the lower-yielding JPY and acts as a tailwind for the currency pair amid a bullish USD.

Gold price consolidates below multi-week top; looks to US NFP for fresh impetus

Gold price enters a bullish consolidation phase below a four-week top touched on Thursday as bulls await the US NFP report before placing fresh bets. In the meantime, geopolitical risks, trade war fears and a weaker risk tone might continue to act as a tailwind for the safe-haven XAU/USD.

Ripple's XRP plunges over 4% following funding rates decline

Ripple's XRP declined 4% on Friday following a decline in its funding rates. The remittance-based token could decline to test the $2.17 support level if the crypto market decline extends.

How to trade NFP, one of the most volatile events Premium

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world. The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.