ULTA Beauty, Inc., (ULTA) operates as specialty beauty retailer in the United States. It offers branded & private label beauty products, including cosmetics, fragrance, haircare, skincare, bath & body products, professional hair products, salon styling tools through stores, shop-in-shops, e-commerce websites & mobile applications. It is based in Bolingbrook, IL, comes under Consumer Cyclical sector & trades as “ULTA” ticker as Nasdaq.

ULTA ended impulse sequence as ((I)) in weekly at $574.76 high in March-2024. Below there, it favors pullback in ((II)) as double correction & remain choppy to lower for few months.

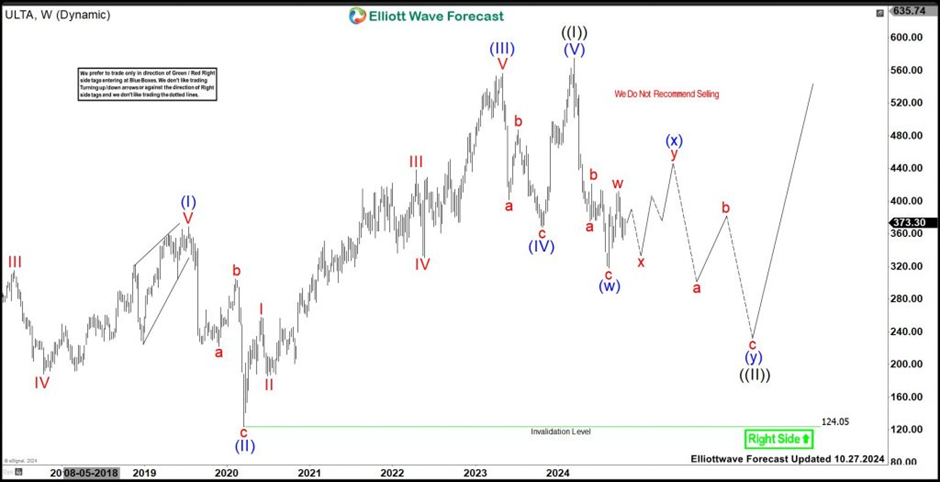

ULTA – Elliott Wave latest weekly view

In weekly, it placed (I) of ((I)) at $368.83 high in July-2019 & (II) as zigzag correction at $124.05 low in March-2020. Later, it ended (III) at $556.60 high in May-2023 & (IV) at $368.02 low as around 0.382 Fibonacci retracement of (III) in October-2023. Finally, it ended impulse (V) as impulse ((I)) at $574.76 high as diagonal in weekly. Below there, it favors correction in ((II)) against all time low & expect choppiness before another push lower. Below $574.76 high, it ended (w) of ((II)) at $318.17 low in August-2024. Within (W), it placed a at $375.31 low, b at $421.21 high & c at $318.17 as (w) in double correction.

It is relatively underperforming the US market & so expect another push lower in coming months after (x) ends. Currently, it favors pullback in x against August-2024 low, while placed w at $412 high before resume higher in y. Once it ends (x) in few weeks, it should resume lower in (y) towards 1.0 – 1.618 Fibonacci extension to finish ((II)), where it should see at least 3 swing bounce. We like to buy the next extreme areas in (y) of ((II)). Alternatively, it can be a flat correction in (IV) ended at $318.17 low & resume higher in (V), which later confirms with new high. So, do not like selling it in any pullback.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended content

Editors’ Picks

EUR/USD tumbles below 1.0800 on Trump’s tariff plan

The EUR/USD pair plunges to near 1.0780 amid the renewed US Dollar demand on Friday during the Asian trading hours. Also, Donald Trump’s proposals to raise tariffs weigh on the Euro against the Greenback. Traders await the advanced US Michigan Consumer Sentiment data for November for fresh impetus.

GBP/USD faces rejection near 100-day SMA, holds above mid-1.2900s

GBP/USD edges lower on Friday amid the emergence of some USD dip-buying. The BoE’s hawkish tilt could underpin the GBP and limit losses for the major. The technical setup favors bears and supports prospects for a further downfall.

Gold appears stuck between key technical levels, what’s next?

Gold price has returned to the red early Thursday after reversing more than half of the Trump win-led 3% slide on Wednesday. Gold sellers fight back control, as the US Dollar finds its feet amid a pause in the US Treasury bond yields sell-off while awaiting the Michigan preliminary Consumer Sentiment data.

BTC touches new all-time high near $77,000 following Fed rate cut

Bitcoin price rallied and reached a new all-time high of $76,849 following the US Federal Reserve’s 25 basis point rate cut. Ethereum and Ripple followed suit and closed above their key resistance levels, hinting at a possible rally ahead.

Outlook for the markets under Trump 2.0

On November 5, the United States held presidential elections. Republican and former president Donald Trump won the elections surprisingly clearly. The Electoral College, which in fact elects the president, will meet on December 17, while the inauguration is scheduled for January 20, 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.